Initial investments in Israeli startups dropped 90% in Q1 of 2023

A new report says that the 10 most active VCs in Israeli high-tech made only three initial investments in the first quarter of 2023, compared to 30 such investments in the same period last year

This year has seen both domestic and foreign investment in Israeli high-tech come to a screeching halt, says a report released by law firm Gornitzky GNY and the IVC Research Center. The report shows that the ten most active funds in Israel made only three initial investments in startup companies in the first quarter of 2023, compared to 30 initial investments made by the same firms in the corresponding quarter in 2022. For example, U.S. firm Insight Partners, which was the most active fund in Israeli high tech in 2022 with 29 initial investments, made just one investment in the first quarter of 2023.

This is not an isolated case. Tiger Global, which was only second to Insight in terms of activity in Israel in 2022 with 23 deals, including 17 initial investments, did not make any initial investments in the first quarter of 2023. The trend of investment slowdown is more noticeable among foreign investors compared to local investors. Israeli high-tech has historically received far more foreign investment than local investment, but in the first quarter of 2023 foreign investment was nearly equal to domestic investment.

The downward trend in investments by VCs is expected to continue into 2024. The reason for this is that rising interest rates cause many institutional investors, primarily in the United States, to refrain from investing in venture capital funds (which performed better in the zero-interest-rate environment, both due to cheap money and the low yield of alternative assets) and to make relatively safe investments rather than invest in startups.

Related articles:

The report says that in 2022 there was a period of prosperity for VCs that created various tools for investment, such as credit for high-tech companies, financing for funds, or secondary funds. 2022 was a record year for secondary funds which raised nearly $2.5 billion. This is a dramatic increase compared to the approximately $195 million raised by secondary funds in 2021.

Despite the sharp decline in initial investments in the first quarter of 2023, the report indicates that among the top ten most active VCs in the Israeli high-tech sector, there was an increase in secondary investments in the same quarter (compared to the fourth quarter of 2022) in companies they had previously invested in. It is also noted that in 2022, the most active investors focused primarily on early-stage rounds (Seed and Round A), and the most popular sectors for investment were cybersecurity, fintech, and big data.

Although the report focuses on the top ten most active VCs, the trend of investment slowdown applies to the entire industry, as most funds are choosing to hold onto their money. The lack of activity in recent times is due to several reasons, most of which are unlikely to change in the coming year. Many VCs are hesitant to approach their investors and call for money for new investments or follow-up investments, as many institutional investors are reluctant to invest right now.

Another concern for both companies and investors is valuation. The high valuations at which many companies raised funds during the peak years of 2020 and 2021, mean that many companies are concerned about a valuation collapse and therefore are hesitant to initiate another funding round. Follow-up rounds will only occur when both sides reach a fair valuation. The result is a high number of funding rounds using models such as SAFE (simple agreement for future equity), which allows for the flow of money while determining the company's valuation in a future funding round. However, many investors also refrain from investing in this way as it creates a burden on future funding rounds. Nevertheless, the field of AI may change this equation and create new investment opportunities.

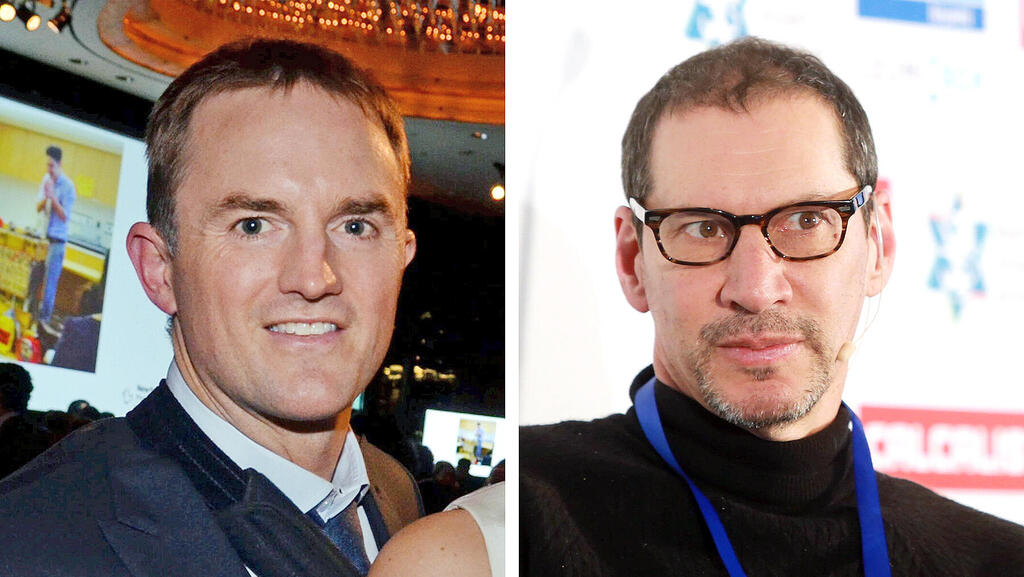

Shlomo Landress, Partner and Head of the Technology Practice at Gornitzky GNY said: "The crisis in the world of technology investments in 2023 is expected to have several effects, some of which are already visible. The value of companies is expected to decrease and companies will become more attractive for acquisitions." He added that "the SAFE mechanism, which enables capital investment without pre-determining a company's value, will continue to be a significant investment channel, especially after the Israel Tax Authority recently issued instructions regarding it. Large exit deals will disappear and, because of this, management in developed companies will be asked by their employees to allow a secondary market for their shares."

Guy Holtzman, CEO of IVC Research Center said: "The years 2022-2023 have been a challenging period for the Israeli VC community. After years of prosperity, the change in the global economy demands a different conduct for VCs and companies in order to maximize returns."