Top 50 Startups List

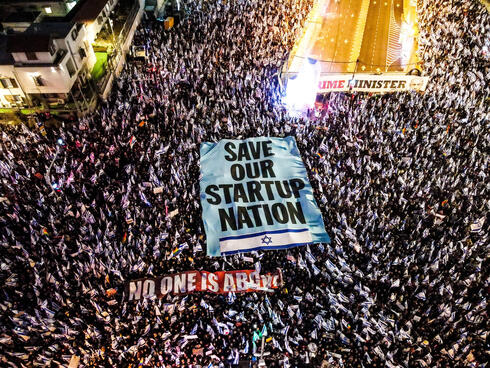

Israeli high-tech must contend with the global economy and its own government to survive

The shrinking of Israeli high-tech comes amid the global economic downturn, but it is clear to those within the industry that without a return to political sanity, the industry and the Israeli economy will suffer

In the first quarter of 2022, 215 Israeli startups successfully raised funds. A year later, and that number has been nearly halved, with only 112 Israeli startups having done so. This is a staggering, and once unimaginable, drop for the startup nation.

The 50 most promising Israeli startups - 2023

Typically within the tech industry, only one in ten startups will succeed. That only 112 companies have been able to receive financing for their company indicates serious damage to the growth capacity of the sector often referred to as the engine of the Israeli economy. And, since the high-tech industry in Israel and globally, is based on a multi-year cycle, it is highly likely that we are only seeing the beginning of this decline.

There are two types of companies that are currently able to raise funds. The first type, which is less common, is composed of successful companies that actually attract investors. These are companies that were not affected by the crisis or have adjusted to the new market, and, consequently, can raise funds even at a higher value than before and under similar conditions. Assaf Rappaport's Wiz is a notable example. The company has seen a significant increase in sales and raised $300 million two months ago at an astronomical value of $10 billion.

The second type of companies that raise funds are the exact opposite: companies facing existential pressure who are forced to compromise on the terms of the funding. For example, Bizzabo, whose value fell by 30% during its funding round in July compared to its previous round, realized that without more money it would not recover.

According to a report recently published by Shibolet and Co. Law Firm, in 2022 almost one in 10 funding rounds was conducted at a reduced value compared to the previous funding round. There are only a few truly successful and stable companies, while others are simply avoiding new funding rounds so as not to publicize their declining value.

Related articles:

There is another disturbing trend: the lack of new startups in Israel. Accounting and law firms report that since the beginning of the year, only a small number of Israel-based startups have been established, and they were largely not registered as Israeli companies. This is the most profound example of the change in Israel’s tech industry, and the most dramatic threat to the growth engine of the Israeli economy.

2023 is expected to be one of the most difficult years for raising capital. Investment funds, knowing this, will examine each potential investment especially carefully. If the amount invested in Israeli startups this year reaches even half of what was raised last year, it will be considered a great success.

As if this wasn’t enough, the government judicial coup is deeply damaging the economy, and, in particular, the success of the local high-tech sector, achieved with great effort over the past decades. But "fortunately" for Israel, the tech industry has been affected all over the world, so at this stage it is difficult to distinguish between the reduced capital raised by Israeli startups and that of their competitors abroad.

The decline in funds raised by Israeli companies in 2023 is reverting the sector back to figures not seen since 2018, with startups only raising $1.7 billion in the first quarter of the year, a drop of 15% from the previous quarter. But the situation in Europe is not fundamentally different, and perhaps even worse, with a 32% drop in investments in the first quarter of 2023 compared to the previous quarter. In Europe, startup funding has reached levels not seen since 2015.

In the U.S., with the exception of two extremely large deals, OpenAI's ChatGPT, which received $10 billion from Microsoft, and Stripe, which raised $6.5 billion, the situation is no different. Other than these two deals, startup funding in the United States decreased by 18% compared to the previous quarter, similar to Israel. Compared to the corresponding quarter last year, the decline reached 60%, not far from the 70% fall in Israel. Even the popular cyber sector saw investments fall by 58% in the first quarter, amounting to only $2.7 billion. On a global scale, investment in startups has decreased by 53% compared to the corresponding period in 2022.

During periods of prosperity, U.S. companies invest abroad, and during periods of economic instability they tend to invest at home. As a result, the Israeli tech sector, which relies on a huge amount of foreign investment, is unable to rely on U.S. investment.

And this brings us back to the government. Within the industry there has been much discussion about investors canceling meetings left and right. This can no longer be blamed solely on the interest rates or the global crisis, especially because some investors say outright that their reluctance to invest is specifically due to the political instability within Israel.

