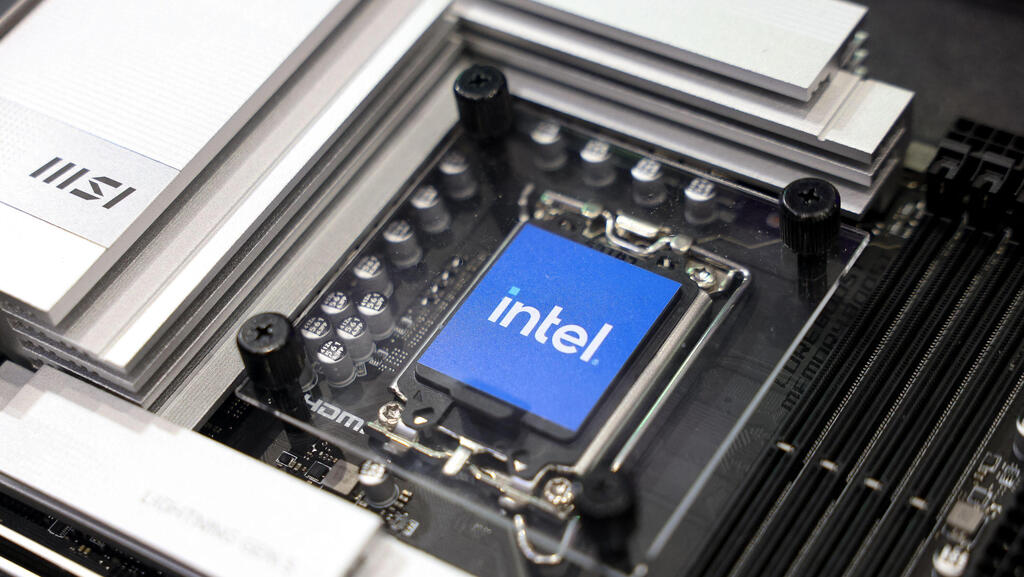

Intel CFO: External foundry commitments “not significant” yet

Intel Foundry is projected to break even by 2027. David Zinsner said this will require the unit to generate low- to mid-single-digit billions of dollars in revenue from external customers.

The volume of processors Intel is set to manufacture for external customers using its next-generation technology remains “not significant,” Chief Financial Officer David Zinsner said Tuesday.

Speaking at J.P. Morgan’s Global Technology, Media and Communications Conference in Boston, Zinsner acknowledged that committed volumes—the amount of chips that external customers have formally agreed to produce with Intel’s upcoming manufacturing processes—are currently limited.

Santa Clara-based Intel is attempting to transform itself into a major contract manufacturer of semiconductors, competing with foundry giants like TSMC. However, it has faced challenges with its 18A and latest 14A chip production technologies.

Last month, Intel said several customers had agreed to produce test chips using its upcoming processes. But Zinsner noted that not all test engagements result in long-term contracts.

“We get test chips, and then some customers fall out of the test chips,” he said. “So committed volume is not significant right now, for sure.”

Reuters reported in March that AI chip leader Nvidia and custom chipmaker Broadcom are among the companies running manufacturing tests with Intel.

Intel’s contract manufacturing division, known as Intel Foundry, is projected to break even by 2027. Zinsner said this will require the unit to generate low- to mid-single-digit billions of dollars in revenue from external customers.

The foundry business reported $4.7 billion in revenue for the March quarter, a 7% increase from the same period last year. However, a large portion of that figure still comes from chips manufactured for Intel’s internal products division.

New CEO Lip-Bu Tan, who took the helm earlier this year, has so far maintained Intel’s dual-track strategy: continuing to produce chips for its own use while trying to become a foundry for other companies.

“It’s a fair assessment that Lip-Bu isn’t thinking about massive changes,” Zinsner said.

Tan has moved quickly to flatten the company’s organizational structure and focus the business by divesting non-core assets, including part of Intel’s stake in FPGA unit Altera.

Earlier this month, Intel’s chairman of the board issued a rare and sober letter in the Intel 2025 Proxy Statement ahead of the company’s annual shareholder meeting, He warned that “there are no quick fixes” for the once-dominant chipmaker as it attempts to reverse years of strategic missteps and declining market position.

Related articles:

Frank Yeary, Intel’s independent chairman, used the letter to acknowledge what many on Wall Street and in Silicon Valley have long suspected: Intel’s current performance falls short of its vast potential, and despite years of effort to regain its footing, the turnaround is far from complete.

“We are at a critical moment in Intel’s history,” Yeary wrote. “It has been a few years since we set out to remake this great company... While these are important steps forward, we have faced undeniable challenges.” The message framed the shareholder meeting and the company’s recent leadership shake-up, culminating in the appointment of veteran investor and executive Lip-Bu Tan as Intel’s new CEO in March. Tan replaced Pat Gelsinger, whose multi-year turnaround strategy failed to deliver results and lost the board’s confidence.