What drove Pat Gelsinger to step down as Intel CEO? Inside the tumultuous tenure

Missteps, delays, and strained partnerships defined his three-year journey.

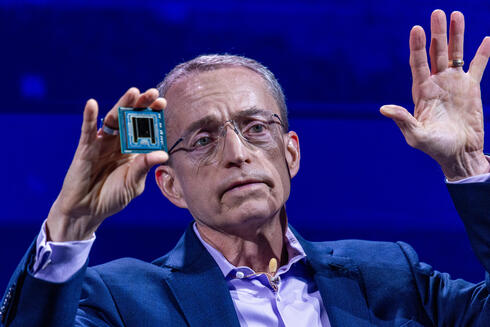

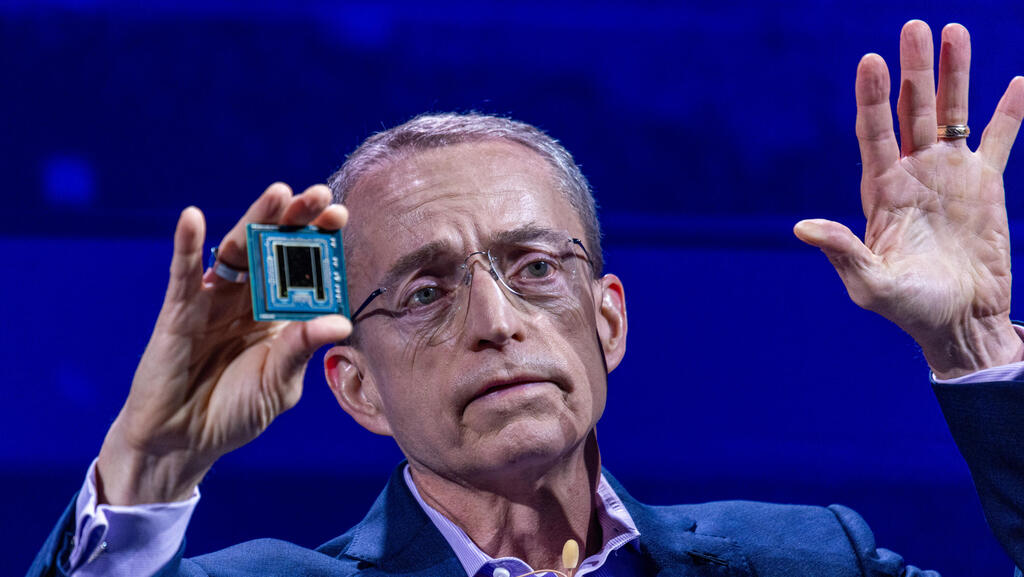

Pat Gelsinger, Intel’s charismatic CEO, has retired after three challenging years at the helm, leaving a company still striving to reclaim its position as a leader in the semiconductor industry. His departure follows a series of missteps and financial challenges as Intel battles formidable rivals like Taiwan Semiconductor Manufacturing Co. (TSMC) and Nvidia.

Ousted Intel CEO Pat Gelsinger set to receive $10 million in severance

Can Intel recover? Gelsinger’s exit sparks speculation and uncertainty

Gelsinger, who began his Intel career in 1979, returned as CEO in 2021 to reinvigorate the struggling chip giant. While he set ambitious goals, including a $20 billion investment in two new Arizona factories and the promise of cutting-edge manufacturing processes like the 18A node, Intel has failed to meet many of these targets. Analysts and insiders criticized Gelsinger’s overly optimistic public forecasts, which often contrasted with internal assessments.

One of Gelsinger’s most notable missteps was straining Intel's critical relationship with TSMC, the world’s leading chip manufacturer. His remarks questioning Taiwan’s geopolitical stability alienated TSMC, which retaliated by withdrawing discounts for Intel. This miscalculation increased Intel’s production costs and further damaged its competitiveness in the semiconductor space.

Intel’s struggles were compounded by the rapid rise of AI, where Nvidia has emerged as the dominant player. Nvidia’s graphics processing units (GPUs), key to AI workloads, have outpaced Intel’s AI-focused Gaudi chips. Despite Gelsinger’s public claims of burgeoning AI chip demand, Intel’s internal projections remained far more modest, highlighting a disconnect that dented its credibility.

Earlier this year, Intel announced bold measures to address declining revenue and sharpen its competitive edge. Its foundry division, Intel Foundry Services, is set to operate as a subsidiary, a move designed to attract external investment and reassure potential customers wary of sharing designs with a direct competitor. The subsidiary model aligns Intel with competitors like Taiwan’s TSMC and could provide the flexibility to raise capital independently.

Intel is also consolidating operations, postponing factory projects in Poland, Germany, and Malaysia, and reducing its real estate footprint by two-thirds. These actions follow a $10 billion cost-cutting plan announced earlier this year, including 15,000 layoffs and curtailed employee benefits.

Related articles:

Under Gelsinger, Intel’s revenues plummeted to $54 billion in 2023, a 33% drop since his appointment. The company also posted its first net loss in decades. Meanwhile, Intel’s share price declined sharply, losing two-thirds of its value since Gelsinger’s early months as CEO. The downturn has fueled speculation about potential takeover bids and left investors questioning Intel’s long-term strategy.

Intel’s board has appointed CFO David Zinsner and senior executive Michelle Johnston Holthaus as interim co-CEOs while searching for a permanent successor. Despite its challenges, Intel has secured over $11 billion in U.S. government funding under the CHIPS Act, aiming to bolster domestic semiconductor manufacturing.

While Gelsinger’s efforts to transform Intel into a foundry for other chipmakers were bold, they faced significant technical and logistical hurdles. Critics argue that the company’s attempt to rebuild its manufacturing capabilities from scratch is an uphill battle in an industry dominated by more agile competitors.

As Intel embarks on its next chapter, the company must grapple with tough questions about its direction, strategy, and ability to compete in an era defined by AI and advanced semiconductor technologies. Gelsinger’s tenure, marked by lofty ambitions and stark realities, serves as a cautionary tale for the challenges of turning around a tech behemoth.

Reuters contributed to this report.