StartUp+

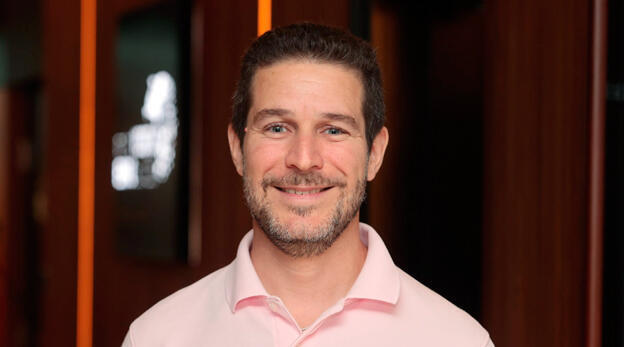

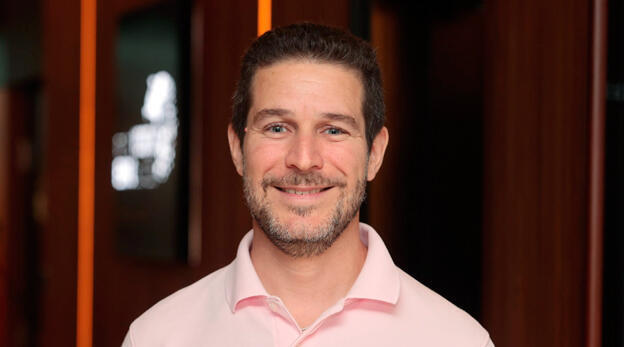

Notkin knocks napkin negotiations: "It’s no longer enough to present an idea on a napkin to obtain funding for a startup"

"There is enough investment money for quality companies and teams,” Tomer Notkin, business center manager at Poalim Hi-Tech, said in an interview in advance of the Startup+ competition sponsored by Bank Hapoalim and Calcalist. “The question is in what scope and value”

"If two years ago you could have raised money for a startup by presenting a napkin with a drawing, today a significant proof of feasibility is required and there is a great chance that the magnitude of the initial fundraising scope will be smaller than before," says Tomer Notkin, business center manager at Poalim Hi-Tech, in an interview conducted ahead of Bank Hapoalim and Calcalist's Startup+ competition.

According to him, despite the high-tech crisis and the slowdown in investments, early-stage startup companies still have an opportunity to obtain funding. "Unfortunately, the current mood is significantly different from the atmosphere of euphoria in 2021 as a result of a combination of several parameters: interest rate increases, digitization moving slower than expected, reluctance to return to the labor market, and valuations that do not correctly reflect reality, all of which led to a decrease and stagnation in the scope of investments with special emphasis on advanced stages that permeate the earlier stages as well. Despite all this, technology will not disappear from the world and there are enough funds waiting for good companies and quality teams, the question is regarding their magnitude, and the valuations."

The volume of transactions, the volume of investment, and the initial value of the transactions in early-stage startups is significantly lower now compared to 2021, but according to Notkin this is a desirable and even healthy process. "This process creates a filter that will allow the entry of higher quality entrepreneurs and teams, with more mature initiatives, which have higher chances of success. Entrepreneurs who are not mature enough will be screened out. In conclusion, it can be said that the new reality that has been created is healthier for the economy, Israeli society and the labor market as a whole. At the same time, we believe that it is important that young startups continue to grow so that the high-tech industry continues to serve as the driving engine of the Israeli economy. Therefore, attention must be paid to the delicate balance between the resulting situation in which investors are supporting fewer companies and continuing to build a suitable infrastructure for the creation of new companies," he says.

In addition to the global crisis, the political crisis in Israel also affects recruitment opportunities for young technology companies. "According to what we have seen so far, the current crisis has an effect on the inflow of funds into Israel, given the investment alternatives that exist in the international arena, and in view of this also on the recruitment prospects of entrepreneurs in the initial stages."

Related articles:

"The decrease in the amount of investments coming to Israel is certainly troubling," says Hanan Brand, VP and head of startups at the Israel Innovation Authority, "and there is no doubt that today it is difficult for entrepreneurs at all stages to raise money. It is important to note, however, that there was actually an increase in the Seed stages in the last year, from $1.3 billion invested in 2021 to $1.6 billion in 2022 according to SNC data, and there are quite a few funds, new and existing, that in light of the relaxation in valuations transferred their center of focus to early-stage investments. In the data published last week, there is also a decrease in the first quarter of 2023 in the number of Seed transactions compared to last year. But on the scale of the last decade, we are in a reasonable situation - there are excellent investors in Israel, including micro funds and angels who provide significant added value to entrepreneurs at the beginning of their journey, such as the incubators and labs that we operate throughout the country and focus on these stages."

The 'hot' areas in which entrepreneurs should establish startup companies are first and foremost related to products focused on efficiency. "Any product that optimizes the customer's operation and saves them money - this is the time for such products," says Eyal Niv, managing partner at Pitango VC. According to him, other areas that entrepreneurs should focus on include healthtech and AI. "There is an opportunity to establish companies that are AI native, because everything we did in the past without AI is now being done using artificial intelligence," he explained.

Regarding funding opportunities, according to him there is a large movement of VCs towards making more early-stage investments.

According to Brand, in the fields of software, cyber and fintech there is a lull, but in the fields of climate, health, and deeptech - we see stability and even an increase in hiring, therefore for companies in the early stages that solve global problems, this may well be a period of opportunity.

The opportunities, as mentioned, still exist, but the capital raising strategy should be adapted to the period. Noa Zabar, CFO at Artlist explains that "even today there are a variety of options for startups to raise funds in the initial stages, through capital or debt raising and also through support through government grants and incentives (on innovation, R&D, etc.). The situation mainly affected the pricing of transactions and the determination of company values, and various limitations on raising debt, but not raising funds in general, because investors continue to find good investment opportunities. The challenge is in finding the right investor and the correct capital raising strategy." According to her, "the cost of money has changed during this period, which means transaction pricing (multipliers) has changed. The drop in value of young startups in the first stages is lower than that of mature companies, so the damage to pricing will likely be less significant."