Expert

Why are Chinese investors shying away from Israeli tech?

New study reveals a sharp decline in investments since 2018 due to Beijing’s shifting priorities and a watchful Washington

Elihay Vidal | 16:13, 28.01.21

Even though China’s involvement in the Israeli economy has largely grown over the past decade, particularly when it comes to the local tech sector, a new study indicates that the peak of Chinese investments came in 2018 and has been in decline over the past two years.

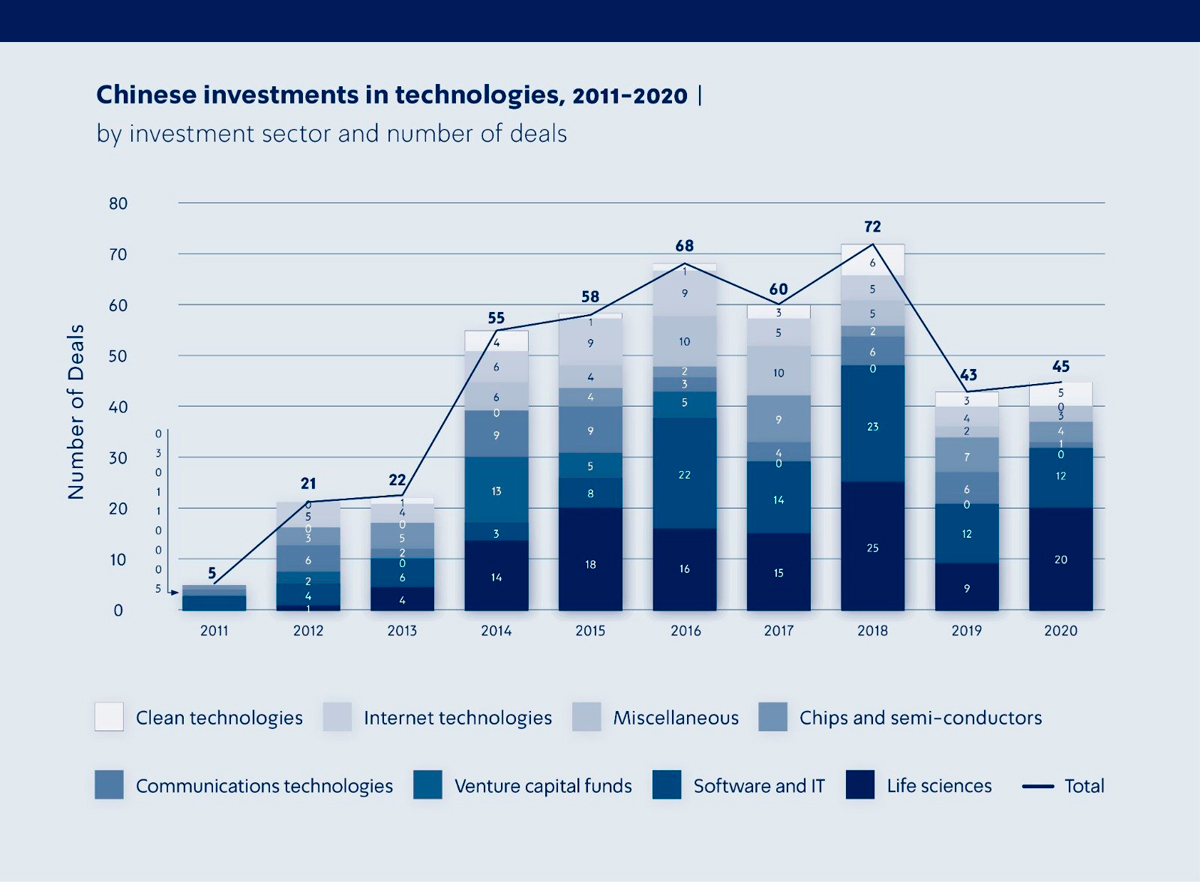

The study, authored by Dr. Doron Ella for the Institute of National Security Studies, revealed that between 2014 and 2018 there was a steady rise in Chinese investments, especially in the tech sector, both in the number of investments and their volume, but that trend reversed after hitting the zenith and investments have been in decline, indicating somewhat of a halt to China’s penetration of the Israeli economy, similar to the decline in China’s overall global investments.

