Analysis

Wall Street’s investment frenzy is not over, it is just shifting its focus

With the U.S. presidential election right around the corner, President Trump will not let the U.S. stock markets crash, but his administration is likely to pay more attention to sectors that have been severely affected by the Covid-19 crisis

The fact that Tesla was left out of the latest additions to the S&P Index —despite a $400 billion market cap making it bigger than The Toyota Group or The Coca-Cola Company—might further hurt its stock during this week’s trade. The committee responsible for adding new companies to the index did not provide an explanation to its decision to leave Tesla out and on Friday’s after-hours trading, Tesla’s stock already fell 7% following the news.

Related Stories

The market quickly shifted its gaze to SoftBank Group, which transitioned over the past year from an esteemed investment company to one of the most slandered entities on Wall Street. This transition came after it became apparent how devastating the bloated valuations it created for private tech companies were, as exemplified by Uber and WeWork, two of its portfolio companies. As they looked to turn public, the latter came crumbling down as soon as it attempted an initial public offering (IPO).

On Friday, The Financial Times named SoftBank as the Nasdaq whale responsible for buying billions of dollars’ worth of U.S. equity derivatives over the past months, contributing to the trading frenzy that ended abruptly with a sharp pullback since Thursday.

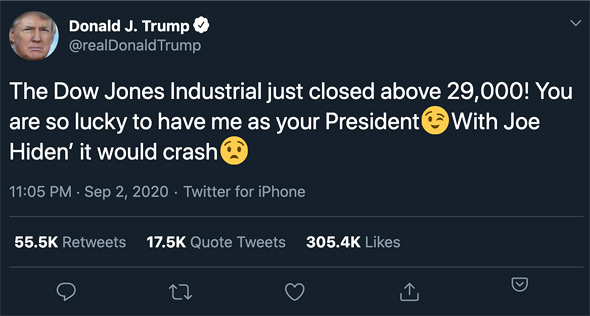

SoftBank’s actions focused on a few major companies, including Amazon and Tesla, suspiciously increasing their trade volumes and drawing attention. According to Goldman Sachs, the overall nominal value of calls traded on individual U.S. stocks during the past two weeks averaged $335 billion a day, three times the moving average between 2017 and 2019. Until recently, SoftBank was known to focus on private companies and its invasion into the exchange is causing some raised eyebrows for both investors and the companies it buys into. While SoftBank’s activity is legal, it is not without its victims. Plenty of those can be found on online trading app Robinhood and most of them are young investors who have yet to experience significant drops. SoftBank’s moves may be irregular, but the activity by small private investors has also grown far beyond its traditional volume in recent months. Recently, for the first time in history, one-fifth of the daily activity on Wall Street was attributed to these investors, while, traditionally, they account for just 10% of the daily activity. Add to this the fact advertised by the app’s developer, Robinhood Markets Inc., that half its new users have never traded on the exchange before, and you get potential mass hysteria that might spread through Wall Street in the near future. If most of these new players never experienced significant drops of hundreds of points on a single day, these SoftBank-induced market shifts can be just what chases them away. When good is bad Traditionally, September is a strong month on the American stock market as professional investors return from their summer vacations at the Hamptons and position themselves ahead of the last quarter of the year and the annual reports they issue to clients. This year, things are different both due to the coronavirus (Covid-19) crisis and the upcoming U.S. presidential election in November. Until now, most institutional players counted on U.S. President Donald Trump to maintain the stock market rally at least until the election. This certainty was fed by statements like the one he tweeted on Wednesday, just before the market drops, taking credit for the Dow Jones closing above 29,000 points.However, a report published Friday by the U.S. Bureau of Labor Statistics, which was surprisingly positive, managed to rattle large investors. According to the report, the American economy is strong—the unemployment rate has dropped from 10.2% in July to 8.4% and more than 1 million new jobs were added in August.

This is excellent news, but not so much for the American stock market, which, in recent months, became accustomed to a steady dose of government steroids. Large investors are counting on the continued support of the U.S. administration and the Federal Reserve System but if the macroeconomics numbers continue to improve, Trump would have a hard time justifying the continued infusion of funds into the market, which means investors will need to say goodbye to the positive momentum of the past six months.In addition, there is also concern that the economic recovery will be K shaped, meaning it will vary greatly between industries. In this scenario, some sectors, mostly tech, will continue to stride forward while the traditional economy will be left far behind, suffering from heavy unemployment. This possibility makes any solution far more complex and unpredictable.

The assumption that the U.S. administration will choose to shift its focus towards sectors that have been more severely affected was already evident by the trade over the weekend. Money pulled away from tech shares was invested, at least partly, in more battered sectors, including banking and aviation, where stocks went up. This was a signal that Trump can indeed be trusted not to let the markets crash so close to the election but that the party is moving from one industry to another.