These Ten Israeli Companies Raised the Most Money in 2018

CTech takes a look at the biggest funding rounds of the past six months

For daily updates, subscribe to our newsletter by clicking here.

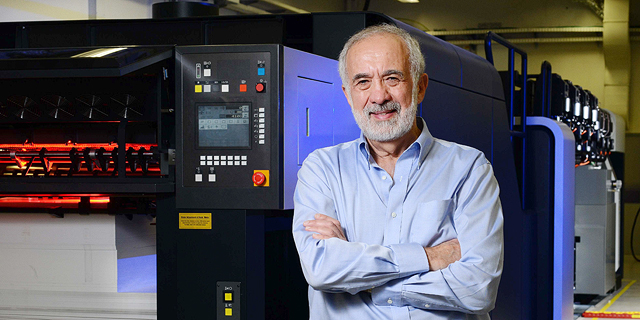

In 2017, venture capital investment in Israel-based or Israel-linked startups totaled $5.24 billion, up 9% from 2016, according to data from Israel-based market research firm IVC Research Center Ltd. The data also shows that as the local tech scene matures, investors are gravitating towards larger investments across fewer deals. Accordingly, in 2017, four investment rounds of $100 million or more accounted for 12% of the total money invested in Israeli startups. At the half-year mark, 2018 is shaping up to continue the trend. The following list includes the ten Israeli-linked tech companies that raised the largest funding rounds between January and June, compiled from CTech reports. While many other startups raised funds during those months, the decision was made to include companies that raised $50 million or more, only in equity funding and not in debt financing or initial coin offerings. As such, the list does not include companies like fintech startup Pagaya Investments, which raised $75 million in debt financing in March; LeadCoin, which announced in March it raised $50 million through a public offering of its cryptocurrency; or shared office company Mixer, which raised $40 million in February. 1. Landa Digital PrintingAmount: $300 million, announced in June

Investors in the round: SKion GmbH led the round, with participation from existing investor Altana AG. Together, the two now hold a 46% stake in the company.

Sector: digital printing

Founders: Benny Landa

Year founded: 2002

Total funding to date: around $700 million

A division of Landa Corporation Ltd., Landa develops industrial digital printing technologies for the commercial, packaging, and publishing markets. Based in Rehovot, a town in central Israel, the company employs around 450 people.2. Trax Image Recognition

Amount: $125 million, announced in June

Investors: Boyu Capital Consultancy Co. Ltd. led the round, with participation from DC Thomson

Sector: Retail Analytics

Founders: Joel Bar-El and Dror Feldheim

Year founded: 2010

Total funding to date: $235 million

Headquartered in Singapore with a research and development center in Tel Aviv, Trax enables retailers to keep track of their stock using image recognition and computer vision analytic tools. The company operates in over 50 countries, with clients including some of Coca Cola's anchor bottlers and Henkel AG & Company.

3. eToro Group Ltd.

Amount: $100 million, announced in March

Investors: China Minsheng Financial Holding Corporation Ltd. led the round, with participation from SBI Group and Korea Investment Partners.

Sector: alternative financing

Founders: David Ring, Ronen Assia, Yoni Assia

Year founded: 2007

Total funding to date: $162 million

eToro operates a website that enables users to make investments in a variety of financial assets. Investments can be made manually, or “socially” by copying the trading activity of other users.

4. Selina Ltd.

Amount: $95 million, announced in April

Investors in the round: WeWork founder Adam Neumann, the Abraaj Group

Sector: hospitality and co-working

Founders: Rafael Museri and Daniel Rudasevski

Year founded: 2014

Total funding to date: $95 million

Established in Panama by Israeli-born entrepreneurs, Selina operates hostels that combine a hotel, a co-working space, curated tours, wellness and fitness classes, homegrown produce-based meals, and volunteer activities. The company operates mainly in Latin America.

5. Gett

Amount: $80 million, announced in June

Investors in the round: Volkswagen, Access Industries, Baring Vistok, MCI

Sector: mobility

Founders: Shahar Waiser and Roi More

Year founded: 2010

Total funding to date: around $700 million

Israel-based Gett develops a taxi-hailing app that connects users with registered taxis and cabs. The company operates in over 120 cities across the U.S., U.K., Russia and Israel, and has over 13,000 corporate clients.

6. V-Wave Ltd.

Amount: $70 million, announced in April

Investors in the round: Deerfield Management Company L.P. led the round, with participation from Endeavour Vision SA, Quark Venture Inc., Aperture Venture Partners LLC, Johnson & Johnson Innovation, Edwards Lifesciences, BRM Group, and Pontifax Ltd.

Sector: medical shunts

Founders: Yaacov Nitzan and Gad Keren

Year founded: 2009

Total funding to date: $104.5 million

Israel-headquartered V-Wave develops a minimally invasive implanted shunt device for treating patients with severe heart failure. According to the company, its device can help control elevated left atrial pressure, the primary cause of breathing difficulty and hospitalization due to heart failure.

7. BlueVine Capital Inc.

Amount: the company raised $60 million in equity in June and $200 million in debt financing in May

Investors in the round: Menlo Ventures led the June round, with participation from SVB Capital and existing investors. Credit Suisse granted BlueVine the credit line in May.

Sector: Alternative financing

Founders: Eyal Lifshitz, Moti Shatner, Nir Klar

Year founded: 2013

Total funding to date: $128 million in equity, $500 million in credit lines

BlueVine offers small and medium-sized businesses capital financing, either by credit line or invoice factoring, which allows businesses to receive cash advances on outstanding invoices.

8. Claroty Ltd.

Amount: $60 million, announced in June

Investors in the round: Temasek Holdings led the round, with participation from Rockwell Automation, Aster Capital, Next47, Envision Ventures, Tekfen Ventures, Bessemer Venture Partners, Team8, Innovation Endeavors, ICV

Sector: Cybersecurity

Founders: Amir Zilberstein, Benny Porat, Galina Antova

Year founded: 2014

Total funding to date: $93 million

Claroty develops and markets cybersecurity platform for industrial networks. Headquartered in New York, the company also has an office in Tel Aviv.

9. TripActions Inc.Amount: $51 million, announced in March

Investors in the round: Lightspeed Management Company LLC led the round

Sector: travel

Founders: Ariel Cohen and Ilan Twig

Year founded: 2015

Total funding to date: $78 million

California-based TripActions develops a business travel management service aimed at saving companies money on their employees’ work-related trips. The company also offers around-the-clock customer support that reaches out to travelers in cases when further assistance is needed, such as flight delays or cancellations.

10. Moovit App Global Ltd.

Amount: $50 million, announced in February

Investors in the round: Intel led the round, with participation from Sequoia Capital, BMW i Ventures Inc., NGP Capital, Sound Ventures, Vintage Investment Partners, BRM group, Gemini Israel Ventures, Vaizra Investments and Hanaco Venture Capital.

Sector: public transportation

Founders: Roy Bick, Yaron Evron and Nir Erez

Year founded: 2012

Total funding to date: $131.5 million

Moovit’s free app uses data collected from users to track the location of buses and trains, offering real-time public transit information.

No Comments Add Comment