Nvidia to Acquire Mellanox for $6.9 Billion

On Sunday, Calcalist reported Nvidia has joined the bidding race for Mellanox

Update: Nvidia Corporation is set to acquire Israeli chipmaker Mellanox Technologies Ltd. for $6.9 billion, the companies announced Monday. As per the companies’ agreement, Nvidia will acquire Mellanox’ issued and outstanding common stocks for $125 per share in cash, adding up to a total enterprise value of approximately $6.9 billion. The acquisition has been approved by both companies’ boards of directors, but is subject to regulatory approvals including approval by Mellanox shareholders.

On Sunday, Bloomberg and CNBC reported Nvidia nears a closing of a deal to acquire Mellanox. CNBC placed the deal at over $7 billion, while Bloomberg did not provide financial details.

For daily updates, subscribe to our newsletter by clicking here.

The reports followed a Sunday Calcalist report stating that Nvidia has joined the bidding for Mellanox and has overtaken Intel Corporation, previously considered the leading bidder. In January, Calcalist reported that Intel made a $6 billion offer for the chipmaker.

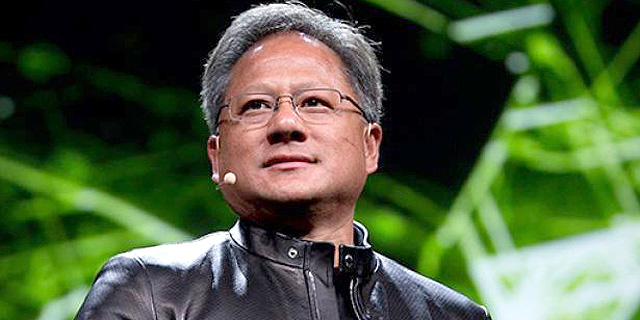

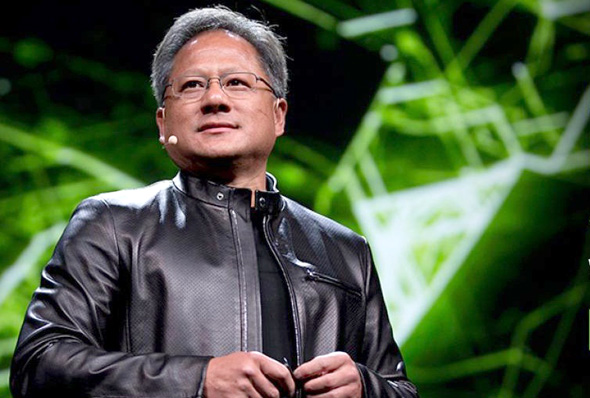

Nvidia expects its biggest-ever acquisition to boost the company’s data center business. “We’re excited to unite Nvidia’s accelerated computing platform with Mellanox’s world-renowned accelerated networking platform under one roof to create next-generation datacenter-scale computing solutions," Nvidia’s CEO Jensen Huang said in a statement.

Nasdaq-traded Mellanox manufactures interconnect chips for data centers, used by suppliers of real-time online services, and cloud services, including Japanese messaging company LINE Corporation and Alibaba. Most of the company's 2,700 employees are based in Israel. The company reported revenues of $1.09 billion for 2018, the first time its annual revenues topped $1 billion.

Nvidia intends to continue investing in local talent in Israel, the company said in a statement.

Intel, which opened its first offices in Israel in 1974, employs almost 13,000 people in the country. Its largest Israeli acquisition to date was Jerusalem-headquartered automotive chipmaker Mobileye, for which it paid $15.3 billion in 2017.

Nvidia employs several dozen people in Israel after opening a research and development center in the country in 2017. Mellanox's stock has risen by almost 66% since the company October 2018 low point was turned around following the company's report of a fifth consecutive quarter of record results. In June 2018, Mellanox settled a boardroom struggle for control with New York-headquartered activist investor Starboard Value LP. The firm acquired a 10.7% stake in the company in November and proceeded to push for widespread changes in Mellanox, accusing the company’s management and board of mismanaging the company.

No Comments Add Comment