Israel Aerospace Industries CEO says it can assist the IDF in confronting Gaza threat

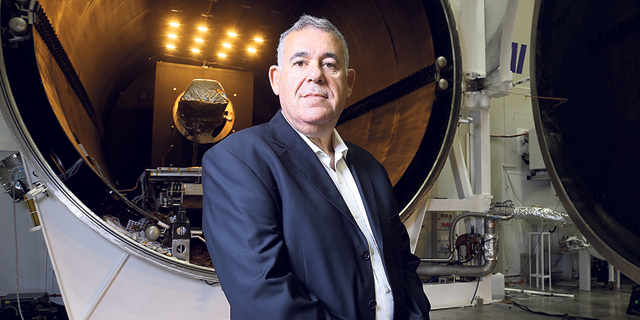

Boaz Levy, the new CEO of the IAI, comments on the current flare-up and how his company registered a 23.5% income bump despite the pandemic

Udi Etsion | 16:08, 13.05.21

Israel Aerospace Industries (IAI) recorded a 23.5% increase in its net income, generating approximately $42 million in the first quarter of 2021. The company also maintained its sales volume from the same period last year - a little over $1 billion. The company's order backlog decreased by 2%, to $12.2 billion.

"While IAI systems are used by the IDF to protect the Israeli population, we are recording a ninth consecutive quarter of growth and profitability, even though this is a quarter that is still within the tail end of the Covid-19 pandemic," Boaz Levy, who was appointed IAI CEO last November, told Calcalist.

IAI sales in the first quarter of this year totaled $1.015 billion, slightly below the same quarter last year - $1.018 billion. The company recorded a 17.6% increase in EBITDA to approximately $120 million compared to approximately $102 million in the corresponding period last year, and an increase of approximately 10% in operating income to about $67 million (approximately 6.6% of sales) compared to about $61 million (6% of sales). IAI’s gross profit amounted to approximately $166 million (about 16.4% of sales) compared to approximately $170 million in the same quarter last year (approximately 16.7% of sales).

The company also recorded a positive cash flow of $167 million from operating activities during the last quarter, in part due to the continued reduction of the Defense Ministry’s debt. "Our cash flow has increased, thanks in part to the Defense Ministry’s effort to keep low debt levels. We work collaboratively with the defense establishment and we understand the circumstances in which it operates, receiving payment in installments, whenever they have the option, they pay."

Commenting for the first time on the current fighting on the Israeli-Gaza border, Levy, who has been involved throughout his career with advanced missile and weapon systems projects said that “the current operation is in full swing, and it is too early to draw any conclusions. We work to assist the Defense Ministry through every means of development and restocking. Systems that provide pinpoint defense exist, and if the defense establishment decides to, and receives the necessary funds, it will be possible to expand the capabilities dealing with that threat. There are technical solutions for this."

As Calcalist revealed earlier this week,

IAI is expected to feel the effects of the Covid crisis in India more than the other Israeli defense companies, as India accounts for about 15% of IAI’s sales in recent years. Due to the eruption of the pandemic through the subcontinent, the company brought forward the return of some of the families of its dozens of employees living in India.

“IAI's relations with India are long-standing and rely on the strong ties between the two governments. As a governmental company, we work with all branches of the military, governmental, and privately owned companies. We continue to be in constant touch with all the incumbents who are limited in their actions by the coronavirus and it should be noted that many are in their homes under quarantine. We have dozens of our employees there who are staying with their families. We flew them to Israel during this past year to get vaccinated and we flew them back to India. Recently, families seeking to return early for their summer vacation have been allowed to return, as well as workers who are currently inactive due to the health conditions in India. Many of our employees are still there continuing to support our work in light of the needs of the Indian government."

Yesterday saw the end of a labor dispute at IAI after understandings between the management and the workers' union headed by Yair Katz and the commissioner of wages were reached. 3,500 of IAI’s employees will receive a 3.5% pay rise that other public sector employees will not receive, and in return they will accelerate negotiations to complete a new collective agreement that is required for the company’s IPO, which is currently scheduled for the last quarter of this year.