WeWork Considers Cutting IPO Valuation Under $20 Billion, Report Says

Some existing shareholders are pushing the company to cancel the IPO, the Wall Street Journal reported Sunday

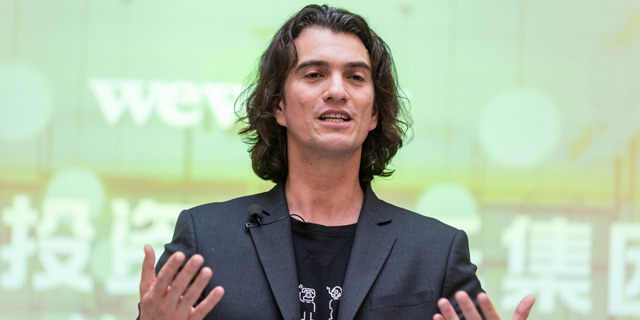

WeWork, recently rebranded as the We Company, initially aimed for the same valuation it achieved during its last funding round in January, $47 billion. But after the company published its prospectus, revealing heavy losses and several questionable business practices and agreements with its co-founder and CEO Adam Neumann, many analysts and investors were of the opinion the valuation was too high. In recent days, many news outlets reported the company has reduced its target valuation to between $20 billion and $30 billion.

WeWork needs almost $10 billion to finance the continued quick expansion it is planning. The company initially said it aims to raise between $3 billion and $4 billion via the IPO, and another $6 billion in debt, but a successful debt raising is contingent on the IPO.

No Comments Add Comment