ZIM’s board seeks global buyers to counter CEO’s bid

Evercore reaches out to Maersk and others as takeover battle looms.

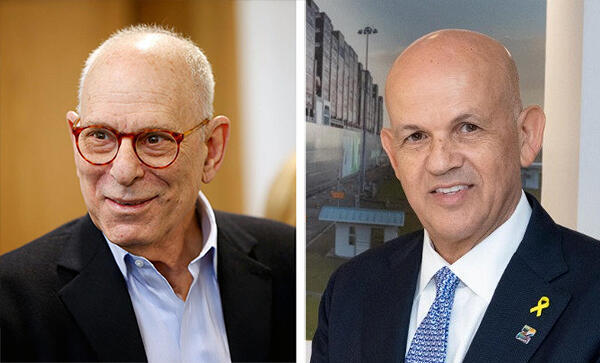

The board of directors of the shipping company ZIM is in no hurry to negotiate with CEO Eli Glickman, who, together with shipping tycoon Rami Ungar, is interested in purchasing all of ZIM’s shares. The reason: the price Glickman is considering, together with five senior ZIM executives and Ungar, does not meet the board’s expectations.

ZIM currently holds around $2.8 billion in cash, while Glickman and Ungar are likely to offer less. The company also carries $5.7 billion in liabilities, including $1.23 billion in short-term debt.

To prepare, ZIM’s board has enlisted the consulting firm Evercore, whose Israel operations are led by Len Rosen, to reach out to strategic companies and investment funds that might be interested in acquiring the company. Evercore has already approached several global shipping companies, including Denmark’s Møller-Maersk. In 2024, Maersk reported $6.5 billion in profit, describing the year as exceptional. The container shipping industry as a whole posted $60 billion in profits in 2024, though analysts expect a sharp drop to just $10 billion in 2025.

It is worth noting that Glickman has not yet submitted a formal offer. One purpose of engaging Evercore is to ensure the board has a clear picture of ZIM’s market value once he does.

ZIM’s share price, which climbed to $17.40, has since fallen to $13.63 entering this week following weaker second-quarter results, giving the company a market capitalization of $1.64 billion. Quarterly profit dropped to just $24 million compared with $373 million in the same period last year. The decline reflects volatility in global trade, falling freight rates, and disruptions linked to U.S. tax policy changes, especially on imports from China and other countries. Additionally, Israeli vessels being barred from Turkish ports has weighed on results.

Despite these challenges, ZIM updated its 2025 forecast to project EBITDA of $1.8–2.2 billion. First-half profit stood at $320 million.

For now, Glickman continues as CEO alongside the executives who are part of his bidding group. The board has not identified a conflict of interest in their performance. However, if rival offers emerge, the situation could shift, since the executives are simultaneously managing the company and planning its acquisition. This dual role could raise concerns that they may prefer ZIM’s valuation to remain subdued, making their potential buyout easier. In such a scenario, Glickman could be asked to take a leave of absence until the fate of his proposal is clarified.

The board, chaired by Yair Seroussi, former chairman of Bank Hapoalim, will ultimately decide whether selling ZIM is in the company’s best interest. Until recently, the board had not heard from Glickman that the company required a new owner, even after Idan Ofer ceased to be the controlling shareholder in 2024. Two directors linked to Ofer still sit on ZIM’s board.

Related articles:

Industry sources estimate that Ungar, who also imports Kia vehicles to Israel, intends to acquire ZIM and later merge it with his own shipping company, Ray Shipping, through a share-swap and cash deal. This would give him control of a mid-to-large-sized shipping group. The companies’ operations complement each other, with ZIM focused on container shipping and Ray specializing in transporting cars and trucks with its 65 vessels registered worldwide.

ZIM is subject to Israel’s golden share provisions, requiring a majority-Israeli board, an Israeli chairman, and a fleet of 11 ships available for state use in emergencies. While such terms could dissuade foreign buyers, for a global shipping company they represent only a minor restriction.

ZIM did not comment on the matter.