Analysis

Mapping mental health innovation in Israel

“Necessity is the mother of innovation, and the national trauma that has befallen Israel could be a catalyst for the next wave of mental health solutions from Israel,” says Yoav Fisher, Head of Technical Innovation at HealthIL

On October 7th Hamas terrorists launched a unilateral attack on Israel, brutally killing over 1,200 civilians, including infants and children, taking 240 hostages, and injuring thousands more.

Since then, I have been working with HealthIL on trying to address mental health concerns at the national level, to help every demographic group cope with the long-term trauma that will undoubtedly affect all Israeli civilians - of every religion - for many years to come.

As a result of these efforts, we wanted to give insights about the Mental Health startup ecosystem in Israel, including opportunities and challenges for both founders and investors.

Introduction

For many years, mental health was an overlooked and underrepresented aspect of healthcare. More recently, and particularly since Corona, mental wellbeing has emerged as a crucial aspect of healthcare, on par with physical wellbeing.

Significant progress has been made in recent years, with well-established companies like Lyra Health, Meru Health, Spring Health, Wysa, Modern Health and many more actively filling in the gaps of mental healthcare and integrating with broader healthcare systems.

But challenges still remain regarding mental health, and there are a number of important aspects and trends with global relevance:

- Disparities in care are wide: there is a large and growing gap in access to mental health services between demographic groups.

- Increasing public awareness and demand: The stigma around mental health has decreased significantly in recent years, and there is an increasing interest in including mental health services as part of the larger basket of healthcare, from both national providers and employers.

- Employers, particularly in the U.S, are recognizing the importance of mental health on their workforce, and their bottom lines, and are putting more emphasis on mental health services.

- Digital products and services have an incredible opportunity to increase access to care and assist with all aspects of care, from screening and prevention through therapy and treatment.

- Most importantly – mental health issues are growing rapidly across all age groups, and certain demographic groups, like children, minorities, or those with substance abuse, are reaching near-crisis levels.

The mental health startup ecosystem in Israel has unique aspects as well that should be highlighted:

TL;DR highlights:

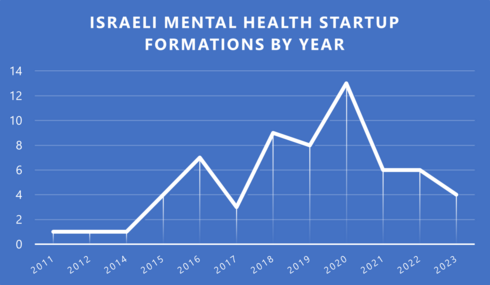

- First wave of Israeli startups in mental health happened before Corona, and new startup formation has remained active since, especially when compared to other sectors.

- Mental health is one of the few sectors in Israeli health-tech that continues to receive investments, even in early stages.Investor appetite skews toward solutions that incorporate both patient-facing care options as well as a strong understanding of back-end infrastructure and integration to workflows, processes, systems, and clinician usability.

- Israeli startups are noticeably less advanced than incumbents in the U.S. or UK, and most startups focus on self-care and treatment, but without consideration of infrastructural needs of healthcare systems.

- The Israeli healthcare system has not been as supportive of mental health as other areas of care, which has created a gap between innovation and implementation, and the proliferation of more wellness oriented startups that do not integrate with the healthcare system.

- This means that for Israeli mental health startups to succeed, founders (and investors) need to put an emphasis on both unique technological approaches as well as a deep understanding of how healthcare systems outside of Israel operate and what it takes to integrate with clinical workflows, processes, and economic considerations.

- We should see increased startup activity coming from Israel in the mental health space, driven by interest at the national level, a strong foundation for innovation in healthcare, and the clear need for new solutions as a result of the events on October 7th.

Defining the Space

There is significant confusion about how to define “mental health”, as can be seen in various reports and industry surveys. For example, there is a frequent tendency to include neurodegenerative and neurodivergent products and services into mental health.

For the purposes of this summary, we aim to isolate only software driven products and services that directly address the spectrum of mental health for the neurotypical population.

Therefore, neurodivergent and neurodegenerative conditions like ADHD, Autism, and Alzheimer’s are not included in this review, but will be considered separately at a later date.

This review also does not include drugs or molecules, but it does cover the entire spectrum of mental health, including “lighter” aspects of mental health care like mindfulness through more “traditional” clinical aspects of care like PTSD.

