Opinion

The dangers of chasing big funding rounds: A cautionary tale for startup founders

"In the race for bigger funding rounds and higher valuations, founders must exercise caution and consider the long-term consequences of their decisions," writes Eran Bielski, General Partner at Entrée Capital.

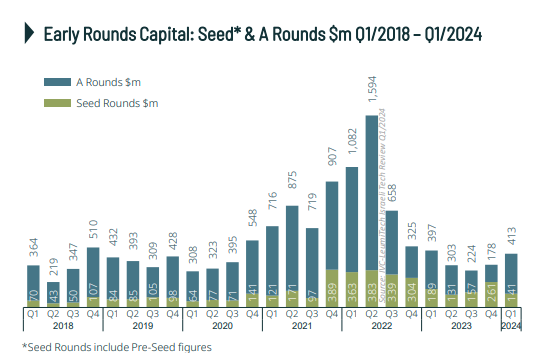

In the recent months since the beginning of 2024, we noticed that bigger funding rounds and higher valuations have become more common in the startup ecosystem, bringing back memories of the tech bubble of 2021. This trend is not only appealing to founders, who equate it with success and desirability but also reflective of intense competition among investors. However, while the allure of these larger rounds may seem beneficial, they don't always deliver what they promise, hindering long-term success.

The Risk of Chasing Big Funding Rounds

If you take a closer look, it becomes apparent that this obsession with securing big funding rounds is not always in the best interest of founders. By focusing on raising large amounts of capital, they risk overlooking the fundamental aspect of growing their business and making it profitable. This one-dimensional focus on the next funding round can distract from building a solid foundation and achieving product-market fit.

Our Two Cents on Startup Funding

We believe that raising significant funding at your early stage is not always the smartest move. It usually results in less equity and high expectations, requiring rapid growth within a short timeframe. Many cases have revealed that founders who secure significant funding rounds early in their journey often end up unintentionally burning their cash before they have the chance to fully scale their business.

When Raising, What Should Founders Do?

- Understand the purpose of fundraising

Founders should recognize that the goal of raising money is not solely to secure funding but rather to reach a specific milestone, such as developing a marketable product. By keeping this objective in mind, founders can maintain focus and ensure that each round of funding is aligned with their progress toward reaching that milestone.

- Embrace financial discipline

The success of future funding rounds will depend on how effectively previous funding has been utilized. Even if a large sum has been raised, founders should operate with the mindset of having raised less, using financial discipline to optimize resources and avoid premature burnout.

- Choose partners, not just dollars

Founders should view investors as long-term partners rather than simply sources of funding. When evaluating potential investors, it is crucial to consider factors beyond the amount of money they bring to the table. Choosing the right partner involves assessing their expertise, connections, and alignment with the company's vision, rather than being solely driven by the dollar amount offered.

In the race for bigger funding rounds and higher valuations, founders must exercise caution and consider the long-term consequences of their decisions. While it may initially seem appealing to secure large amounts of capital, chasing after big funding rounds can divert attention from building a solid business foundation and achieving profitability. By maintaining a clear understanding of their goals, embracing financial discipline, and selecting partners wisely, founders can navigate the investor landscape with greater clarity and increase their chances of long-term success.

Eran Bielski is a General Partner at Entrée Capital