What's next?

"The Israeli entrepreneur will fight to get this train back on track, but at what price?"

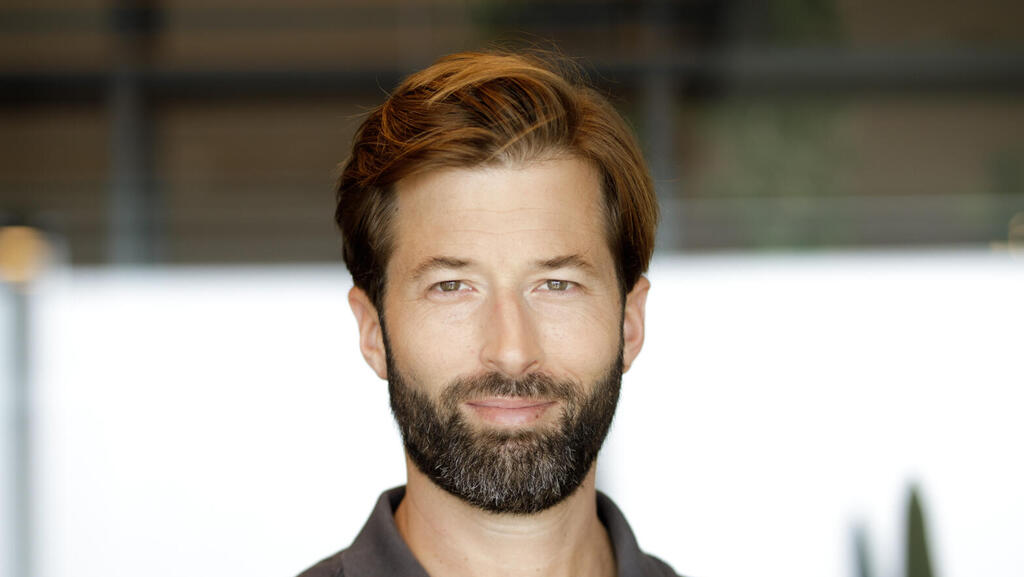

Itay Rand, General Partner at 10D, spoke with CTech as part of the project “Where do we go from here?”, which aims to examine how the Israeli VC industry is dealing with the crisis in the sector

"When the local crisis ends, it is likely that the Israeli sector will not automatically resume from the exact point where it started in January 2023. Setbacks may have occurred, requiring time to recover fully,” says Itay Rand, General Partner at 10D. "However", he stresses in a special interview with CTech, "and this is the main reason to maintain an optimistic view - the Israeli entrepreneur’s DNA - will fight until he finds a way to get this train back on track. The question remains - at what price.”

Check out every What's Next? article

Rand spoke with CTech as part of the project “Where do we go from here?”, which aims to examine how the Israeli VC industry is dealing with the crisis in the sector.

Over recent months, we have witnessed one of the most serious crises to hit Israeli high-tech in recent decades: on the one hand, a global economic slowdown, and on the other hand, local political turmoil that sent the industry into deep stagnation. Since the general assumption is that the situation will not change in the near future, the question hovering over the industry is what can still be done to minimize the damage to the Israeli high-tech industry and how should we act so that when the crisis passes - all those involved can take a leap forward. Therefore, as part of this on-going project, we spoke with senior executives from the local venture capital industry to try and understand from them what needs to be done now to justify the reputation Israeli high-tech has earned as being creative, adaptive, innovative, agile and cunning.

Name: 10D

Total sum of funds: $355M

Partners: Rotem Eldar, Yahal Zilka, Itay Rand, Adi Dangot Zukovsky

Notable portfolio companies: DriveNets, Exodigo, Juno Journey, Obligo, OneStep, Seebo (now Augury)

"It is reasonable to assume that indicators of growth will emerge by the second half of 2025"

How long do you think the global economic slowdown will last?

“First and foremost, it is important to acknowledge the inherent uncertainty and limitations of making estimates or predictions, however it is beneficial to have a working hypothesis in order to guide decision-making. Taking into account past downturns and economic cycles, as well as the current market sentiment observed in day-to-day operations, it is reasonable to assume that indicators of growth will emerge by the second half of 2025.”

Does the fact that major international funds have generally slowed down the pace of their investments - play to the benefit of the local Israeli funds and to the benefit of the local ecosystem. If not why, if so - in what way?

“There are two parts to this question: On one hand, the reduced activity of international funds in Israel can be perceived as a negative indicator for local economic growth as it results in decreased capital inflow, a reduced motivation to engage in financing rounds and more hesitancy to make new investments.

