11 Israeli fintech unicorns helping to change the world

Israel has more startup tech unicorns than all of Europe combined, and the fintech sector has seen its share boom over recent months

The latter saw a spike in demand for fast, customer driven websites and other online solutions for shopping. Meanwhile, the latter

Furthermore, 2021 also brought a new animal, the "Decacorn"- a private company worth $10 billion or more. One example is Stripe, a fintech company valued at about $95 billion earlier this year after raising a total of $2.2 billion. This rush for commercial and financial solutions was felt in the Israeli tech ecosystem as well, creating new unicorns in a short span. Between September 2020 and January 2021, $1.4 billion poured into the Israeli fintech sector (24% of all tech investments for that period), compared to a $340 million investment in the first six months of 2020, with five companies raising more than $100 million at a value of more than $1 billion. This growing stream of investment continued strong in the first half of 2021, which provides us with an opportunity to look at the 11 leading Israeli fintech unicorns.Fundbox

Product: AI-powered financial platform for small businesses

Valued: $1.5 billion

Total raised: $453.5 million

Investment round: C

Year founded: 2013

Founders: Yuval Ariav, Eyal Shinar, Tomer Michaeli

Employees: 200-500

Investors: MUFG Innovation Partners, Allianz X, Healthcare of Ontario Pension Plan, Khosla Ventures, Recruit Strategic Partners, Spark Capital, General Catalyst, HarbourVest Partners, Bezos Expeditions, Shlomo Kramer, Blumberg Capital, Tom Glocer, Jay Mandelbaum, Emil Michael, Vikram S. Pandit, SV Angel

Next Insurance

Product: Small Business Insurance Solutions

Valued: $4 billion

Total raised: $881 million

Acquisitions: AP Intego, Juniper Labs

Investment round: E

Year founded: 2016

Founders: Nissim Tapiro, Alon Huri, Guy Goldstein

Employees: 200-500

Investors: FinTLV Ventures, Battery Ventures, CapitalG, Group11, Zeev Ventures, G Squared, Founder Circle Capital, Munich Re / HSB Ventures, TLV Capital, Nationwide Insurance, Ribbit Capital, Markel Corporation, American Express Ventures

Payoneer

Product: Business management software

Valued: $3.3 billion

Total raised: $282 million

Acquisitions: optile

Investment round: E

Year founded: 2005

Founder: Yuval Tal

Employees: 500+

Investors: CBC Capital, Susquehanna Growth Equity, Viola Ventures, Loeb.nyc, TCV, 83North, Wellington Management, Nyca Partners, Ping An Group, Vintage Investment Partners, Greylock Partners, Crossbar Capital, Yuval Tal, Zohar Gilon, Michael Loeb, Charlie Federman, Ilan Kaufthal

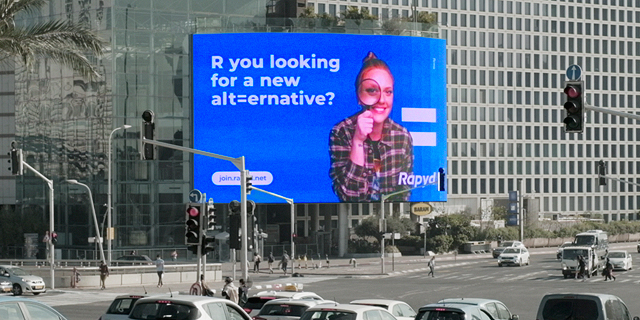

Rapyd

Product: Multi-currency mobile wallet

Valued: $2.5 billion

Total raised: $478 million

Acquisitions: Korta

Investment round: D

Year founded: 2015

Founders: Arik Shtilman, Arkady Karpman, Omer Priel

Employees: 50-200

Investors: Coatue Management, Spark Capital, FJ Labs, Latitude Ventures, General Catalyst, Oak HC/FT, Tiger Global, Durable Capital Partners, Tal Capital, Entree Capital, Avid Ventures, Target Global, Stripe, IGNIA

Tipalti

Product: Automation for supplier payments

Valued: $2 billion

Total raised: $286 million

Acquisitions: Approve

Investment round: E

Year founded: 2010

Founder: Chen Amit

Employees: 200-500

Investors: Durable Capital Partners, Greenoaks Capital, 01 Advisors, Group 11, Greenspring Associates, TrueBridge Capital, Zeev Ventures, Wicklow Capital

Melio

Product: B2B payment platform for small businesses

Valued: $1.3 billion

Total raised: $256 million

Investment round: C

Year founded: 2018

Founders: Ilan Atias, Matan Bar, Ziv Paz

Employees: 200-500

Investors: Coatue Management, Accel, Aleph, Bessemer Venture Partners, Corner Ventures, General Catalyst, Latitude Ventures, LocalGlobe, Salesforce Ventures, American Express Ventures, Amex

Sunbit

Product: Flexible payment solutions for retailers

Valued: $1.1 billion

Total raised: $161.9 million

Investment round: C

Year founded: 2016

Founders: Arad Levertov, Ornit Dweck-Maizel, Tal Reisenfeld, Tamir Hazan.

Employees: 50-200

Investors: Group 11, Zeev Ventures, Migdal Investment Banking, Harel Insurance Investments, AltalR Capital, More Investment House, G-Bar Ventures, Iool Ventures, 2B Angels, Polsky Holdings, Heroic Ventures, Amnon Shashua

HoneyBook

Product: Business management software

Valued: $1 billion +

Total raised: $229 million

Acquisitions: AppMyDay

Investment round: D

Year founded: 2013

Founders: Shadiah Sigala, Dror Shimoni, Naama Alon, Oz Alon

Employees: 50-200

Investors: Durable Capital Partners, Tiger Capital, Battery Ventures, Oren Zeev, 01 Advisors, Norwest Venture Partners, OurCrowd, Citi Ventures, Aleph, Vintage Investment Partners, Tank Hill Ventures, Hillsven Capital, Eric Kagan, Carthona Capital, UpWest Ventures, Oliver Thylmann, Ooga Labs, Michael Birch, Ben Narasin, Naval Ravikant, Rick Marini, Ev Williams

Earnix

Product: Mission-critical systems for global insurers and banks

Valued: $1 billion +

Total raised: $100.5 million

Investment round: D

Year founded: 2001

Founder: Sammy Krikler

Employees: 200-500

Investors: Insight Partners, JVP, Vintage Investment Partners, Israel Growth Partners, Viola Credit, Formula Ventures

Papaya GlobalProduct: Payroll and workforce management tool for global enterprises

Valued: $1 billion +

Total raised: $90.6 million

Acquisitions: Mensch.io

Investment round: C

Year founded: 2016

Founders: Ofer Herman, Eynat Guez, Ruben Drong

Employees: 50-200

Investors: Greenoaks Capital, Institutional Venture Partners (IVP), Alkeon Capital Management, Insight Partners, Bessemer Venture Partners, Scale Venture Partners, Workday Ventures, ClalTech, New Era Capital, Dynamic Loop Capital, Group 11, Ronald Cohen, Angel Investors

Lili

Product: Mobile banking and tax tools for freelancers

Valued: $1 billion +

Total raised: $80 million

Investment round: B

Year founded: 2018

Founders: Liran Zelkha, Lilac Bar David

Employees: 11-50

Investors: Group 11, Target Global, AltalR Cpital, Foundation Capital, Primary Venture Partners, Torch Capital, Zeev Ventures, SilverTech Ventures