VC AI Survey

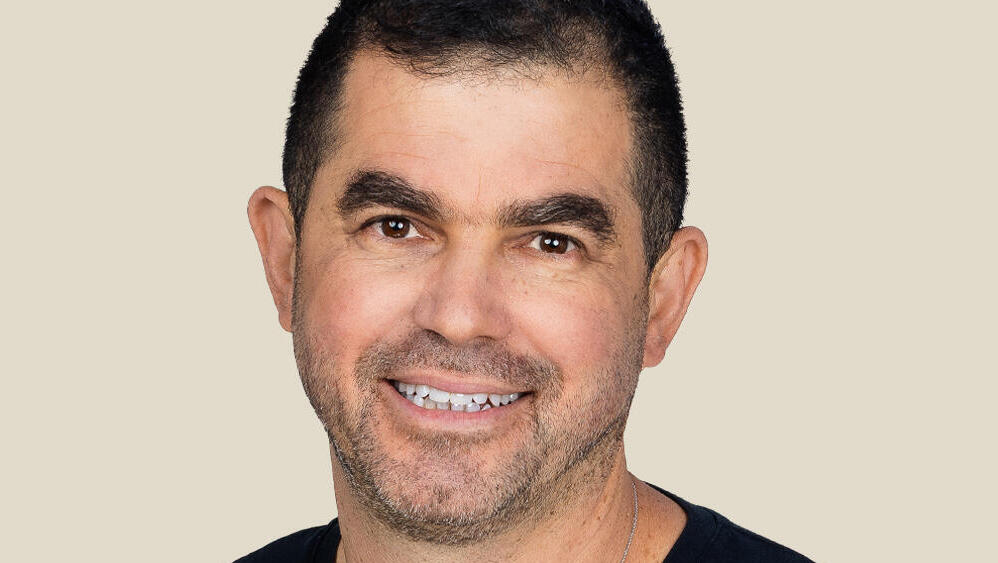

Israel can “own anything it wants” in AI, says Pitango First’s Eyal Niv

In CTech’s VC AI Survey, Niv explained how the VC firm is adapting its investment strategy to a market transformed by artificial intelligence

“Israel is active across the entire AI stack, from the underlying infrastructure to the applications layer,” says Eyal Niv, Managing Partner at Pitango First. “If you’re asking about a specific niche Israel can ‘own,’ I think Israel can own anything it wants.”

Speaking in CTech’s VC AI Survey, Niv explained how Pitango is adapting its investment strategy to a market transformed by artificial intelligence — shifting focus to AI-native, AI-resilient companies with defensible moats built on unique datasets.

You can learn more in the interview below.

Fund ID

Name and Title: Eyal Niv, Managing Partner, Pitango First

Fund Name: Pitango First

Founding Team: Chemi Peres & Rami Kalish

Founding Year: 1993

Investment Stage: Early stage

Investment Sectors: Sector-agnostic within deeptech

On a scale of 1 to 10, how has AI impacted your fund’s operations over the past year - specifically in terms of the day-to-day work of the fund's partners and team members?

10 - AI has totally changed the way we think and invest in startups, in terms of the types of companies we’re considering now. We look for AI nativity, how they use AI to build the Company and their own products, if the offering is both AI native and, perhaps more important, if it's AI resilient. That’s an extreme shift from our point of view. In fact, things we used to consider innovative and core now feel almost trivial by comparison.

While our investment focus may have evolved dramatically due to the introduction of AI, our day-to-day operations haven’t changed as much. However, we use AI extensively for market research, competitive and market gap analyses, as well as integrating AI into our own CRM, workflows, and tools like Affinity. You could say we are using AI to enhance our operations.

Have you already had any significant exits from AI companies? If so, what were the key characteristics of those companies?

We are working on a number of AI infra companies, some of which have already gained unicorn status, including DriveNets, AI21, AAI, PsiQuantum, Quantum Source, Volumez, and a few more which are in stealth mode. It’s obvious from these names that the big outcomes are ahead of us, but we’ve also had some early exits in the last few years.

Some examples include Cortex Labs, a machine-learning operations (MLOps) startup we invested in, which was acquired by Databricks. McKinsey’s first acquisition in Israel was one of our portfolio companies as well – Iguazio, a leading MLOps platform. And SoftBank acquired Graphcore, a leading AI chipmaker for which we were an early investor.

Recently IBM’s Red Hat acquired a stealth startup we seeded, Jounce, just one year after it was founded. The company’s platform for deploying, running, and monitoring complex AI systems will be integrated into Red Hat’s cloud and open-source systems.

What’s interesting is that all of these companies are focused on AI infrastructure. That is, they build the underlying systems that power AI, rather than just using AI in their products. That’s a clear common denominator. Each one is technologically advanced, took an innovative approach, and has strong IP. They fit squarely into the deeptech category we are focused on, solving hard problems at the core of AI.

Is identifying promising AI startups different from evaluating companies in your more traditional investment domains? If so, how does that difference manifest?

Absolutely. One of the key differences in evaluating AI companies, both infrastructure and application-level, is how we think about defensibility. In the AI world, with the rise of open-source models and accessible tooling, software and tech are generally no longer enough to create a lasting competitive edge. They’ve become more or less a commodity in this field. So, we’ve had to rethink what constitutes a true moat for AI startups.

It was initially somewhat more difficult to define and characterize, but I’d say that the key differentiator for AI startups nowadays is access to unique datasets, especially those generated through customer usage.