“At the same time, it is essential to consider that this slowdown is part of a broader global phenomenon and that a significant portion of international funds' recent activity in Israel can be attributed to a small number of players.

“Nevertheless, we observe a surge in involvement of new participants in the Israeli market: early-stage funds, corporate venture capital firms, financial investors, and strategic players are increasingly active and often even expanding their local presence by hiring staff on the ground. This influx of new players indicates a diversification of investment sources and a strengthening of the local ecosystem.

“Therefore, I am hopeful that the current slowdown is a temporary situation primarily driven by a global economic downturn, and that it may create opportunities for new players to engage more actively in Israel. I am hopeful that by embracing these new entrants and their fresh perspectives, the Israeli market can continue to grow and potentially thrive despite the temporary setbacks caused by the global slowdown.”

Do you see a significant decrease in the number of new startups in the sectors you cover? If not, why? What is different in the sector?

“We see a lot of activity in the startup ecosystem, and the early-stage segment appears to have been relatively resilient in recent times. There is a wealth of talent available, and the entrepreneurial spirit remains high, contributing to the continued growth of early-stage startups. Furthermore, early-stage funding options remain available to talented entrepreneurs, enabling them to scale their ventures

“In the realm of deep tech, there is a particularly strong motivation among entrepreneurs and we believe this is due to the fact that there is less pressure on the fundraising front (given longer periods of time in between rounds), which means they now perceive they can spend more time on R&D and product building.The presence of readily available tech talent further enhances the attractiveness of deep tech ventures, making them lucrative opportunities.

“Another noticeable trend is the increased demand for products and applications that support remote work or tele-services. These areas experienced a surge in demand due to the global shift towards remote work arrangements but we now see a slightly lower motivation to invest in these domains as the market stabilizes and gets used to the ‘new normal’.

“Overall, there is a perception that the time period between funding rounds, particularly the duration between the Seed stage (first funding round) and Series A, has been extended. This observation suggests that startups are taking more time to develop their products, refine their strategies, and reach the next funding milestone.”

Related articles:

- “The decline in new startups and the loss of trust from global investors will take several years to recover from”

- “We have hit the bottom…but I don’t expect to see the markets quickly rebounding and reaching their peaks”

- "Bull markets are wonderful, but bull markets create sloppy thinking and sloppy performance"

Do you support the general assumption that AI can rescue the industry from the current crisis?

“While it is important to recognize that no single technology can single-handedly revive the market, AI possesses significant potential to emerge as a pivotal force within the tech industry in the years to come. The industry's ability to advance AI, cultivate talent within the field, identify attractive business opportunities, and provide robust support to entrepreneurs, can effectively support the ecosystem’s recovery and growth.”

Are there positive sides to this crisis?

“A crisis is NOT a positive event. However, as the question suggests - there are, and we have to look at the positive sides, some opportunities associated with it.

“The crisis has compelled companies to adopt a more efficient, agile, and focused approach, which I perceive as positive attributes. This shift towards increased efficiency has enabled quicker decision-making, leaner operations, and heightened focus on core business objectives.

"Shorter funding cycles have emerged as a consequence, contributing to greater stability in R&D processes and affording founders the opportunity to concentrate on building their businesses rather than constantly engaging in fundraising activities.

“Furthermore, there is a noticeable stabilization of valuations, indicating a more balanced and rational market. Investors are dedicating more time to conducting thorough due diligences, resulting in better-informed decisions and enhanced support for founders. I firmly believe that a robust due diligence process should offer mutual value to both investors and founders.

“The relative scarcity of advanced funding rounds has provided an avenue for adjusting valuations, fostering alignment between investors' expectations and entrepreneurs' aspirations.

"In this evolving landscape, the emphasis on business metrics has regained prominence. Founders are actively seeking and working towards cultivating healthier financial and business structures right from the outset, ensuring long-term sustainability and growth.”

What are the critical points in which the Israeli venture capital industry was hit - if at all?

“The Israeli venture capital industry has faced challenges in several areas. Capital raising ability may have been impacted by economic uncertainty and investors’ slowing investment cycles. Returns on investments could have been affected in the short-term by market volatility and business disruptions, limiting exit opportunities in both the private and public markets. This would have led to lower valuations for parts of portfolios, postponed exit events and some investments’ write-offs in bad case scenarios.

“There could have been a smaller inventory of startups for investment, as some may have delayed launches or taking longer to fundraise.”