In addition, we do not include “Israel related” startups that are frequently included in other reports, like BetterHelp or Twill as they do not have activity in Israel.

Startup Deep-Dive: Insights

Based on the definition of the mental health above, 63 startups have been formed since 2011. Of those, one third (21) are inactive. Contrary to some articles, activity in the mental health space began prior to Corona, with the formation of 30 new startups between 2018 – 2020. Even though startup formation has declined since, there is still noticeable recent activity, with five new startup formations per year, on average, in 2021 – 2023.

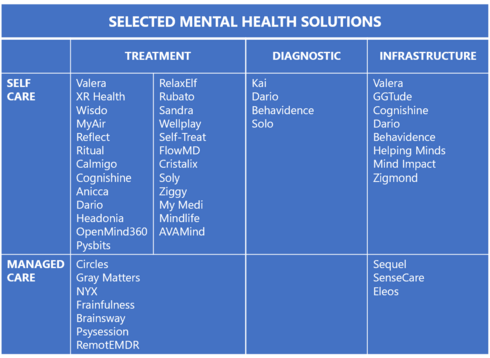

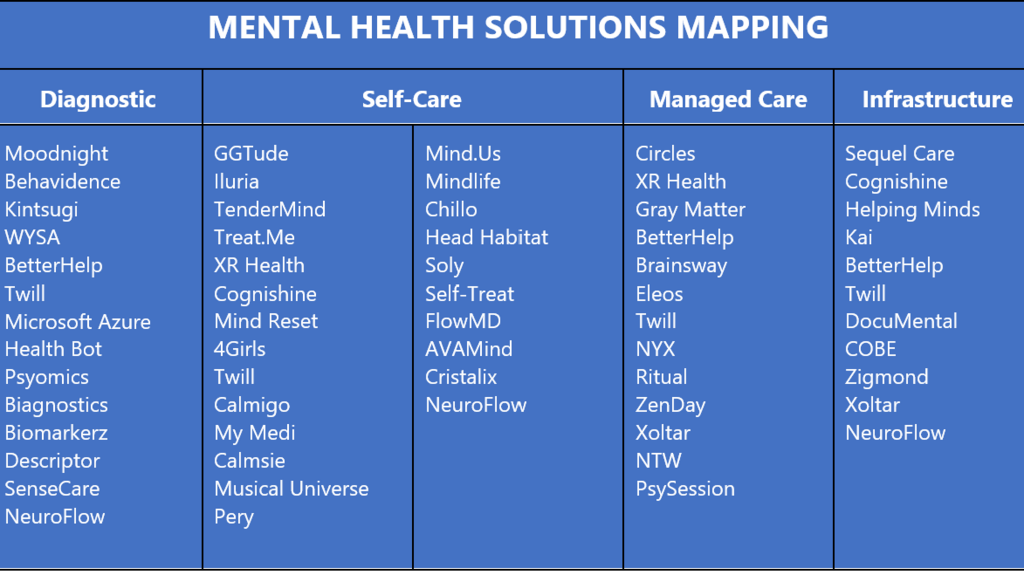

It is important to classify startups correctly in accordance with the provision of care. For the purposes of the summary, we classify startups according to two key parameters:

Diagnostic vs. Treatment vs. Infrastructure

Self-Care vs. Managed Care

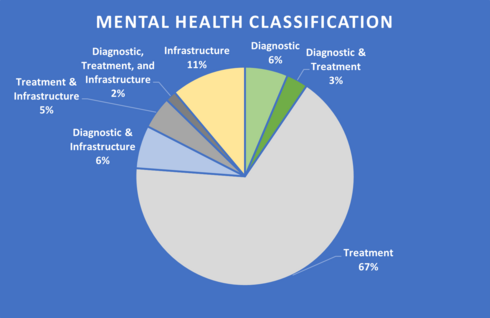

Diagnostic refers to startups that deal with the assessment of the mental health of the user. This can include assessment of the type of condition (anxiety, grief, stress, depression, etc..) and/or severity of the condition.

Treatment refers to startups that have some form of treatment for the condition. This can include treatment that does not require clinical validation through those that require rigorous clinical review.

Infrastructure refers to startups whose core product offering is designed to address workflow, processes, integration, or clinical usability aspects of mental health care. This can include startups that offer clinical automation, clinician management and administration, integration with healthcare systems, or any additional back-end features.

Some startups address multiple parameters, like diagnostics along with the infrastructure platform.

