Analysis

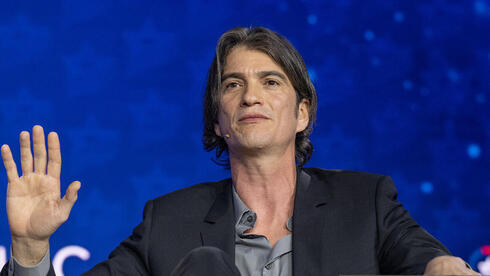

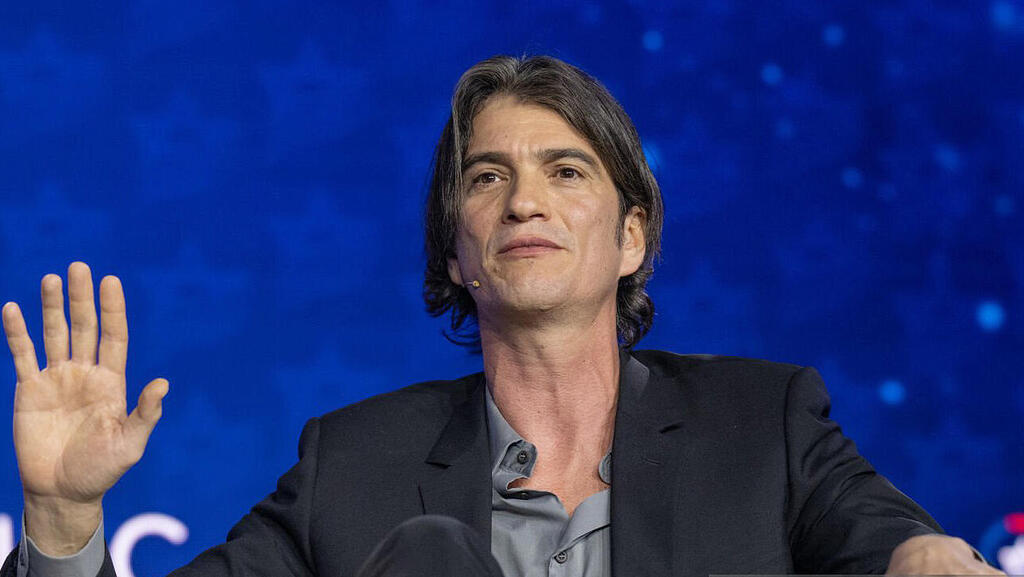

We forgive? WeWork collapsed but investors are once again embracing Adam Neumann

Despite being ousted from the debt-ridden company he created, the founder has managed to recruit activist investor Dan Loeb and venture capitalist Marc Andreessen to fund his dream of reacquiring control of his brainchild

The venture capital market loves Adam Neumann, there seems to be little doubt about that. On the other hand, among the general public he has a reputation of someone it is better to avoid doing business with. He may be a great marketer who builds excellent brands and convinces investors to attribute high value to his ventures. However, he is also a reminder for a sector of how one should beware of grandiose stories, cosmic promises and the burning cash that end in massive collapses (not his). Now Neumann wants us to learn another lesson: in fact, everything pays off.

Last week, Neumann's attorney, his real estate company Flow, and "other partners" sent a letter to WeWork, which he founded and is currently in bankruptcy proceedings. In the letter, Neumann expressed his displeasure with WeWork's failure to provide information on what was intended to be "a transaction that increases value for all stakeholders." Neumann, it was revealed, is interested in buying back the company through financing provided by, among others, veteran investor Dan Loeb and his hedge fund Third Point. But WeWork, which, according to the documents submitted to the court, wants to transfer ownership to debt holders who are owed around $3.7 billion, is not cooperating.

Upon publication, Loeb was quick to distance himself and the fund announced that only initial talks had taken place with Flow and Neumann and that it has not committed to participate in any transaction. And yet, the state of affairs does not seem as early as it was presented. In a three-page letter, Neuman's attorney detailed the course of events. Since the end of December he has been working to obtain information about the company in order to submit a purchase offer for it or its assets. It also appears that in practice he has been trying to return to WeWork since October 2022, more than a year before it filed for bankruptcy. So, according to him, he had already raised a billion dollars in funding, but a meeting scheduled with him was canceled.

But what exactly is Neumann trying to acquire with the help of Loeb and "additional investors"? A few properties, lots of branding, and nothing that is free. Lesson learned for all of us: this is how you buy back cheaply what you claimed was expensive.

