Interview

In the Race for Autonomous Vehicles, Mobileye Looks to China

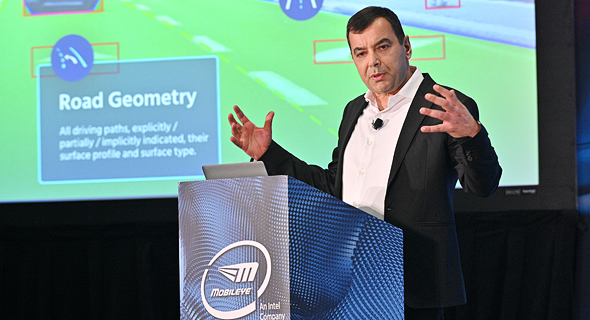

Mobileye CEO and co-founder Amnon Shashua spoke with Calcalist during CES 2020 last week

Lilach Baumer, Las Vegas | 16:16, 14.01.20

For automotive chip developer Mobileye, the road to private autonomous vehicles goes through becoming a MaaS (mobility as a service) company with its robotaxi ventures, according to CEO and co-founder Amnon Shashua.

In 2015, Tesla founder and CEO Elon Musk forecasted autonomous vehicles will hit the roads by 2018. In late 2017, shortly after chipmaker Intel bought Mobileye for $15.3 billion as a way to get a leg-up in the autonomous vehicle race, Shashua put the timeline at 2021. But earlier estimates have since been pushed back, and major industry players have acknowledged that the technology and its adoption may take longer to materialize. Ford took a step back last year, shifting focus to level 4 and semi-autonomous vehicles. Carlos Tavares, the head of the PSA Group, said in February 2019 that the consumer autonomous vehicle revolution may never happen due to the cost of the technology, and in September, Morgan Stanley cut its valuation for Alphabet’s Waymo, stating the technology is taking longer to develop than expected.

For Mobileye, the change came in 2018. Back then, the company realized three factors were acting as a barrier for the widespread adoption of consumer autonomous vehicles: the cost of developing the technology, the lack of appropriate infrastructure, and the slow work of the regulators. Robotaxis, according to Shashua, are the answer: a fleet operator will bear the initial costs of the technology better, and the service will be easier for authorities to regulate and adapt to. “In terms of cost per kilometer for users,” Shashua told Calcalist last week, “our data shows that ride-sharing robotaxis will not cost more than public transportation, which is subsidized by the state.”

Last week, at a press conference held at the Consumer Electronics Show (CES) 2020 in Las Vegas, Shashua announced a

new autonomous taxi venture in partnership with South Korean city Daegu. The project, for which Mobileye will supply the technology, joins three others the company is currently developing: one in Tel Aviv with Volkswagen and Champion Motors, one in Paris with state-owned public transportation operator RATP Group, also known as the Régie Autonome des Transports Parisiens, and one in China, with Chinese electric auto manufacturer NIO.

Mobileye usually looks for a technological partner, like RATP, Shashua said, but Daegu was willing to put down significant funding for the opportunity to host robotaxis. It is the recently announced NIO partnership, however, that has Mobileye’s co-founder particularly enthusiastic. Last year at CES, Mobileye announced a partnership with the Beijing Public Transport Corporation and Beijing Beytai, a company providing system integration, big data processing, and analysis, to commercially deploy autonomous public transport services in China. That collaboration has yet to take off, Shashua said. Now, it is NIO that will provide Mobileye with a gateway into China.

As part of their collaboration, NIO vehicles will be mapping the Asian nation for Mobileye’s high-definition maps, a necessity for both robotaxis and autonomous vehicles. But more than that, the company will be integrating Mobileye’s self-driving system—its silicone, hardware, and sensors—into its vehicles, Shashua said. “That means that in 2022, a person buying a NIO vehicle in China will be buying a car capable of changing into an autonomous vehicle at the push of a button.” This holds true for Mobileye as well, enabling the company to buy ready-made vehicles for its fleets instead of retrofitting vehicles with its technology.

As Mobileye has stated several times in the past, 2022 is the planned timeline for the commercial deployment of the first few thousand robotaxis across Mobileye’s various collaborations. But in China, Shashua said, 2022 could signal the start of consumer autonomous vehicle sales, three years ahead of the rest of the world, which is not expected to reach that point before 2025, according to Mobileye’s current timeline.

“China announced that electric vehicles are going to be the standard as of 2025,” Shashua said. “They announced autonomous vehicles are a very important direction. It is a very significant territory with very advanced regulation,” he added. According to Shashua, China is the first country to adopt a standard based on Mobileye’s RSS (responsibility sensitive safety) model, released two years ago, which aims to advance a global autonomous vehicle safety standard. “China is a very important territory for us,” Shashua said.