Boarding Pass

Fincom’s ‘Phonetic Fingerprint’ for e-commerce platforms

The company has recently raised $2 million for its AML Screening Solution

“One of the first significant problems solved by Fincom was finding a common cross-language denominator for unifying database entries,” explained the company. “The need for this approach arises from the fact that different languages, with their various spelling formats, scripts, and resulting transliterations, as well as typical spelling mistakes and variations, compromise the integrity of the database.”

According to Fincom, the industry has been plagued by unstructured databases due to different database formats. To date, no other technology has been able to process these unstructured databases and achieve database entry unification.

Fincom claims to overcome this problem through a linguistic and semantic approach to the incorporation of phonology and its focus on the interpretation of sound in language. “The approach taken by Fincom is based on the notation of speech sounds, addressing known challenges in auditory phonetics and descriptive linguistics. This is necessary because existing language notations are not universally adopted across dictionaries in languages other than English,” the company added.

You can learn more about Fincom below.

Company Name: Fincom

Sector: Fintech

Product/Service description:

Fincom's AML Screening Solution: revolutionizing sanctions screening for banking, payments, and eCommerce.

Fincom’s solution for AML sanction screening helps banks and FIs meet the AML compliance requirements while reducing operational costs by >90% and mitigating alert rates from the industry average of 30% to <3%. The results are validated with numerous U.S. banks.

The solution is based on the company’s Phonetic-Linguistic Engine & Phonetic Fingerprint Technology Fincom’s Phonetic-Linguistic Engine has an exceptional ability to measure the true level of Phonetic Proximity by utilizing phonetics, computational linguistics, and advanced mathematics to transform the entire name into a mathematical sequence – Phonetic Fingerprint.

Phonetic Fingerprint is a single mathematical representation of the pronunciation and phonemes of a name (individual or entity). The use of 48 mathematical algorithms, phonetics, computational linguistics, and distance algorithms (within and in between languages) tracing phonemes across over 44 different languages, transliterations, and spelling variations, enables accurate name matching.

The solution’s key advantages:

- Reducing operational expenses by >90%

- Real Time screening (<200ms)

- No Missed Hits

- Accurate Name Matching – resulting in high effectiveness and minimal workload

- Reduction of Alert rate and False Positives by 60-60%

- Screening and matching in 44 languages in original alphabets or transliterated forms, and more.

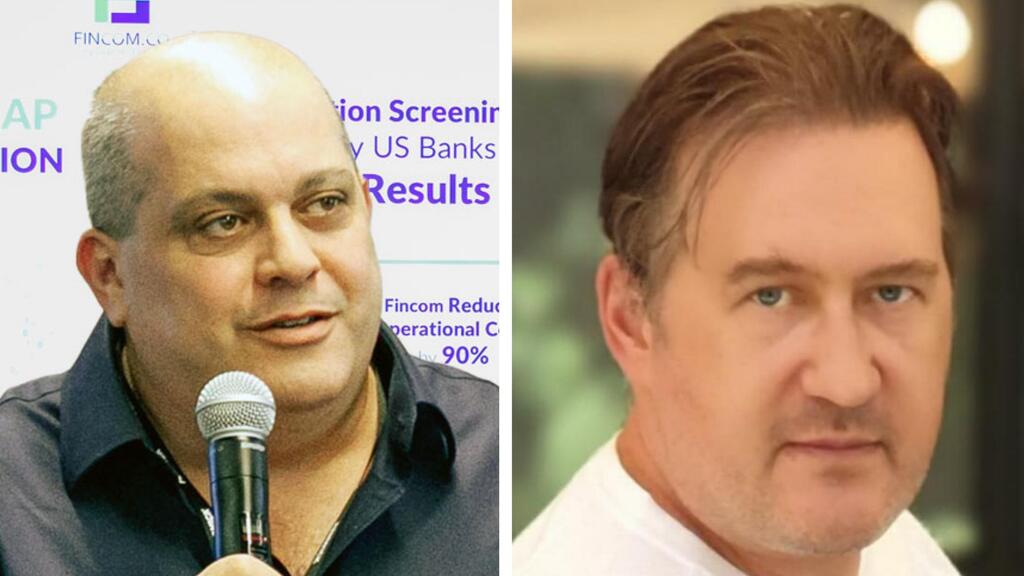

Founder Bios:

Gideon Drori: The founder and the visionary behind three successful startups: Fincom, Ecotech Recycling, and That Systems. The driving force behind these ventures with a strong belief in “Leading by Example”, raising tens of million in funding and creating a far greater value for his investors. Over 20 years of visionary strategic consulting both for business and governmental affairs (including political lobbying); successfully establishing and leading businesses in areas of breakthrough technologies. As of 2017 CEO of Phonemix Ltd. a.k.a Fincom. He is a published author of 32 international granted patents.

Dr. Oleg Golobrodsky: Visionary and researcher, with a solid business and scientific background. Member of the European AI Alliance, New York Academy of Sciences, Israeli Chamber of Information Systems Analysts, former non-fellow professor and scientific supervisor at the Dept. of Computer Sciences at Bar-Ilan University. He has extensive experience in leadership, management, R&D, and deployment in complex markets with a Ph.D. in Computer Sciences. Published author of publications, books, and over 50 international granted patents.

