Analysis

Mellanox magic: The secret behind Nvidia's meteoric trillion-dollar rise

In 2019, the American chip giant purchased Yokneam-based Mellanox for about $7 billion. While success has many fathers, you cannot deny the Israeli contribution to ensuring Nvidia was in the right place and at the right time for the AI revolution

How did 93+7 become 1,000? This strange equation is the essence of the Israeliness of Nvidia, one of the few companies in the world that trade at a value of more than a trillion dollars. When you talk about the worlds of chips and processors in Israel you immediately think of Intel, which employs over 10,000 workers here. Nvidia went almost unnoticed for many years. The purchase deal of Mellanox for $6.9 billion, signed in March 2019, made a lot of noise because of the high amount, but Nvidia was then still a fairly unknown company for most Israelis.

The completion of the deal and the start of the actual merger between the companies happened deep into the pandemic, when everyone was mainly dealing with masks and vaccines and much less with chips. But for both Nvidia and Mellanox employees, it was a defining event. This is exactly what they mean in the corridors of Nvidia when they ask the job candidates - and the occasional guests - how is it possible that 7 plus 93 equals 1,000? The answer lies in the value of Mellanox in the purchase and the value of Nvidia at the time, which was around $93 billion. Somehow in just three years, they have joined the very limited trillion dollar club together. Intel, by the way, is traded today with a market value of only $150 billion.

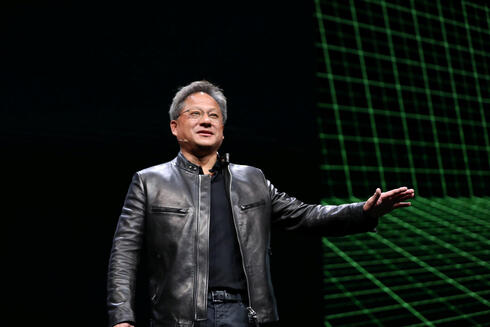

Nvidia announced on Sunday that Jensen Huang, the company's founder and CEO, who in recent years has become one of the most revered figures in high-tech, will visit Israel in October. The visit will take place on the occasion of the Nvidia AI Summit, where the company will try to establish its position as a major hardware player for the AI era. Huang also visited Israel earlier this year, on a quiet working visit just before Nvidia stunned the local ecosystem by announcing that it would build Israel-1, which is supposed to be one of the world's most powerful supercomputers for calculations for artificial intelligence applications.

The computer was developed in Israel in the last 18 months and will be located in the country. This is one of Nvidia's most significant and central investments in recent years, both in terms of money and prestige. This will be the infrastructure for smart data centers, which will be able to optimally utilize the capabilities of generative AI. In order to benefit from the new capabilities provided by solutions such as ChatGPT or Google Bard at the commercial level, and not only among the broad user public for which it has become a hobby, there is a need for computational infrastructure that will enable this.

It is the AI revolution that has boosted Nvidia's market value tenfold in the last three years, as it transformed from just another high-tech company that was known mainly to gamers thanks to its graphics processors, to one of the companies with the highest market value in the world. Of course, Mellanox is not the only thing that led Nvidia to its extraordinary success, but it is definitely among the main factors that contributed to it, and Nvidia admits it.

Acquisitions and mergers always sound great on paper, with both parties smiling at the cameras as they talk about looking ahead to the joint venture. However, in the vast majority of cases, the actual reality is bleak and quite a few of the purchases end up with merely bringing quality personnel to the purchasing company. The case of Nvidia and Mellanox is one of the exceptions, which do not prove the rule.

Related articles:

It is difficult to put one's finger on all the factors of success, especially when doing so in retrospect, but there are two prominent ones that also seem to go against the intuition of most mergers. Nvidia's decision to acquire Mellanox greatly surprised the market at the time, because Nvidia was a Mellanox customer and did not even have a product line close to that of the Israeli company. They operated almost in parallel lines, and only after the acquisition did Nvidia grow an arm of communication networks based on Mellanox. Mellanox's solutions were actually used as a kind of "roads" that lead to the chips and data centers that Nvidia is building, and they are also the ones who knew how to make them particularly effective against the competitors in managing loads and access.

The second factor of success is related to the decision of Eyal Waldman, the founder and very dominant CEO of Mellanox, to leave shortly after the completion of the merger. Waldman, who is known for his frequent television appearances mainly as part of the high-tech protest against the judicial reform in Israel, but also during the pandemic period, is an opinionated type and if he had stayed with Nvidia he might have made quite a few of the merger processes more difficult.

What can testify to how much Mellanox has become an ingrained part of the purchasing company is also the fact that today, and despite the fact that Waldman himself is no longer there, five Israelis report directly to Huang. Among them is Amit Krig, SVP software and NIC Product line at the company and the head of the Israeli site, who joined Mellanox as employee number 40 in 2000 after leaving Intel. Michael Kagan, who founded Mellanox together with Eyal Waldman, is today the global CTO of Nvidia. At the time of the acquisition of Mellanox, the company employed 2,000 people and in the three years since the completion of the merger, their number has jumped by 50% to 3,000. Nvidia is currently recruiting 250 more engineers and this is in contrast to the trend of layoffs that still characterizes the high-tech industry. Although Nvidia as a whole already employs 26,000 people, the Israeli center is its second largest outside the U.S.

Similarly to Intel, Nvidia's activity in Israel is an almost complete reflection of everything that is done at the company headquarters in the U.S. There is almost no activity in Nvidia that does not have a development arm here. Israel participates in a substantial way in the development of two of the three main chips of Nvidia: the traditional graphics GPU, the central processor CPU, and the DPU intended for data centers. Beyond that, Israel also has development groups for Nvidia's most futuristic and wild projects, from on-chip laboratories to software for autonomous vehicles.

Mellanox, which was established in Yokneam in 1999 (the same year as Nvidia), has made many Israeli engineers very wealthy people. "For many years we suffered because no one, not even our families, understood what we were doing and we ourselves called Mellanox 'the factory'. Today everyone knows what Nvidia is and you can talk about it on the street. People don't come to work with Ferraris, but you see the smiles in the corridors," noted senior officials at Nvidia Israel.