The reasons for the decline according to Ella, a research fellow at the China program at the INSS and a post-doctoral fellow at the University of Toronto, are attributed to a shifting of priorities within China itself, the fallout of the Covid-19 pandemic, and an apparent change in the Israeli investment ecosystem linked to American political pressure. The study, (availabale in full here in Hebrew)

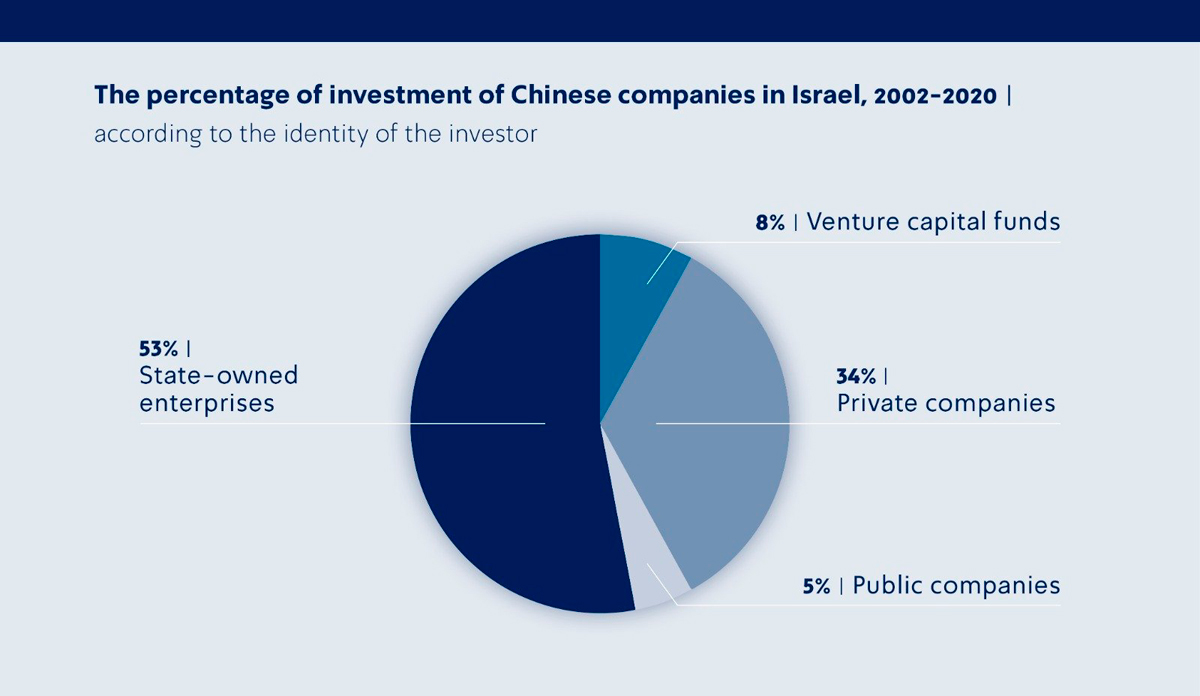

which examined 463 investment deals, mergers, and acquisitions of Israeli companies by Chinese companies (including companies from Hong Kong) between 2002 and 2020, indicates that while government-owned companies tended to invest in infrastructure projects, privately-owned or venture-capital-backed companies prefer investing in Israeli tech startups. The study found that investments from China made up a little less than 10% of the total foreign capital invested in Israel, far behind investments from the U.S. and Europe.

