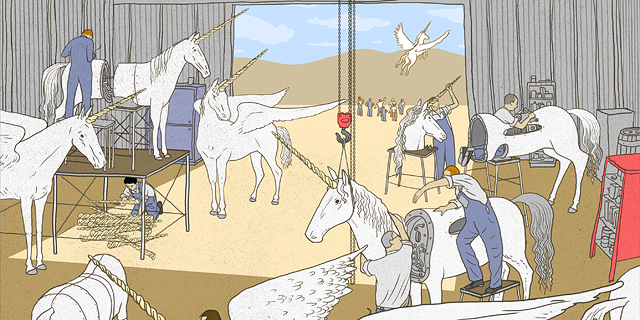

7 reasons why Israel has become an assembly line for tech unicorns

The stars aligned perfectly for the local tech sector over the past year, sparking a baby boom of billion-dollar companies

This article first appeared on April 17, 2021 and is being reshared as part of CTech's Top 10 stories of 2021.

The only word that can compete with ”coronavirus” or “elections” for the title of word-of-the-year is “unicorn.” The mythical creature is taking over Israel’s streets, particularly the costume version of it, with a pretty pink and purple horn. But when it comes to the tech world, in which a unicorn is what you call a startup valued at more than a billion dollars, things look completely different — it's a manifestation of excess money that accumulated in the financial system prior to the pandemic, and only grew to much higher magnitudes over the course of the past year. It’s the over-designed offices with gaming stations and fully-stocked kitchens; it’s the young employees zooming around on electric scooters dressed in hoodies, while hundreds of thousands of shekels pile up in their bank accounts; it’s the shiny new cars that have flooded the roads since the end of the first lockdown, and it is the housing costs that kept on climbing even in the crisis-stricken 2020 due to the demands created by wealthy techies. In fact, it’s the entire Israeli economy, which in spite of the heavy economic blow, suffered minimal injury due to the country’s tech exports.