It is not for nothing that the local high-tech sector is so active in the protest movement against the judicial coup. Eynat Guez, founder of Papaya Global, and Assaf Rappaport, co-founder and CEO of Wiz, are perhaps the faces most identified with the protest, but there is almost no high-tech company that is not involved in some way. The mobilization of the sector ranges from significant funding through personal contributions from industry executives to organizing activities at demonstrations, days of disruption and more. Their prominent presence surprised many, since Israeli tech has often been viewed as detached from the rest of society, unbothered by the problems of "ordinary" people.

This is also happening because soon the funds raised during the years of plenty will begin to dwindle. Industry leaders understand this well, so their war is both a war for democracy and for the survival of their companies. They depend on foreign capital that will be invested in them much more than businesses that sell to the local market, and they know that capital will not flow easily to a country that is losing its stability and democratic character.

The Ministry of Finance is also beginning to realize that the 2023 and 2024 budgets were overly optimistic. While the magnitude of the damage to the Israeli tech sector may not be disproportionate compared to the rest of the world, the Israeli economy is notably dependent on high-tech.

In the end, all roads lead to Wall Street. 2021 was a year of plenty, both on Wall Street and for privately held companies. In 2022, this was turned upside down with negative returns in shares and a historic stagnation in issuances. In the second half of 2022, investment funds began to internalize the situation: without an exit horizon, there is no point in investing in risky and illiquid ventures like startups. Although there has been a slight recovery in the stock market in recent months, large investors have an attractive alternative of bonds or a bank deposit. When you can get a 5% return without risk, the appetite for VC investments is small.

So even without the judicial coup, the appetite for risky investments is at a low. VC funds receive negative signals from their investors, and in turn signal to the startups in which they have already invested to tighten their belts because new money is not expected to arrive soon. These funds may not admit that they have difficulty calling for money from investors due to the macroeconomic situation in Israel, but the stock market is already clearly revealing the gap created by the political uncertainty: the TA-125 Index lost 11% in the six months that have passed since the elections, while in the United States and Europe there were double-digit returns.

The reality in the IPO market may change as quickly as it did from 2021 to 2022. And in order to prevent greater damage to Israeli high-tech, the judicial coup must end. We have received a few months of grace, but Wall Street is expected to reopen by the end of 2023. The appetite for investments and the need for cash will overcome the fear, especially if interest rate hikes come to an end.

Even after the bursting of the Dot-com bubble, the IPO market remained frozen for just over a year, then opened up and gave birth to companies that are today considered the best of their kind, primarily Google and Salesforce. Israeli startups need to reach the end of the downturn so that they can jump through the IPO window. Unicorns are still being born in local stables, and they will be welcomed by Wall Street investors. What must be dealt with first though is the damage being caused by the Israeli government.

To summarize 2022, we also need to talk about employees. Last year was a year of layoffs in the Israeli high-tech industry, and 2023 will also most likely not be very positive for the industry's workers, who felt very safe during the years of the tech bubble. In 2022, about 8,500 employees were laid off, and according to estimates, 2,500 more have been laid off since the start of this year. If in 2020 and 2021 the conversation revolved around talent and personnel shortage, today it is about cost reduction and layoffs.

Companies, even those that raised hundreds of millions of dollars, have realized two things: the first is that they over-hired employees, a large part of them for positions that are completely unnecessary. The second is that the money in the bank needs to last much longer.

Most companies have realized that the only way to significantly reduce expenses is through layoffs. Initially, those who were not related to the company's core business were fired, but as time passed, companies began to fire more essential employees as well. For example, the Israeli information security company Snyk, which at its peak was valued at $8.5 billion, had a major drop in value to $7.4 billion, and initiated three rounds of layoffs that reduced the company's workforce by a quarter.

But much larger companies also suffered, and giant companies such as Meta and Amazon laid off tens of thousands of employees, including senior ones. The giants, who once posed the biggest threat to startup companies seeking quality personnel, released enormous amounts of talent to the market. But Israeli companies, which are currently standing on unstable ground, hesitate to increase their expenses by recruitment. Even their employees, who until recently were powerful in negotiations with management, today feel under threat. The CEOs who once waxed poetic about how important talent is, today hasten to explain the importance of profit and the high cost of talent.

Moderate estimates show that 2023 will end with about 10,000 layoffs. But the bigger problem in terms of the economy is that demand has fallen. According to the Central Bureau of Statistics, the demand for high-tech workers continues to be on a downward trajectory. The number of vacant jobs for software developers fell to about 6,300 on average over the past three months - 10% less than their number in January.

And yet, there are many tech companies that are growing and succeeding and recruiting more and more employees. Calcalist's list of the 50 most promising startups of 2023 depicts an industry that may garner fewer headlines but is definitely alive and kicking. Looking ahead to 2024, and assuming that the chaos created by the government will end, it is certainly possible to remain optimistic.