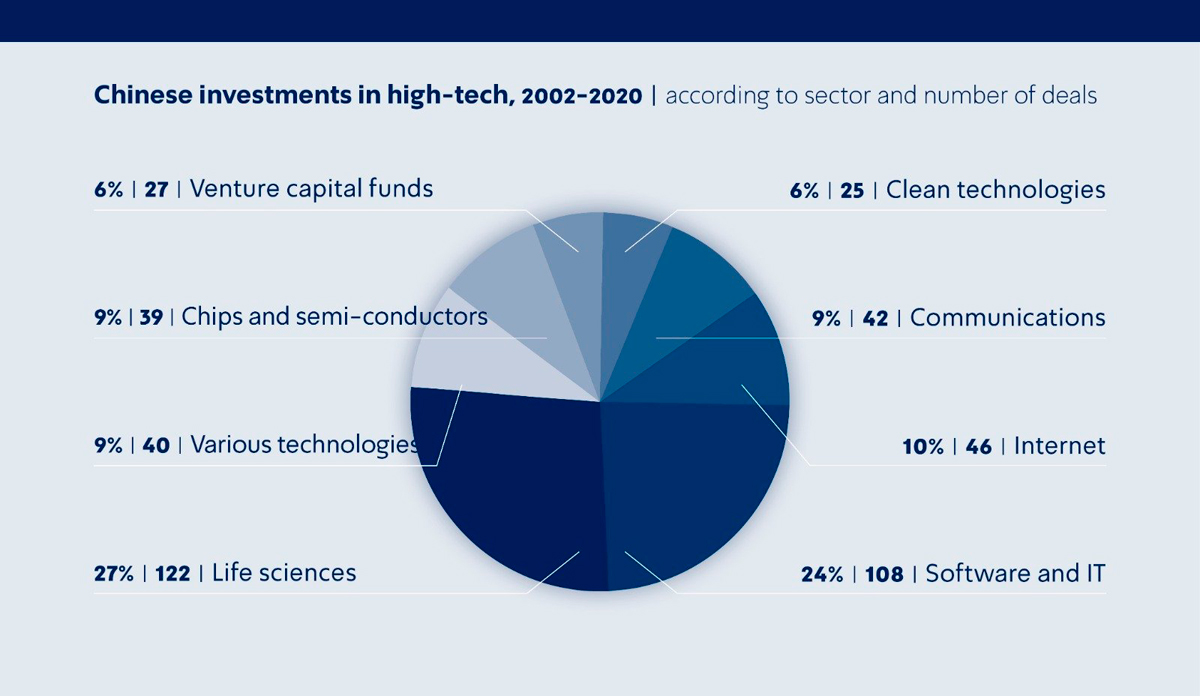

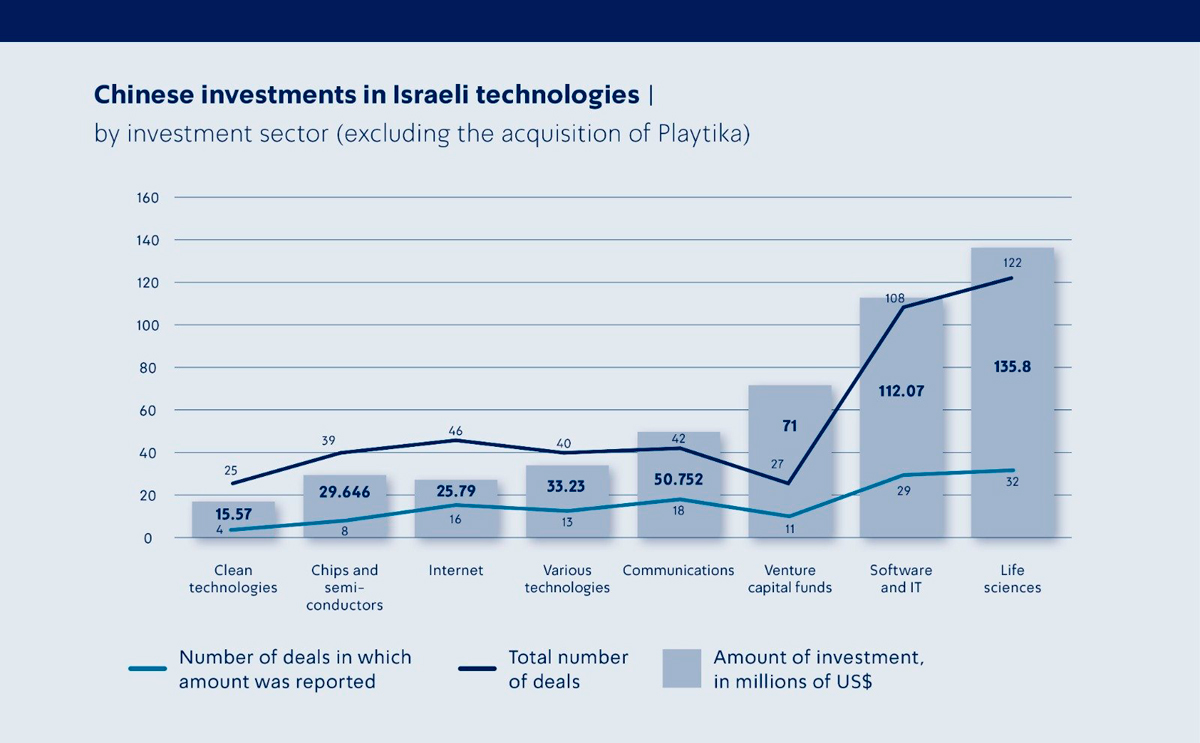

According to the study, Chinese investments gradually increased over the last two decades, and especially from 2014 onward, with most of the money going to the tech sector (449 deals at a reported valuation of $9 billion, out of a total of 463 deals worth $19.4 billion). Ella stressed that the sums invested in the tech sector are not always transparently reported and that often the reported sum of a certain financing round includes capital raised from several investors lumped together, which suggests that the actual numbers may be significantly higher than the ones recorded in the databases his study was based on (IVC, Crunchbase, and local and international media reports).

Ella’s figures show that 53% of the total investments in Israel by Chinese companies between 2002-2020 were made by government-owned companies (which make up only 5% of the number of deals) since government companies invest primarily in large infrastructure projects. Privately-owned companies were found to invest primarily in technology, making up 34% of the total investment volume. The study notes that the relatively small volume of investment by venture capital funds can be explained by virtue of the fact that such funds often invest in small startups that require relatively modest investment sums and those are most often part of larger funding rounds that include other investors, resulting in the funds making a large number of deals, but at low volumes that frequently don’t get reported. Chinese tech investments primarily go to companies active in the life sciences field (122 investment deals in companies that operate in the healthtech, biotech, biochemistry, and pharma industry) followed by software and IT (108 deals), internet (46), communications (42), chips and semiconductors (39), VCs (27), and cleantech (25). Ella noted that throughout the period he examined there were changes in the sectors the Chinese chose to invest in and that from 2014 onward there was more of an emphasis on life sciences, software development, and IT, with the peak coming in 2018, after which there was a significant decline. He further noted that after three years of robust investment in well-known Israeli VC funds, such as Catalyst, Carmel Ventures, JVP, and Singulariteam, in 2017 those investments dried up completely. According to Ella, the decline in the number and volume of transactions with China may indicate a cautionary note on the part of Chinese companies when it comes to foreign investments in light of the new government restrictions on capital expenditures from China and the Communist Party's increased supervision of investments and acquisitions by Chinese companies abroad, as well as the drop in capital liquidity in the Chinese financial sector and consequent restriction of capital for foreign investments. It is also possible that Beijing backed off investments in Israel having concluded that the latter is under pressure from the U.S. government that is critical of China’s foreign investments, as well as the establishment of a new government agency to oversee foreign investment which began its work in January 2020.