A great Israeli example is Waze. They didn’t just build a navigation app. They built a platform where user behavior created the most accurate traffic reports and maps in the world. That usage data feedback loop made it incredibly hard to compete with Waze, even to this today.

The same logic now applies to AI startups. The infrastructure or the technology itself is not the moat. Rather, the real value is in its usage and the creation of new datasets, which then help make the technology itself more accurate, more valuable, and easier to use.

And yes, that means the evaluation process itself changes for investors. It’s no longer just about assessing the tech. It’s much more about understanding customer needs and how the product is built around real-world usage. That’s why we were the first to invest in AI21 Labs before it was as top of mind as it is today, and we continue to back extraordinary companies like AAI, DriveNets, and more.

What specific financial performance indicators (KPIs) do you examine when assessing a potential AI company? Are there any AI-specific metrics you consider particularly important?

When we assess an AI company, there are some dynamics that really matter. Reliance on AI can be very costly for a company, so we need to understand whether it’s truly creating value or if it’s just what we call an “AI wrapper.”

An AI wrapper is essentially a thin layer of user interface or functionality that sits on top of a third-party LLM like ChatGPT. The problem is that it’s very hard to charge the customer more than the company pays to OpenAI. It’s quite easy to create such AI wrappers. But they don’t create much value and their gross margin is very low.

So, when we evaluate AI companies, we’re trying to understand whether they’re just wrapping a LLM with a beautiful UI, or whether they’re actually building something meaningful on top of it. We look closely at the cost of using external AI models (token costs, compute costs, etc) and compare that to the value the company is creating for the customer. In that way, we try to estimate the margins and the value that company will generate. If it is using AI to power something that creates a huge value for users, then the margins are more likely to be strong and sustainable.

How do you approach the valuation of early-stage AI startups, which often lack significant revenues but possess strong technological potential?

The AI space is certainly very nascent, very new, and very innovative. Valuations are driven largely by expectations about market size, technological impact, and huge long-term potential. That’s a large part of how early-stage AI startups are evaluated. But it’s not completely uncharted territory.

We do have some market data to work with. As with every other segment that we examine, we use a similar methodology and look at market dynamics, public multiples, past funding rounds, and significant M&As. While acquisitions in AI are still relatively rare, we might look at the valuations of companies like OpenAI or Anthropic, for example, along with comparable smaller companies. These give us reference points, even if the sample size is still small.

Multiples and valuations in AI tend to be significantly higher than in many other sectors, maybe most comparable to cyber, but we’re getting more data every day. In any case, it’s clear we’re still in the very early stages of this market and a lot of the valuation work is based on big expectations and even bigger dreams.

What financial risks do you associate with investing in AI companies, beyond the usual technological risks?

There are several financial risks that we take into account. One major factor is rapid change in the underlying technologies. Many companies build on third-party models and infrastructure that evolve rapidly, which can introduce volatility and uncertainty into their cost structures. For example, a breakthrough in model architecture might drive up compute costs or require a complete overhaul of existing systems, and so forth, which can significantly impact margins.

Regulation is another big one. Expectations around privacy, data usage, and AI governance are still taking shape, and it is unclear how that will impact each project or product in the future. AI agents can be powerful, but it’s not always easy to monitor or control them, or even to understand how they use the data they’re fed. That raises complex questions about compliance and risk exposure.

Security, particularly enterprise security, is also a major issue. Installing and implementing AI solutions within large organizations is both a technical challenge and a matter of trust. It’s not always easy to clearly explain what the technology is actually doing in terms of how it handles data and integrates with existing systems. Security concerns arise, adoption slows, and that affects revenue and growth.

So when we evaluate AI companies, we’re also looking at how well they manage these operational and regulatory complexities.

Do you focus on particular subdomains within AI?

We see all these areas as deeply interconnected. Multimodality, where different types of AI work together, is a large part of the opportunity we see in this field. So, no, we don't focus on one subdomain.

How do you view AI’s impact on traditional industries? Are there specific AI technologies you believe will be especially transformative in certain sectors?

Some industries are clearly more receptive to AI than others. Anything that relies heavily on language, rather than precision, like marketing, customer service, or content creation, is already seeing big shifts. The latter will require more work and precision in order to be transformed but our expectation is that every sector will be transformed sooner or later.

When it comes to sectors like finance and healthcare, the impact will be huge too, but it’s more complex. AI’s strength currently lies in pattern recognition, so adoption depends on how well the systems can be trusted and validated for assistance in those kinds of sectors.

What specific AI trends in Israel do you see as having strong exit potential in the next five years? Are there niches where you believe Israeli startups particularly excel?

Honestly, Israel is active across the entire AI stack, from the underlying infrastructure all the way up to the applications layer. I think Israel has definitely proven its ability to build both B2B and B2C solutions, and that is reflected in the kinds of startups emerging here.

So, if you’re asking about a specific niche Israel can “own,” I think Israel can own anything it wants.

Are there gaps or missing segments in the Israeli AI landscape that you’ve identified? What types of AI founders are you especially looking to back right now in Israel?

I don’t think it’s that different from what we look for anywhere else. We back founders who deeply understand their customers and their specific markets. People who are willing to invest their lives into building something meaningful, with commitment and clarity. In that sense, it’s similar to what we look for in other segments. Founders who are focused, customer-driven, and relentless will find a way through no matter what. That’s who we’re looking to back.