Six Traps Foreign Founders Fall For in the U.S. Market

From “Michael Jordan Effect” to Ghost CEOs - novice and veteran entrepreneurs alike tend to make these common mistakes; Ignore the risks at your own peril

The opportunities to build a unicorn company are clearly in the U.S. market, but those who choose that path must aim high and find the best opportunities to scale and grow their businesses. They also need to avoid the traps that can send them packing for home.

In my work, I have worked closely with more than 300 international start-ups. Watching them navigate the complex and literally foreign territory has provided me a bird’s-eye view of how founders manage the transition.

Here are the six known traps any entrepreneur should consider.

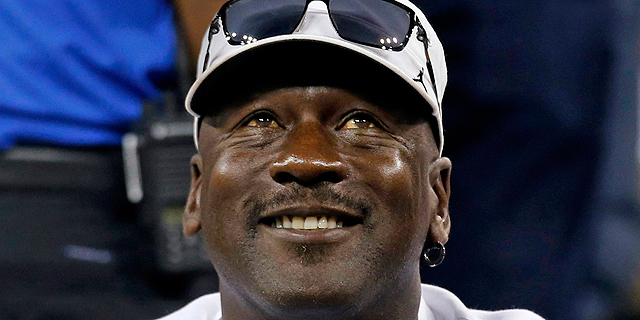

1. The "Michael Jordan Effect"

My partner at UpWest Labs, Gil Ben-Artzy, calls this the “Michael Jordan Effect” – hundreds of foreign basketball players who grew up wanting to “be like Mike,” have become NBA players.

If the U.S is where the Michael Jordan equivalents of startups play, you best be ready to face them.

The sheer number of unicorns (98 companies valued at $372B combined, according to CB Insights), the immense size of U.S. funds, and the staggering sum of investments made ($58.5 billion in U.S. venture capital funding in 2016) creates a perfect storm for international entrepreneurs who often come from smaller, local ecosystems.

An entrepreneur’s definition of success should be shaped by the environment in which he or she plays in — and in places like Silicon Valley, that environment is always fast-moving, disruptive, and high stakes.

2. Working the Product to Death

Foreign founders at early-stage companies are extremely product-oriented, often to a fault. As they often lack a person or team to be the interface with customers (and sometimes a language barrier is at play), these founders’ fallback is to work on the product to death.

One of the biggest challenges I’ve observed for foreign founders is getting them to articulate what problem he or she is solving and for whom. That transition — from thinking about the product to thinking about the customer —is difficult to do, but crucial.

It requires a lot of customer feedback, learning the pain points first-hand, and constantly iterating on the design. Through this, the founder begins to learn the art of storytelling — not just what they built and what it does, but why they are doing it and how it is going to change people’s lives.

3. Getting Caught in the Industry Echo Chamber

This is one of the hardest traps to detect. When foreign founders come to the States, they immediately buy into the positive encouragement and validation they receive from the wrong people.

Often this comes from players in ecosystems indirectly involved in their domain - startups, industry associations, and even accelerators and innovation labs sponsored by big brand-name companies.

While such encouragement can be a short-term confidence boost, founders need to remember that these well-intended individuals aren’t being directly impacted by the business, and ultimately they won’t write you a check.

Cultivating relationships is important, but be wary of getting caught up in an industry echo chamber. The people who have the biggest pain are the ones you need to talk to.

4. Street Cred Doesn’t Transfer

It’s cringe-worthy to watch a foreign-born entrepreneur walk into a meeting with either a potential investor and boast about the number of partnerships they have back home.

Few U.S. investors or companies care about what you did before you arrived. Any street cred earned in other countries doesn’t transfer to the United States — no matter how much capital you’ve raised elsewhere, how many customers you have, how many startups you’ve been a part of.

Foreign founders must learn the art of immersion, absorbing the DNA and culture of the city that surrounds them, and connect with the people who make that market thrive.

5. Ghost CEOs

Founders need to be physically present in the U.S. — no ifs, ands, or buts. With the trust of the company behind them, the founder is the only person who should hold meetings, do product demos, talk to investors, and ultimately make decisions on the ground.

To avoid being physically present in the U.S. market founders many times create a workaround system by hiring what I call the “Ghost CEO.” This person is hired to act on behalf of the CEO on the ground, and usually bears the title Business Development, VP Partnerships, VP of Customer Success, or another vague combination.

I’ve seen this set-up repeatedly and disastrously fail. The “Ghost CEO” is given directions remotely, and often has no insight into how or why decisions are made before meeting with customers, partners, or investors. It quickly becomes apparent the Ghost CEO has no actual authority.

Even worse, being the person that often receives the most critical and honest feedback from U.S. customers and partners, Ghost CEOs are often met with defensiveness at their own company when conveying the information.

6. Rinse and Repeat Doesn't Work

Just because a product worked in your home country doesn’t mean it can be rinsed and repeated in the States. The dream of building a product or service that has never existed before can quickly come crashing down when met with unforeseen U.S. regulatory and compliance hurdles. This is particularly true in highly regulated U.S. industries, like banking and finance, healthcare, and insurance.

Founders have to do their homework on the types of certifications and compliance protocols they must meet at the local, state, and national level.

How quickly entrepreneurs can both understand and comply with regulations is actually a competitive advantage — as investors, customers, and other partners will value that you have thoroughly assessed risk and have a strong compliance plan in place.

This article was originally published on Medium.

Shuly Galili is a partner at UpWest Labs, a Silicon Valley based seed fund investing in Israeli startups looking to break into the U.S. market. For twelve years Ms. Galili served as an Executive Director at the California Israel Chamber of Commerce.

No Comments Add Comment