Neumann founded the office sharing company together with Miguel McKelvey in 2010. WeWork grew rapidly through capital and a lot of debt that it raised over the years. Among the investors, Softbank led by Masayoshi Sun was particularly dominant with an investment of $18 billion. At the end of 2018, WeWork had more than 400,000 members, and offices in 425 locations in 100 cities and 27 countries that created commitments and long-term leases for the company in the amount of $50 billion. In 2019, the company submitted a pre-IPO prospectus, when it was valued at $47 billion. When the prospectus was submitted, low performance, a lot of extravagance and an unhealthy obsession with the founder were revealed. The IPO was halted, Neumann was fired (during which he received hundreds of millions of dollars), and SoftBank took over 80% of the company and injected another $5 billion into it. In 2021, WeWork was issued through a SPAC merger at a value of $9 billion.

WeWork never came out of the crisis, the depth of which was revealed in the IPO. The company cut back, streamlined, reduced interest on loans, reorganized debt and also successfully negotiated hundreds of lease agreements, but all this did not help. Except for once early on, WeWork failed to post a net profit. In fact, since its inception, it has accumulated $16 billion in losses—or a loss of a dollar for every dollar it has raised. $14 billion of this amount are losses reported by SoftBank. Last November, WeWork submitted a request for protection from creditors, from which it emerged that the company has $16 billion in liabilities for long-term office contracts and debts of $19 billion compared to $15 billion in assets. It was also revealed that every year over 80% of its income goes towards rent and interest, a sum of about $2.7 billion. On February 2, its cash balances stood at $45 million.

Neumann retired. He founded a rental real estate company called Flow, which began to systematically purchase thousands of housing units. For tenants, the company is aiming to offer a unique "housing experience", a management and financial services company. In August 2022, Andreessen Horowitz poured $350 million into Flow according to a value of a billion dollars, an unusual move for the veteran venture capital fund, and in fact, the largest single fundraising round it has ever given.

Upon revealing the collaboration, the fund's co-founder Marc Andreessen published a long post on the company's blog, in which he detailed, among other things, Neumann's extraordinary skills. "Adam is a visionary leader who revolutionized the second largest asset class in the world — commercial real estate — by bringing community and brand to an industry in which neither existed before," he said, as if Neumann invented the co-working space model (he didn't), or that WeWork was not a business failure (at the time of writing the post, its market value was $5 billion). He also added that "it’s often under appreciated that only one person has fundamentally redesigned the office experience and led a paradigm-changing global company in the process: Adam Neumann."

Today we know that only two months after this huge infusion, Neumann already approached WeWork with Flow's bulging bank account. At the same time that Neuman requested to inject a billion dollars into the company, the office market registered a slight recovery after the shock of the Coronavirus and the transition to working from home. But even this stabilization did not lead the company to present encouraging quarterly reports. WeWork continued to struggle and the new management kept promising a net profit next year, when in practice, it only recorded losses.

Related articles:

In order to complete a deal, Neumann will have to offer something enticing to the senior debt holders, that is to say at least the payment of the debt, and for this he needs financial partners. In such a scenario, he would be able to combine the commercial real estate business with the residential one and perhaps establish an empire for himself again. The condition for establishing the status of a super company is to raise WeWork to the realms of net profit. However, as of today, most of the companies operating in the field are not successful. Competitor TIWG, the large European company. filed for creditor protection in 2020 and has since reorganized its assets, returned to operations and is not making a profit. Soho House is currently suffering from a short attack, following claims that it will face the same fate as WeWork. It is also not making a profit.

This, it seems, is the reason for Loeb's recruitment. The billionaire activist investor is known for having sued the auction house Sotheby's, taking part in the ousting of the CEO of Yahoo and getting into an argument with actor George Clooney when he invested in Sony. He also became known as someone who wrote humiliating letters to companies and CEOs, in which he mockingly described their failures, competence and education and called them a variety of nicknames, such as "Chief Value Destroyer" (CVD).

Loeb and apparently Andreessen, the only outside investors in this venture, have some faith that Neumann can steer WeWork to profitability. This may be achieved through some integration with the Flow business, which at its core offers services and platforms similar to those of WeWork, but for tenants instead of employees. Can WeWork, or even Flow, be profitable? It is not clear. What is clear is that Neumann wants WeWork back and for that he found two billionaires who believe in him. In this market, that is more than enough.