Analysis

While 2020 was good for the gaming industry, the rules of the game are changing

The gaming industry may have gotten a boost from the pandemic but the risks are still the same: growing competition, a fickle audience, and new threats from Apple

Amit Kling | 16:54, 17.01.21

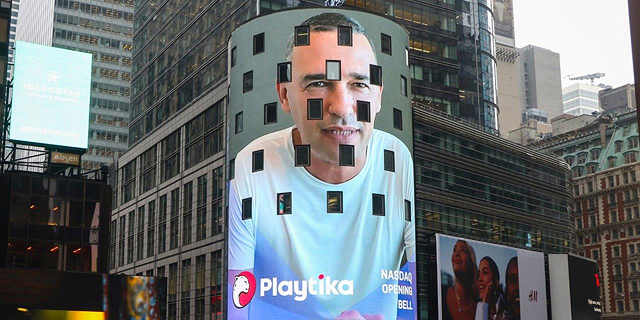

It’s tempting to get hooked on the Israeli angle when examining Playtika’s initial public offering on Nasdaq on Friday with a $11.7 billion valuation, which soared to over $13 billion by the end of the day. Another Israeli success story, another indicator of the blossoming local gaming market, more eyes looking at local companies and talent, and more capital that will expand the ecosystem. It’s even more tempting in light of Playtika’s prominence in Israel. It is a mobile-gaming company that announced its recruiting campaign with a bus stop ad campaign, regularly advertises on giant monitors in the heart of Tel Aviv, and is the main sponsor of the country’s most popular basketball team, all that even though Israel isn’t a major market for it aside for employee recruiting purposes. While all that is true, Playtika’s IPO must be examined in an entirely different light - how will the global gaming industry in 2021 react to the turbulent events of 2020?

The blossoming of the digital gaming industry was one of the great financial success stories of the past year. The industry, which was already described at the beginning of the pandemic as “recession-proof,” kept its promise and the few complications it encountered were mostly due to what could only be categorized as over-success issues: delays in producing new games and problems in production chains, which hampered the ability to bring enough gaming consoles to stores. A strange situation arose, in which industry executives repeatedly said things like “of course the pandemic is tragic, but we can’t deny that we’re having a great year.” And it was a good year indeed, especially for mobile games, the sector Playtika is active in. According to a report published by the market research body Sensor Tower, Inc., Mobile-gaming revenues grew by 26% last year, reaching $79.6 billion.

Today it’s a hit, but tomorrow gamers will flee

The gaming industry has been growing rapidly and stably for years, due to two major and most likely irreversible trends: the fact that smartphones have reached almost everyone on the planet, and a gradual change in people’s leisure habits, especially those of younger people. Still, 2020 saw exceptional growth in the gaming sector due to the pandemic, and it would be optimistic, not to say naive not to expect a certain decline in 2021. Anyone who’s picked up gaming habits while locked up at home over the past year won’t simply stop, but the return to routine will come at the expense of spending less time on games. This probably won’t cause big gaming companies to collapse, but will reduce them slightly in size. And even then, they’ll remain pretty large.

Over the next few months, additional companies from the gaming industry will go the way of Playtika: Roblox, a popular gaming platform for young children that also allows them to create games, was meant to be listed on the stock exchange at the end of December and according to estimates has a valuation of $8 billion, but the move was pushed back to February. AppLovin, which developed a technology that promotes and monitizes mobile games, hired Morgan Stanley ahead of its IPO, and Wall Street has been anticipating for some time an IPO by Niantic, which was responsible for the hit game Pokemon Go. As revealed by Calcalist, Israeli company Ironsource is also expected to go public within the next few months at an estimated valuation of $6 billion. The company offers an advertising platform for mobile apps, and gaming is a major part of that. In 2020, the company started publishing mobile games.

Gaming companies, at least those that develop games, are relatively fragile. Gaming is a fickle market: one day something is a hit, but tomorrow players will abandon it and rush to the next big hit designed by a competitor, which until recently employed only four people. If that seems like an exaggeration, the opposite is true. Among Us, one of the biggest multiplayer gaming hits of 2020, was developed by only three people.

In PC and console gaming, the community often develops loyalty to certain studios. In mobile-gaming, there is almost zero loyalty and most of the games are distributed for free relying on revenue from in-game advertisements and purchases. For the most part, the players aren’t “traditional gamers,” and many of them don’t care about the company that developed the games that they play. Playtika is trying to put its eggs in more baskets, by acquiring many small gaming development studios around the world, but that doesn't mean the company isn’t exposed to this risk.

Facebook is already panicking

The entire mobile-gaming market is preparing to face the dramatic change that Apple is set to put into motion. Nowadays, Apple shares with advertisers some user information, unless asked by the users not to do so. A few months ago, Apple announced that it will begin to demand explicit user consent to share that information, and according to estimates, many are expected to refuse. The change was expected to go into effect last fall, but was pushed off to “somewhere in the coming months.” According to Facebook, that change could cut advertisement revenues on its platform down by “more than 50%.” Facebook, like other companies that rely on targeted advertising as their main source of revenue, is trying to adapt its strategy to the new reality. And, if tech giants such as Facebook are panicking over this, one can only imagine what mobile-gaming companies are going through.