Year of Founding: 2017

Last Investment Round: $2 million

Last Investment Stage: Seed

Date of Last Investment: March 2023

Total investment to date: $5 million

Investors (leading and all): AnD, ffVC, and more.

Current number of employees: 13

Open positions: Development

Website:

www.fincom.co

Social Media:

https://www.linkedin.com/company/fincom-co

How was the idea born?

Fincom is the result of over fifteen years of effort by a dedicated team of highly talented scientists and industry experts to develop the first automated technology for accurately screening multilingual entities. It initially started as a “contact list unification” – the process of unification of unstructured data – applied in the mobile industry.

In 2016, Gideon Drori and Dr. Oleg Golobrodsky, the founders of Fincom, decided to apply their hard-earned knowledge to the field of anti-money laundering (AML). One of the first significant problems solved by Fincom was finding a common cross-language denominator for unifying database entries. The need for this approach arises from the fact that different languages, with their various spelling formats, scripts, and resulting transliterations, as well as typical spelling mistakes and variations, compromise the integrity of the database. The industry has been plagued by unstructured databases due to different database formats. To date, no other technology has been able to process these unstructured databases and achieve database entry unification.

Related articles:

Fincom has successfully overcome this problem through a linguistic and semantic approach to the incorporation of phonology and its focus on the interpretation of sound in language. The approach taken by Fincom is based on the notation of speech sounds, addressing known challenges in auditory phonetics and descriptive linguistics. This is necessary because existing language notations are not universally adopted across dictionaries in languages other than English.

Fincom further advanced this with its groundbreaking patented technology – the ‘Phonetic Fingerprint.’ This technology employs a robust algorithmic approach to compare written text in multiple languages by converting names into mathematical sequences based on the phoneme rather than the spelling. As a result, the Phonetic Fingerprint technology is capable of accurately matching entries across databases.

What is the need for the product?

The mere fact that the product has already proven to reduce operational costs associated with AML compliance in several leading U.S. banks by over 90% demonstrates how the market directly benefits from deploying it. Besides that, the product helps banks and financial institutions solve such problems as:

- Work overload associated with extremely high alert rates when screening against sanctions and watchlists - Fincom’s solution reduces alert rates from the industry standard of 30-50% to below 3%.

- Poor name matching – inability to screen and match names written in non-Latic characters, inability to resolve spelling mistakes and variations (Fincom’s AML sanction screening is capable of matching names in 44 different languages in original alphabets and/or transliterated forms, also resolving spelling mistakes and variations)

- Long alert processing times due to unfriendly technological environments (Fincom’s systems reduce alert processing time from the industry average of 8 minutes to approximately 30 seconds)

- Lack of transparency and explainability lead to the inability to explain the decisions and provide regulators with a clear audit trail (Fincom’s solution is fully transparent, explainable and traceable, with a clear audit trail and reporting system).

How is it changing the market?

It enables banks and other financial and non-financial institutions to serve their customers better and allocate their resources where needed most by cutting down operational costs associated with AML processes by over 90%. Another socially significant feature of the solution is that it mitigates the inherent AML discrimination. Most of the currently existing solutions, due to poor name-matching capabilities, would flag the most common names or names identical or similar to those of sanctioned individuals or entities, delaying the provision of services and/or requiring additional information and identity documentation from the customers. This has a negative impact on customer retention and the bank’s (or other body’s) reputation. This is on top of excessive operational costs and workload. Fincom system’s ability for accurate name matching minimizes the risk of AML discrimination.

How big is the market for the product and who are its main customers?

The market is, basically, any local or global regulated institution: banks, financial institutions, e-commerce, and payment platforms, insurance and legal companies, credit card companies, crypto, forex, investment firms, gaming companies, etc.

Does the product exist already? If not - at what stage is it and when is it expected to hit the market?

Yes, the product exists and is deployed in a number of major U.S. banks and EU Financial Institutions. It is currently expanding into the U.S. and global banking and FI sectors.

Partnerships:

Fincom has established successful partnerships and actively collaborates with industry leaders. An example includes Finastra, a global strategic partner and reseller. Fincom’s AML solution is integrated into all of Finastra’s payment platforms, including PayPlus, GFX, RapidWire, and others. Cognizant – global fulfillment and reseller partner for Tier 1-2 Financial Institutions.

Who are the main competitors in this sector and how big are they?

- LexisNexis

- ComplyAdvantage

- Refinitiv

- Nice Actimize

- And some others

All of them are big, but none of them has Fincom’s sanction screening capabilities, which have already been proven in a number of U.S. banks.

What will the money coming in from the round be used for?

Mostly development and marketing.

In the "Startup Boarding Pass" section, CTech will cover the (relatively) small investments made in companies during the early stages of their existence - and the entrepreneurs and startups who have not yet had the opportunity to reveal their stories to the world. Please use the linked form and fill it out according to the guidelines. This form is intended for startups raising between $500,000 and $3 million from venture capital funds, angels, or official grants from Israeli and foreign institutions. If relevant, someone at CTech will be in touch for follow-up questions.