Self-Care refers to startups who offer care products and services that users can interact with on their own, without the need for clinician intervention

Managed Care refers to startups that require clinician intervention and oversight during usage.

Over two thirds (42) of the startups that have been created since 2011 deal with treatment only. One startup offers solutions for all three aspects: diagnosis, treatment, and infrastructure.

Funding Deep-Dive: Insights

The 63 startups in the analysis have raised $248 million in disclosed funding. Over 55% of the startups in the mental health space remain unfunded – either purposefully bootstrapped or unable to garner interest from investors. In addition, almost 90% of all startups are “early-stage”, defined as Pre-A.

Without the one outlier startup, the average total funding for a startup with an infrastructure component is over twice the average total funding for a startup without an infrastructure component ($5M as opposed to $2.25M)

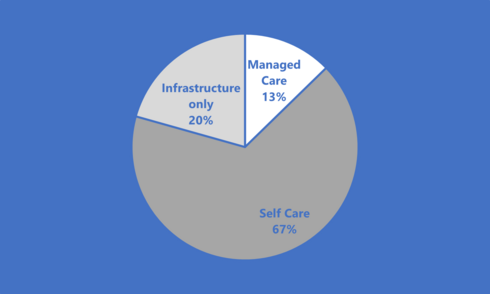

There is also a notable skew regarding managed care as compared to self-care.

Startups focused on managed care represent 13% of all startups, but have garnered 46% of all funding.

This outcome becomes even more pronounced when excluding the one outlier startup that has reached the C round – where managed care startups now account for 64% of all funding.

Together, we can see that funding is flowing to startups who are building managed care solutions with an infrastructure component.

This makes logical sense, as startups focused on managed care require significantly more financial support in order to build out clinical validation or back-end integration and platforms. Clinical validation and infrastructure also creates significant defensibility and a stronger value proposition.

Startups who are only building out infrastructure, without any care component, are the least valued by investors.

Investor Deep-Dive: Insights

82 unique investing entities have disclosed funding for mental health. Interesting, especially when compared to other sectors like Femtech, crowdfunding has not played a major role in supporting Israeli mental health startups, indicating interest from traditional and institutional investing entities.

The mental health space also receives more interest from Israeli investing entities than other sectors, including in early stages. There were 49 distinct investors in early-stage mental health (defined as Pre-A), of which half (24) were Israeli entities. In addition, a few Israeli investing entities participated in multiple rounds and with two or more companies.

In general, as compared to other sectors, support for early-stage investment from Israeli entities remains strong, indicating interest in the space, and interest in supporting new Israeli startups in mental health.

Related articles:

Summary: The potential of Israel in addressing Mental Health

There is clear potential for mental health startups emerging from Israel, and the Israeli healthcare system is an excellent alpha-site for testing new innovations, especially considering the renewed interest and national support for addressing mental health.

But simple digitization of standard protocols like PHQ-9 or GAD-7 is not enough for successful innovation and viability. Startups should explore ways to create unique tech-driven solutions for diagnostics, self-care, or managed care, but with a dedicated emphasis on building out the infrastructure for integration, clinical usage, workflow, processes, or other back-end considerations.

Behavidence and Eleos Health are two examples of emerging Israeli startups that balance between innovative technological approaches to mental health coupled with an understanding of the infrastructure needs of healthcare systems.

Kintsugi, Psyomics, and NeuroFlow are examples of international startups that have successfully balanced between technology and infrastructure to create solutions that have been widely deployed in healthcare systems in the U.S. and the UK.

While investor support for mental health is strong, particularly when compared to other sectors, investors should seek out startups that look beyond digitization of off-the-shelf analog protocols. As stated, common standards like PHQ-9, GAD-7, or known CBT protocols for self-care can be good starting points for innovative solutions, but are rarely enough to justify defensible investments.

Investors should also help guide founders toward addressing the future needs of mental health, like demographic gaps in care or increasing accessibility.

It is also important to note that the mental health space is filled with incumbents who are well funded and well entrenched with healthcare systems, and founders and investors should be mindful of creating unique value propositions that are based on both technological innovation and a deep understanding how solutions can work alongside healthcare systems.

If there is any light at the end of the tunnel to the horrific attack by Hamas terrorists, it is that necessity is the mother of innovation, and the national trauma that has befallen Israel could be a catalyst for the next wave of mental health solutions from Israel.

Yoav Fisher is the Head of Technical Innovation at HealthIL