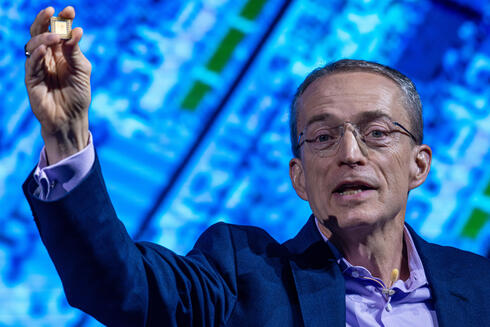

Former Intel CEO Pat Gelsinger: “Intel was late on AI. It made bad decisions over 15 years”

The former CEO says America’s semiconductor revival will only matter if it leads to real manufacturing.

Pat Gelsinger, the former CEO of Intel, has offered one of his frankest assessments yet of the semiconductor giant’s decline, and a pointed warning about the forces shaping the next technological boom.

“Is the stake that the U.S. government has taken in Intel good or bad?” Gelsinger asked in an interview to CNBC. “To me, the only metric that matters is: does it cause the building and filling of Intel fabs? If it causes more fabs to be built and filled in the U.S., then it is good. And if that doesn’t occur, then it is not.”

It was a characteristically pragmatic answer from a man who has spent decades at the center of America’s chip industry. Gelsinger defended the government’s growing role, as long as it results in tangible industrial output. “This administration has clearly said when they see something that isn’t okay, they are ready to blow them up and reconceive them,” he said. “And that is what we’ve seen here.”

Gelsinger, who led Intel’s comeback effort between 2021 and 2024, did not shy away from diagnosing the company’s decline. “Intel made a set of bad decisions over 15 years,” he said. “Intel lost technical leadership and wasn’t led by technologists for many years. We were late on AI as well, but it was long-term decisions that were made that put Intel in a difficult position.”

The admission underscores the depth of the company’s troubles after years of falling behind rivals such as Taiwan’s TSMC and South Korea’s Samsung.

“I wish Intel nothing but the best,” Gelsinger said. “This is seminally important for the nation. We need R&D and leading manufacturing in the U.S. for our supply chains.”

Related articles:

Gelsinger also had a blunt assessment of today’s artificial intelligence boom: it’s a bubble, and everyone knows it.

“Are we in an AI bubble? Of course we are,” he said. “We are hyped, we’re accelerating, we’re putting enormous leverage into the system.”

Still, he does not foresee an imminent crash. “I don’t see it ending for several years,” he added. “We have an industry shift to AI… we’re displacing all of the internet and the service provider industry as we think about it today, we have a long way to go.”

The former Intel chief described a market drenched in cash and ambition. “There’s a lot of leverage in the system, there’s a lot of cash,” he said. “But then there’s a whole bunch of other folks who are trying to build these data centers. Whether it’s the energy component or the real estate component, there’s just a whole lot of things happening at one time.”