Analysis

WeWork’s Prospectus: No Big Reveals, but the Devil Is in the Details

WeWork’s IPO prospectus, published Wednesday, shows that the company’s losses continue to grow, but its revenues are growing even quicker. Will that be enough to sway investors?

Sophie Schulman | 14:32, 15.08.19

Co-working company WeWork, which raised its last round in January at a company valuation of $47 million, published its highly anticipated initial public offering prospectus Wednesday. Some of the numbers of WeWork—which recently rebranded as the We Company—were leaked during its debt financing last year and its preliminary meeting with investors. But even if there were no real surprises in its prospectus, the devil is in the details.

WeWork ended the first quarter of 2019 with a $690 million loss (attributable to shareholders) and revenues of $1.5 billion—twice the revenues reported in 2018, with a $60 million increase in loss. The company’s total losses over the past three and a half years amount to $3.6 billion.

Data for the first six months of 2019 shows that WeWork’s losses continue to grow, but its revenues are growing even faster, and that is something investors favor. Unlike Uber, expected to keep its largest-ever tech IPO crown even after WeWork goes public, WeWork’s prospectus shows a trend of decreasing losses. The company’s debt currently stands at $8.4 billion, but WeWork recently received commitments for another $6 billion in debt financing. The company has cash reserves of $2.4 billion as of June 30, and minimum future lease obligations of around $47 billion.

When considering WeWork’s finances over several years, the company has become better at balancing real estate expenses and revenue from tenants. Until 2018, the company’s base expenses exceeded its revenue, meaning it was already starting each quarter at a loss. Other expenses such as advertising and marketing are not unusual.

Like all fast-growing, user-based market disruptors, WeWork is trying to focus attention less on its heavy losses and more on the trendy concept of unit economics: according to the company, each employee using WeWork’s offices costs their employers on average $7,300 per year, around 60% less than an employee using traditional offices.

The prospectus stresses that WeWork’s annual revenue (run-rate revenue) is now $3.3 billion, a sum forecasted based on the company’s revenues for the last reported month—making for 86% year-over-year growth. The company has also emphasized the growing presence of large organizations among its clients, which enables it to make better forecasts. Around 40% of WeWork’s current tenants are companies with 500 or more employees.

Previous criticism of WeWork was that the company’s model was yet to be tested during a financial crisis. Neumann’s answer in the past was that the company’s diverse customer base, and the fact that most of the tenants were small companies less likely to lay off employees, made for more robust model. But now, it seems, WeWork is leaning more and more on corporations.

WeWork profitability profile relies on the “maturity” of its assets. The company defines mature assets as locations that have been open for over 24 months, when the tenant base becomes stable and initial investments such as build-out and marketing are complete. As the company is still pursuing a rapid growth strategy, only 30% of its existing locations are currently defined as mature, but WeWork stresses that it could up profitability by slowing down its expansion rate. The company has defined 280 target cities with a total population of 255 million people. Of those, it is currently active in 111 cities.

WeWork has not specified its IPO target or how many shares it intends to issue, but market estimates are that the company is aiming to raise $3.5 billion to $4 billion at a company valuation of at least $45 billion. The main underwriters are JP Morgan Chase—a company shareholder—and Goldman Sachs, but almost every major bank is listed as an affiliate, from Barclays Bank PLC to Citigroup Global Markets Inc. A factor that could threaten WeWork’s IPO success, aside from its previously-known heavy losses, is the current instability in the market.

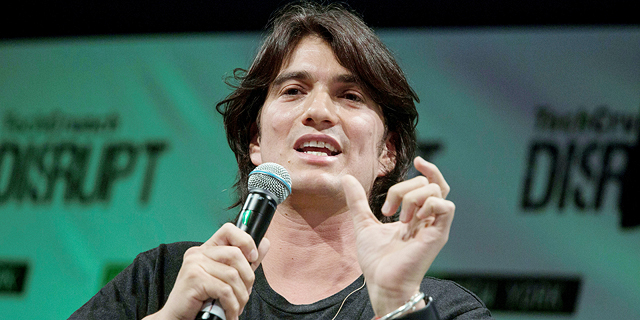

WeWork’s numbers are not the only points of interest that can be gleaned from its prospectus. It also serves as a window into its charismatic co-founder and CEO, who has in recent years grown stronger in his religious belief and upped his activism. The filing reveals that Neumann is the only person who holds three different types of securities, making him the controlling shareholder of the company despite not having the largest stake.

He holds 2.4 million Class A common stock, which grant their owner one vote per share. Softbank Group is the largest owner of such stock, having invested $10.6 billion for 113.9 million shares, and the second is Benchmark Capital, which owns 32.6 million shares. But Neumann also owns 112.5 million Class B common stock and one million Class C common stock, which award 20 votes per share.

One clause states the following: “Rebekah and Adam Neumann have pledged $1 billion to fund charitable causes. To fulfill this pledge, Rebekah and Adam will contribute cash and equity to charitable causes within the 10 years following this offering… if Adam and Rebekah have not contributed at least $1 billion to charitable causes as of the ten-year anniversary of the closing date of this offering, holders of all of the Company’s high-vote stock will only be entitled to ten votes per share instead of twenty votes per share.”

Recently, it was revealed that Neumann realized shares worth $700 million without waiting for the IPO, raising concerns. While the company did not specify its intended target, it seems Neumann is very much impacted by the company’s performance. The last time he sold shares was in October 2017, when both employees and shareholders had the opportunity to sell shares to new investors. He has committed to not sell any of his stock during the IPO. The prospectus also shows that Neumann chose not to draw a salary in 2018, after drawing $1 in 2017.

The prospectus also reveals loans Neumann received over the years from the company at a comfortable interest compared to market rates. Between 2013 and 2016, he took out a $30 million loan spread across several intervals, which he has since repaid in full. In April, the company loaned him over $360 million, which he used mainly to realize options. He also used $380 million of a $500 million credit line extended, and loaned $97.5 million from Morgan Chase.

The prospectus clearly states Neumann has no employment contract with the company, and will not receive any compensation if he steps down as CEO. It also stresses Neumann’s importance to the company: “Adam is a unique leader who has proven he can simultaneously wear the hats of visionary, operator and innovator, while thriving as a community and culture creator.”

No Comments Add Comment