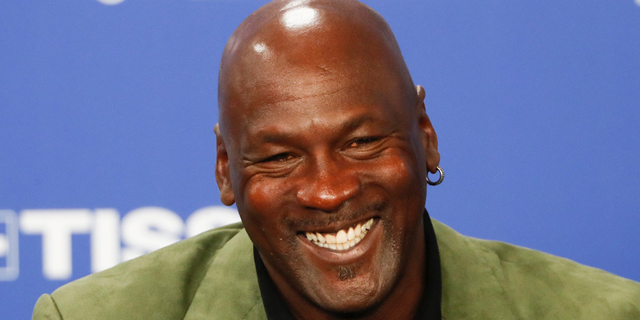

The Israeli connection behind Michael Jordan’s deal with DraftKings

Among those the basketball legend will be advising on the board of the sports entertainment and gaming company is DraftKings’ largest shareholder, Israeli Shalom Meckenzie

“Michael Jordan is among the most important figures in sports and culture, who forever redefined the modern athlete and entrepreneur,” said Jason Robins, DraftKings co-founder and CEO. “The strategic counsel and business acumen Michael brings to our board is invaluable, and I am excited to have him join our team.”

Among those Jordan will be advising on the board is DraftKings’ largest shareholder, Israeli Shalom Meckenzie. Meckenzie’s SBTech, a provider of sports wagering technology solutions which he founded, was part of a reverse merger that resulted in Diamond Eagle, DraftKings, and SBTech signing a business combination agreement (BCA) back in April that led to the combined company debuting on the Nasdaq Stock Exchange under the DraftKings name.

As a special advisor, Jordan will provide strategic and creative input to the board of directors on company strategy, product development, inclusion, equity and belonging, marketing activities and other key initiatives.

DraftKings and SBTech revealed in May that they both saw revenue grow in the first quarter of 2020, but combined losses widened to $74 million in the pair’s last full quarter before their merger closed, with Covid-19 halting most sports leagues across the world.