Why Google needs Wiz to keep up with Amazon and Microsoft

Google does not have a cyber strategy like its cloud competitors, Microsoft and Amazon. It is trying to catch up quickly, but for that it needs Wiz

Most players in the Israeli and global high-tech industry were surprised by Google's intention to purchase the Israeli cyber company Wiz. If finalized, this acquisition will not only be the largest in Israeli high-tech but also the largest purchase of a private cyber company in the world. "I would also be happy to see a scenario where Wiz remains independent and becomes a global giant. However, the presence of multinational companies in Israel and their expression of trust, especially during this period, are of great importance to Israeli high-tech," Israel Innovation Authority CEO Dror Bin tells Calcalist.

Throughout the existence of the Israeli company, which was established in 2020, its founders—Assaf Rappaport, CEO; Ami Luttwak, VP of Technologies; Yinon Costica, VP of Products; and Roy Reznik, VP of Research and Development—have stated that they want to build a huge company. They have worked together for more than 15 years, including at Microsoft's cloud security group, which bought Adallom, which they founded, for $320 million. The first exit yielded them tens of millions of dollars, so the reason for the sale to Google is apparently not only financial but the desire to join the enormous power of Google and its cloud. This can be a tremendous distribution force for the technology of the Israeli company, but not only.

If the deal goes through, it will have huge implications for the entire local cyber industry. "A huge industry will take huge jump forward," a senior investor in the venture capital industry tells Calcalist, "It will provide enormous value to the cyber market and enormous value to the cloud market, which the giant companies see as a strategic target."

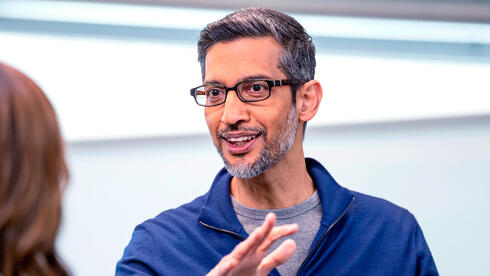

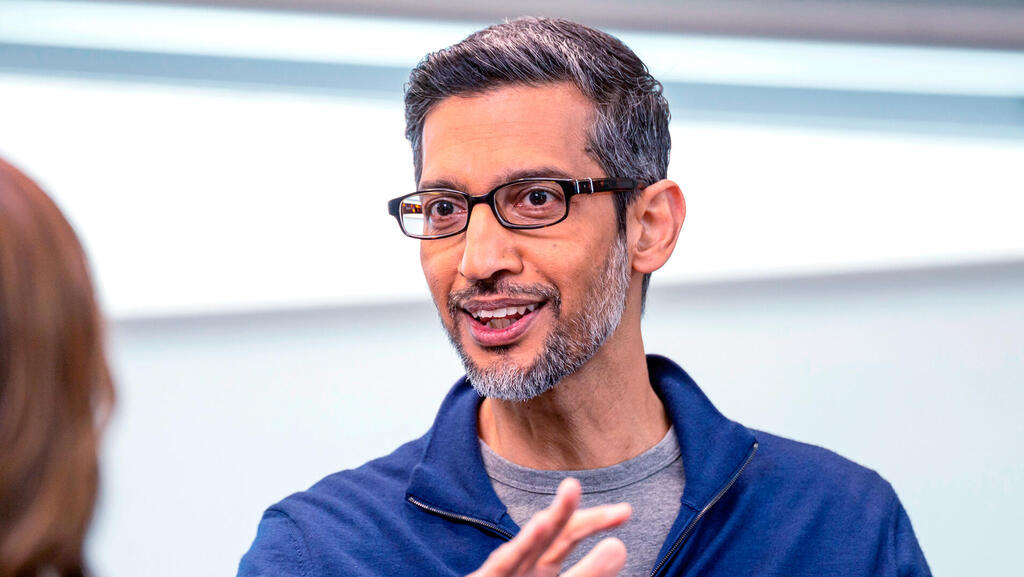

As far as Google is concerned, the purpose of the purchase is clear. Google's cloud company is today one of the three leading cloud providers alongside Amazon's AWS, which leads at the top, followed by Microsoft through Azure, and Google only after them.

Today, the three suppliers hold over 60% of the market, but the balance of power is clear: Amazon with 32%, Microsoft with 23%, and Google with only 10%. One of the main reasons Google lags behind the two companies is cyber. Google does not currently have a cyber strategy similar to that of the other two. The company realized that if it wanted to stay in the game, it had to make a leap forward in cyber as well.

Historically, Google's cloud was focused on the individual user, who was usually reached through email or photos. Today, Google wants a piece of the huge pie of companies and corporations.

"Google's cloud activity is growing fast, but it is trying to catch up mainly in the organizational-enterprise aspect," says the senior investor. "It has no cybersecurity, and many customers choose competitors precisely because of this. In my opinion, Google wants to bring cyber capabilities into its cloud and not sell cyber as an independent unit. It will thus develop the cloud and be a worthy competitor."

Related articles:

Bin adds that the timing of the purchase is crucial: "We are in a very challenging time for Israeli high-tech," he says. "The news about the deal takes on new importance in light of the situation. Whether the deal comes to fruition or not, it is a huge expression of confidence that the world has in the Israeli tech industry, which continues to prove itself in every situation.

"The protection of cloud services, an area in which Wiz brought excellent solutions, is what caused the rapid growth in the company's revenues and value, leading to the desire to close such a deal," Bin said.

In his estimation, if the deal goes through, it will contribute to the state's tax revenues. "However, the impact of the deal on Israel's economic situation will not be as great as might be expected. I estimate that several billion shekels will reach the state coffers. This is not enough, of course, to close the gap in the deficit we are in."