It is a global phenomenon: in the first quarter of 2021, 121 unicorns came into the world, compared to 159 throughout the whole of 2020. At the end of 2019, there were 400 unicorns in the world, now there are more than 600. The first 35 slots are reserved for a new beast, the “Decacorn,” the name for private companies that are valued at more than $10 billion. The top two slots are occupied by ByteDance (the operator of TikTok) and Stripe (a fintech company), each valued at around $100 million, valuations that even few public companies can reach. Israel, a country of nine million people, is a unicorn assembly line: last year every tenth unicorn in the world was born here, a trend that carried on into 2021. Last March alone, seven unicorns were born here, most of them belonging to the cyber sector. Some of the new members of the unicorn club are only a year old, another characteristic of how odd things have become. In the distant past of three years ago, billion-dollar valuations were reserved for mature and truly large startups. If it wasn’t for the mad rush of IPOs and SPAC mergers that transformed unicorns into publicly traded companies and is set to do the same for about 10 more, Israel’s portion of the global unicorn pie would have been even larger. Top 50 Israeli Startups - 2021 Edition >> So what was it about this past year, a year that many business sectors would prefer to erase, that brought about this unicorn baby boom? The question can be answered briefly, with the single word “coronavirus,” or slightly longer with six words: “excessive capital in the financial system.” In any case, here are seven deeper explanations. 1. A decade of rising market tides The private investment market is always a derivative of the public markets because the profits made off stocks and bonds have to be channeled into other avenues. As investors generate returns from their public investments they become wealthier and enter the smaller circle of “accredited investors,” which in Israel means they have at least NIS 8 million (roughly $2.5 million) in liquid capital, granting them access to alternative investment channels that are considered riskier, including private equity funds and venture capital funds. Even prior to the pandemic, the U.S. stock market was enjoying a long period of high tide, which has since become the lengthiest ever, which in turn spilled over to the private capital market, flooding it with new investors. The Nasdaq, for example, multiplied sevenfold in the decade that ended in 2020, which similarly multiplied the capital managed by private equity and venture capital funds, reaching $3 trillion in 2020. Combined with the hedge funds and the real-estate investment funds, the figures reached $10 trillion. There is so much money in the private market that committed, but unallocated capital, or ‘dry powder’ as it’s known, reached the $2 trillion mark at the beginning of 2020. It was against this backdrop that 10 unicorns were born in Israel last year, in what already seemed like a fantastical stretch for the global tech industry and the Israeli industry in particular — but then along came Covid-19 and perfectly aligned the stars. By the end of 2020, the capital managed by the private investment system prior to the pandemic seemed like small change, with the assets of private equity and venture capital funds since ballooning to a record $4.7 trillion. As the pandemic broke out and stock indexes plummeted in March 2020, the private investment sector froze up due to fear of collapsing. Their main concern was that they could no longer rely on institutional investors to honor their commitments in light of the losses they suffered in the public market. But after only two or three months of paralysis, the markets corrected upwards and the funds realized that the money they were promised would be available for investments. In fact, even more money than what they were expecting — courtesy of the governments. 2. An influx of government funds With the outbreak of the pandemic, and with the financial world already accustomed to the zero interest rates of the past decade, the central banks wasted no time in pulling out their “cash cannons.” These munitions hadn’t even had a chance to completely cool down since the last time they were deployed to battle the financial crisis of 2008 and required reinforcement in the form of printing money. These days mark the one-year anniversary of the great cash flood of 2020, a period that saw unprecedented amounts of capital flood the economy to the tune of $4.5 trillion in the U.S. and another $4 trillion in the Euro bloc. That money, which took a variety of different forms — from the purchase of corporate bonds by the Federal Reserve to the delivery of checks bearing the personal signature of President Trump — landed in the lap of the financial system, which was already cash-bloated following a decade of zero interest. Investment funds discovered more and more money flowing their way — only this time they were nervous about sitting on a pile of dry powder because the crisis served as a reminder of how frail the system is. Fund managers realized that it was best to “summon the money” as quickly as possible before everything comes crashing down because of another outbreak or because institutional investors decide to not honor their pledges after all. While companies in traditional markets entered a deep freeze and couldn’t even dream of raising capital, the tech sector — which was already the center of the investment world’s attention — didn’t only continue functioning, it blossomed. 3. The digital transformationExactly one year ago marked the start of the digital transformation rush. A consistent, but slow and gradual process that was already taking place in many aspects of the economy, suddenly received a violent boost. Lockdowns forced companies to switch to remote work, which immediately increased demand for cloud servers and services, for additional software to enable working from home and cheap and simple data storage. The transition to the cloud and work from home led to a spike in attacks on companies’ servers. It was no longer the usual digital robbers who were at work, traditional thieves also had to go through a digital transformation and become acquainted with ransomware attacks. The onslaught of breaches, in turn, led to a sharp increase in demand for cyber solutions.

But life isn’t all about work, and there were plenty of leisure hours to fill too. The lockdowns, combined with government handouts, led to the strengthening of two other sectors: e-commerce and fintech — as millions of people around the world discovered new hobbies: online shopping and online investment. The demand for solutions to enable rapid deployment of online stores had already begun spiking in the first weeks of the pandemic as people sought to relieve boredom and anxiety by shopping. It took slightly longer for things to heat up on the investments side, but the onslaught of young investors to easy to use and nearly cost-free trading apps, began showing in the performance of companies like Robinhood, which is currently preparing for a $20 billion IPO and Israel’s own eToro, which is merging with a SPAC at a $10 billion valuation. 4. It’s SPAC SeasonAs if the capital earmarked for tech investments wasn’t sufficient, SPACs came along and fueled the fire. In 2020, SPACs, shelf companies founded by veteran industry players to leverage their good reputations in order to merge with attractive companies, raised roughly $75 billion; in the first three months of 2021, they raised $100 billion more. That sum poses direct competition to the private investment industry since most SPACs are looking for unicorns of their own to merge with. Essentially, it is a decision by the institutional investors (like the big banks) to bypass making tech investments via mediators (such as private equity firms or late-stage venture capital funds) — in favor of direct investment. The hundreds of SPACs that came to life in the past year and a half constitute another competitor for investments in the successful tech companies that also offer them a fast track to the stock market. In doing so, they also give the companies’ valuation a boost — after all, if a company with zero revenues can merge with a SPAC at a billion-dollar valuation, why shouldn’t a similar privately held company be valued accordingly?

