Harris bets big on digital to beat Trump in 2024

A $200 million digital strategy aims to reshape the electoral landscape and secure swing state votes.

In the short history of digital election campaigns, several key moments stand out. In 2008, Barack Obama's campaign was the first to make significant use of social media to reach young audiences and new voters. In 2016, during the UK referendum on leaving the European Union, much of the campaign was conducted digitally, with Brexiteers exploiting the virality of social media to spread misinformation about the benefits of leaving the EU. That same year, the Trump campaign revolutionized the use of targeted advertising on platforms like Facebook to segment and target voters with personalized messages, while Hillary Clinton's campaign missed the mark with broad and uniform messaging.

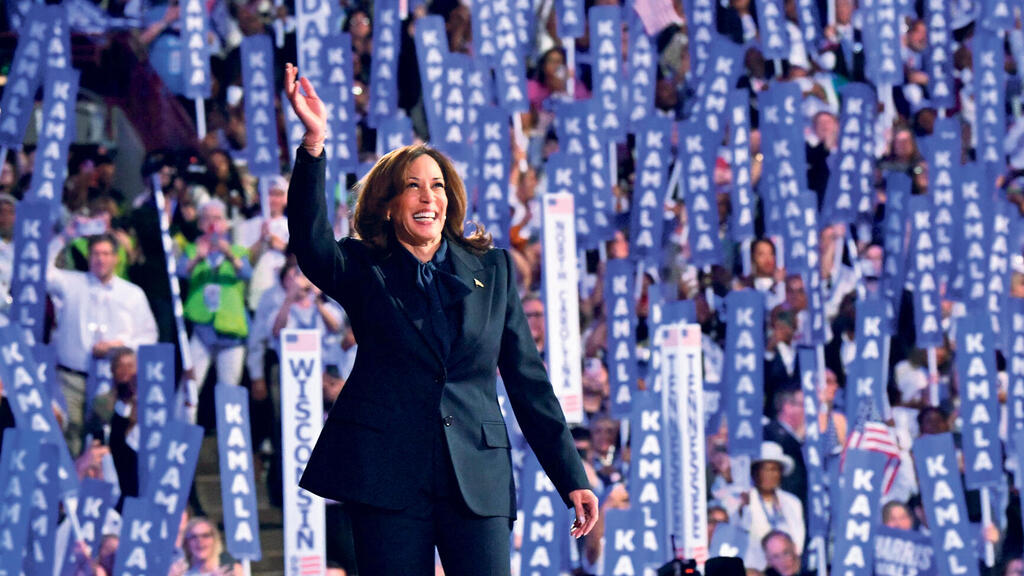

Now, Kamala Harris's election campaign is aiming to add its digital strategy to the list of historic campaigns, hoping this approach will lead to victory. According to a statement released yesterday, the campaign plans to invest $370 million in digital and television advertising, aiming to reach as many voters as possible, especially in swing states.

Most of the funds—$200 million—will be allocated to digital advertising, which, according to the campaign, will be the largest investment of its kind in American political history. "We believe we are on track to spend more on digital media than any political organization ever," wrote campaign executives Quentin Fulks and Rob Flaherty. According to data from AdImpact, since Harris launched her campaign at the beginning of the summer and until August 17, $33.2 million has been spent on television and radio advertisements. The Democratic PAC spent $543 million on Google and Facebook ads—the largest digital expenditure in the presidential race up to that point.

However, the amounts the campaign intends to spend by November are expected to dwarf these figures. In traditional television advertising, the Harris campaign has prioritized purchasing spots early, ahead of Trump. "Pre-ordering secures inventory during high-viewership times, such as major sporting events, before spots run out," Fulks and Flaherty wrote in a memo published in the United States. "The rates go up as you get closer to the broadcast date, and there's also less inventory. By buying later, the Trump campaign is spending more money per ad and getting worse placements, especially on high-volume shows like live sports."

The Harris campaign plans to air ads during NFL, NBA, WNBA, NHL, and MLB games, as well as on popular series like "Grey's Anatomy," "Survivor," and "Abbott Elementary." The campaign will also buy ads on Fox News to reach more moderate Republican audiences, such as Nikki Haley's supporters. In key states, the campaign will invest more significant amounts compared to the Biden campaign in 2020.

Related articles:

However, the primary focus will be on digital advertising, where the campaign plans to invest about 18% more than in television. "It's a modern campaign, and we're not stuck in the old days when 80% of the budget went to television," Fulks told The New York Times. Digital advertising will mainly focus on early investments in popular platforms like Hulu, Roku, YouTube, Paramount, Spotify, and Pandora.

The Harris campaign's emphasis on early purchases is no coincidence. The Trump campaign has only ordered advertisements in two states—Pennsylvania and Georgia—spending just $44 million. Both campaigns have similar amounts available for advertising investment ($327 million for Trump, $377 million for Harris), so those who invest now and wisely will be able to use their resources more effectively.

However, the Trump campaign dismissed suggestions that they needed to catch up with Harris, claiming that her advertising blitz was an "overinvestment" (although, when it comes to the fight for the most important job in the world, is there really such a thing as overinvestment?). "Ads supporting President Trump reach more people than Harris ads," a Trump campaign representative told CNBC. "Her campaign scatters funds carelessly because they have no idea how to run a winning campaign."

So far, the Harris campaign has done a good job of increasing her visibility and shaping the narrative around the presidency she intends to build. The initial burst of enthusiasm has fueled the campaign with donations and a pool of determined volunteers. The challenge now is to find the relevant voters and convey the appropriate messages to them. For reserved Democrats, messages that encourage them to vote; for independents and swing Republicans, messages that persuade them to choose Harris; and for hardline but Trump-daunted Republicans, messages that give them a reason to stay home.

This task is much more challenging and is an area where the Trump campaign has had significant success in the past and currently holds a substantial advantage: enthusiastic support from Elon Musk, who controls X (formerly Twitter), and can assist with various tactics. For example, Harris activists claimed they were blocked by X after a fundraising event. Musk also shared deepfake content on his X account that defamed Harris and misled voters in swing states into providing personal details through a political organization he founded in support of Trump.