Government announces support package for Israeli high-tech sector

Amid the severe damage suffered by Israel’s high-tech industry last year, the Israel Innovation Authority is launching a series of aid initiatives to the tune of NIS 1.2 billion ($319 million), including a fund of half a billion shekels to invest in high-tech companies.

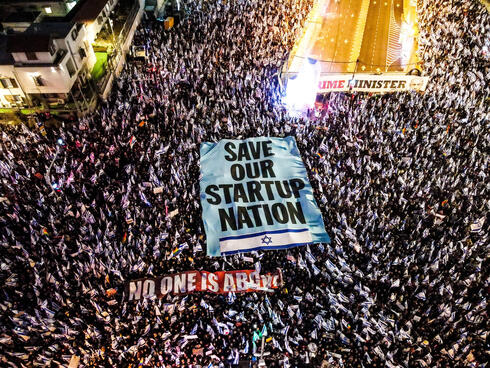

The high-tech industry has suffered significantly in the past year due to the war, the government’s judicial overhaul, and especially the global state of the sector. As part of the 2024 budget proposal, Israel’s finance ministry seeks to offer two new substantial assistance routes for the industry. Additionally, the government is expected to approve a budget of NIS 200 million ($53 million) for a support program for companies that have run out of funds during the war. The total assistance package is set at NIS 1.2 billion ($319 million).

The first proposed route in 2024 by the Israel Innovation Authority includes establishing a half-billion-shekel startup fund. This is intended for investment in early stage startups focusing on deep tech - ventures based on breakthrough scientific developments with broad influence, rather than popular investment areas like cybersecurity and software. The goal of the fund is partly to address the fact that there have been very few startups established in the last two years, and even fewer in deep tech. In response, the Innovation Authority started a program to invest in early-stage startups via grants.

According to the plan, the government will invest up to 60% of the round up to NIS 1 million ($266,600) for pre-Seed companies; up to 50%, with an additional grant of NIS 5 million ($1.3 million) for Seed companies; and up to NIS 15 million ($3.9 million) in a round of up to NIS 50 million ($13 million) for Series A. If the companies include entrepreneurs who are women, Haredi, Arab, or from the periphery, the grant will increase by 10%.

The second proposed route would increase the presence of institutional investors from Israel in funding startup companies. Currently, most funding for the industry comes from abroad, so that foreign investment in Israel accounted for 75-80% of total investment in 2021-2022. While this highlights the attractiveness of Israeli technology, it also exposes the industry to risk and fluctuations during times of political or security instability.

Related articles:

The Innovation Authority and the finance ministry believe that the tech sector’s high dependence on foreign investors leads to a slowdown, noting that studies show that small markets far from their investors take longer to recover. Simultaneously, Israeli institutional bodies invest relatively little in local risk capital compared to their American counterparts: only 0.6% of assets compared to 2.4% in the United States. Furthermore, only half of the money invested by local institutional investors is invested locally, compared to 62% in the United States. Asian institutional investors invest 80% of their risk capital allocation to local funds.

In the proposed plan, the final mechanism for the new program is not detailed, but it is similar to the well-established Yozma Group, which is considered to have laid the foundations for the local venture capital and high-tech industries in the 1990s. According to a plan discussed in recent weeks with Israeli institutional bodies, for every dollar invested by an investment fund or insurance company in an Israeli VC fund, the Innovation Authority will add 30 cents. In total, a substantial sum of NIS 850 million ($226 million) will be set aside for this purpose, two-thirds to be allocated for 2024 and the rest in 2025. This means an injection of approximately $1 billion to the local venture capital industry in the next two years. For comparison, in 2023, local VC funds raised around $1.5 billion.

The investment will only be possible in new funds, and priority will be given to investing in funds that have not already been invested in. If the fund generates a positive return, the government will receive its money back, and the institutional body will keep the excess return. In contrast to the plan adopted following the COVID-19 pandemic to encourage institutional investments in Israeli high-tech, in the current plan institutions will not be protected from losses. Details of the final plan, including incentives for startup companies receiving investment through this program to remain in Israel, are still being discussed. Institutional bodies want to make sure that the companies will be registered and operate in Israel. The Innovation Authority, for its part, wants more investments to be directed towards deep tech areas rather than software, cybersecurity, or gaming.

Besides these two plans, the government is expected to approve NIS 200 million ($53 million) for companies without funds and requiring immediate financial support amid the war. In 2023, the Innovation Authority announced a support program for struggling companies, starting with NIS 100 million ($26 million) and adding another NIS 300 million ($79 million). Now, as part of the 2024 budget, the government intends to approve NIS 200 million ($53 million) for the same purpose.