Opinion

Secondaries go mainstream: The quiet force reshaping liquidity across the startup ecosystem

Once taboo, selling shares early is now a survival tool for founders, VCs, and LPs alike.

Not long ago, selling startup shares before an exit was taboo - seen as a sign of misalignment or even a lack of conviction. Now, it happens weekly - quietly, strategically, and at scale. In a liquidity-starved market, now gradually - and hopefully - picking up, secondaries have become a key tool for survival and growth. Founders seek breathing room, VCs need to show returns, and some LPs are rebalancing portfolios. Once niche, secondaries are now a strategic lever reshaping how capital moves through the tech ecosystem.

Secondaries Aren’t a Side Story Anymore

Every week, I speak with founders, GPs, and LPs weighing this path: Should I sell - and if so, when? What’s fair pricing? Who’s the right buyer? These off-the-record conversations reveal what headlines miss: secondaries are reshaping how liquidity gets done.

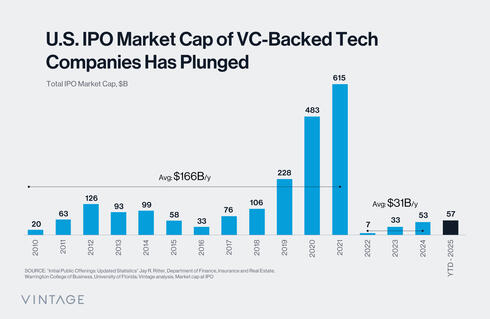

While a few IPOs have recently broken through, the window remains largely limited to companies with >$300M in ARR and efficient growth above 25% year-over-year. With M&A activity also unable to fill the gap, liquidity remains scarce for most companies and VC funds. Founders and employees need breathing room, and secondaries have stepped in - not as a detour, but as a core mechanism for how capital moves through tech. As further evidence, large VC platforms are now building dedicated teams to manage secondaries and liquidity proactively and strategically.

Founders Are Taking the Wheel

What’s different now is who’s leading these processes. Increasingly, we’re seeing founders drive these processes more than ever - whether for themselves, their employees, or early backers, taking a more active role in planning, governing, and shaping liquidity.

It has also become a powerful retention tool. As the CEO of Hightouch shared in the context of a recent employee tender:

“We want their equity to feel as real as possible… They could go work at public companies and get liquid comp, but they're trusting us instead. We want to equalize that tradeoff.”

That mindset is spreading: from leading companies like OpenAI, Databricks, and Stripe, to fast-growing players like Clay and Hightouch, and even to emerging startups that are quietly adopting it as a strategic tool.

Inside the Surge

At Vintage, we invest across the venture ecosystem - backing both VC funds and growth-stage companies, through primary and secondary investments. We see liquidity tensions play out in real time, every week. VCs are under pressure to show DPI and IRR - not for optics, but because those metrics directly influence whether LPs commit to their next fund. Founders turn to secondaries to reduce pressure and stay focused on what matters most: building. Angels recycle capital after years of patient compounding. CVCs use them to realign around shifting strategic priorities.

When structured thoughtfully, secondaries don’t just solve for liquidity, they create alignment across founders, boards, and cap tables. In many cases, they unlock better outcomes than waiting another 3–5 years, especially for early investors with low entry points.

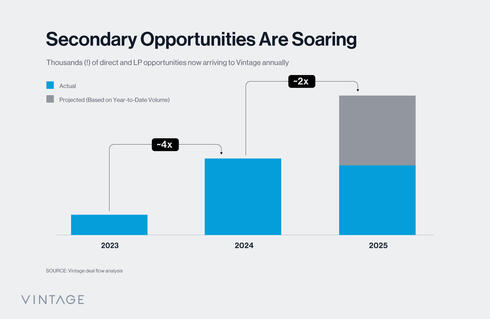

For us, this isn’t theoretical - it’s what we do, every day. Over the past year, we’ve seen our deal flow quadruple, making it one of our busiest periods in the past two decades. We actually started as a $64M secondary fund in 2003 (and have since grown into a $4B platform spanning fund-of-funds and growth strategies) so have been at this for a long time and built deep expertise.

We expect this wave of secondary activity to continue for the next few years, and longer term, to become a standard tool for managing growth, alignment, and liquidity across the startup ecosystem.

The Biggest Mistake We See

One of the most common - and costly - mistakes we see is treating secondaries as purely price-driven. Price matters, but the buyer often matters more.

The wrong partner can create tension, misalignment, and long-term friction that far outweigh a few basis points. I’ve seen deals fall apart at the last minute because buyers who weren’t aligned with the company. We have seen others where price was prioritized over fit, introducing unnecessary risk to the company down the line.

The best secondaries are clean, quiet, and built on trust. They bring in long-term, value-aligned partners, because it’s not just about liquidity, but about who you’re bringing onto your cap table for the long haul.

How to Get It Right

Secondaries have become a strategic tool—and can quietly shape the next chapter of a company or a VC fund. Getting them right is no longer optional. Here is some practical advice, grounded in what we’ve seen work across hundreds of transactions:

- For founders: Get ahead of the process. Alignment with your board and transparency with the buyer are key. It’s rarely just about price as the buyer matters more. Ideally, it’s someone who can contribute (follow-on capital, commercial value, hiring support), or at the very least, doesn’t distract you or the company. Buyers who engage openly and don’t try to work behind stakeholders’ backs through structures will set the stage for a clean, smooth transaction.

- For former employees: The best approach is collaborative - work with company leadership or a trusted partner. The goal is to avoid surprises and ensure the buyer is legitimate, aligned, and someone management is comfortable adding to the cap table.

- For GPs: It’s about serving your LPs and positioning your fund for the next raise while continuing to support the founders you backed. Some GPs choose to de-risk by selling up to a third of their stake in portfolio companies, especially where valuations seem disconnected from fundamentals or future upside feels limited. In an LP secondary, you can help curate a buyer for LPs seeking liquidity and should bring in only LPs who are fully aligned. At best, they’ll be value-add and invest in future funds. At worst, they won’t skip capital calls or create friction when it matters most.

- For LPs: Price matters, but be open to creative structures - they can offer downside protection while preserving upside potential. And in most cases, working with the GP ensures alignment and smoother execution.

Clean secondaries preserve alignment, reduce distraction, and support long-term growth. And that’s what ultimately drives outcomes for everyone involved.

Omri Hozez is a Principal at Vintage Investment Partners.