5. What did all these riches do to companies? The past year has broken all the rules: Once upon a time startups would grow slowly, determinedly and in constant fear for their survival, occasionally one of them would become mature enough to actually be worth anything. These days, they barely have a chance to bud before they get flooded with money. How does showering companies with huge sums of cash affect their performance? The story of WeWork and its founder Adam Neumann, which became the prime example of “money-poisoning,” shows that there is such a thing as “too much and too fast” — however it also has a lot to do with the company’s founders and managers. Perhaps someone older and more experienced than Neumann wouldn’t have been tempted to accept Masayoshi Son’s monstrous investment or would have taken the money, but also taken more care to control expenditures without losing his head. Next Insurance, for example, has already raised $880 million, including a $250 million round it completed in March, but it seems to have a better handle on its expenses, channeling the cash towards growth, including by making acquisitions. It’s possible that it is due to the fact that its three founders had already completed a previous exit (Check, which was sold to Intuit in 2014). That is the major difference between the technological ecosystem today and the bubble of 2000, whose bursting left behind scorched earth: Many of today’s startups benefit from the hands-on involvement of experienced Angels and VC investors who have an exit or two under their belt. As a result, the capital raised nowadays is converted into focused investments in marketing and personnel recruitment, all in the service of achieving rapid growth and taking over market share — tech companies’ holy grail. 6. Israel in the heart of the actionEven though most of the developments described here originated in the U.S., like in the case of Pfizer and the Covid-19 vaccines, Israel has become sort of a laboratory, where everything takes place quickly and with high intensity. The pandemic shattered the last barrier separating Israel from the U.S. by neutralizing differences in location and culture.

Prior to Covid-19, many Israeli startups were slightly undervalued compared to their American counterparts. Despite the vast experience Israeli entrepreneurs had accumulated, being physically close to the target market and being entrenched in the local culture used to carry weight. But the skies closing down and the shift to working from home undermined the ancient balance and erased any disadvantages that Israeli tech companies may have been perceived to have relative to their U.S. counterparts. Moreover, throughout the pandemic, it was the smaller and younger companies that had an easier time making sales, since it was simpler for them to adapt their products to the new demands of the market, mostly “plug and play” solutions that didn’t require the onsite presence of large support teams. That played to the advantage of Israeli companies that are known for being flexible and nimble, especially compared to their larger American counterparts who had a tougher time adapting quickly to the new realities. The Israeli tech market is scorching. No VC fund, private equity firm, or SPAC can afford not to have a presence in Startup Nation. Competition over investments is driving valuations to new heights, in many cases clearly economically unjustifiable ones. Newly founded companies with no real revenues are becoming unicorns simply because everyone wants to invest in them. January 2021 was the venture capital industry’s busiest month ever, with an accumulated $40 billion in investments and when the final numbers are in, it’s likely that March surpassed even that. Tiger Global, one of the most active VC funds — which invested in Israel’s ironSource in its merger with a SPAC at a valuation of $11 billion — broke records by completing a new investment deal every other day during the first quarter of the year. One can also argue that the first Israeli unicorns, the ones that came prior to the pandemic, are in a large part responsible for shining a global spotlight on the Israeli tech market and brought in investors who had never operated in the country before. Throughout the years that Israel was known as Startup Nation, we may have been interesting, but we were under the radar of the truly big investors. As Waze founder Uri Levin said recently, "Google's acquisition of Waze gave birth to 50 other Israeli unicorns." 7. What’s next? Where is all of this going next? It all depends on what happens with the public markets: as long as the Nasdaq keeps climbing, the private investment heyday will continue. However, it seems like the peak of the momentum is behind us, with investors shifting their sites to the other sectors that are starting to recover: compared to the more traditional sectors, tech stocks are starting to look a little bloated. People have been arguing for years now that the Israeli economy is a derivative of Nasdaq and that as long as it is doing well, we are in good standing. Of course, if the stock market goes through a violent correction, the private investment market will suffer a slowdown too — but if that’s how things shake out, Israeli companies, who are enjoying the current days of plenty will be relatively immune to the damages, or at least have a safety buffer in place, assuming they don’t spend it all in the current period of euphoria. Another effect of the current conditions is that as long as the Israeli companies can make good use of their capital, the potential exists for them to grow to become truly large companies, not the kind that will be tempted to sell for a measly several hundred millions of dollars, but instead be confident enough of their long-term vision and short-term survival to grow independently. The current conditions provide fertile soil for the realization of the dream of turning the startup nation into the big-tech nation.