Inside Intel’s biggest-ever layoff: a blueprint for a wounded giant

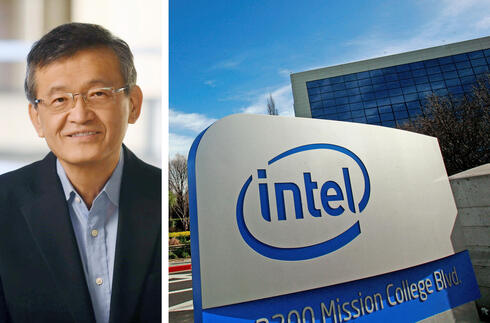

CEO Lip-Bu Tan is gambling on speed, clarity—and the engineers he hopes to rehire.

There’s something deeply unsettling about a company laying off 22,000 people. It’s not just the number—though yes, that’s roughly one in five employees, or a small city’s worth of livelihoods, vanished with the stroke of a strategy memo. It’s what that number represents: a quiet admission that things have been broken for a long time.

Intel CEO warns: “This is just the beginning” as layoffs and reforms begin

Intel braces for massive layoffs, with Israeli operations facing uncertainty

On Thursday, when Intel posts its latest earnings—almost certainly another bruising quarter—you’ll hear the company talk about “realignment,” “focus,” and “operational efficiency.” But none of those terms get at what this really is: Intel’s most radical act of self-correction yet, led by new CEO Lip-Bu Tan, and a last-ditch attempt to rediscover the plot.

The layoffs—reported by Bloomberg and expected to be formally announced alongside the earnings—aren’t just a cost-cutting maneuver. They’re the biggest move Tan has made since taking over in March, and possibly the biggest single redefinition of Intel’s culture since Andy Grove was still roaming the halls.

So what’s really happening here?

Let’s rewind.

Intel has been in free fall for years. Not in a tabloid, crypto-scandal kind of way—but in a quieter, more corporate tragedy: the kind where a $100 billion company slowly loses relevance. Where once it defined the future of computing, it’s now playing catch-up—in personal computers, in data centers, in artificial intelligence, and especially in the public imagination. You don’t see “Intel Inside” stickers anymore. They’ve been replaced by Nvidia’s stock ticker.

Pat Gelsinger, the previous CEO, tried to engineer a turnaround by doubling down on foundry services—Intel’s ability to manufacture chips for other companies, like Apple or Qualcomm. It was ambitious. It was bold. It also burned through billions and, so far, hasn’t delivered much more than shareholder frustration and stripped-down office perks. (Yes, they even cut the coffee stations.)

Gelsinger stepped down in December. Enter Lip-Bu Tan, who’s not a showman, but very much a strategist. He left Intel’s board last August over disagreements with the company’s direction. Seven months later, he was in the CEO chair.

Now, less than two months into his tenure, he’s doing the corporate equivalent of flipping the Monopoly board.

It started with the sale of 51% of Altera—Intel’s programmable chip business—to private equity firm Silver Lake for $8.75 billion. That was Tan testing the market. This week’s layoffs? That’s Tan tearing down the parts of the building that don’t make sense anymore.

The goal, we’re told, is to rebuild Intel as an “engineering-first” company. Not a bloated bureaucracy with layers of middle management and slide decks. A real tech company again. You can already see it in the org chart: Tan has flattened the structure so chip division heads report directly to him. The implication is clear—he doesn’t want layers. He wants clarity, speed, and maybe, just maybe, greatness.

But the stakes here aren’t just about structure. Intel is in a bind that few of its peers are. It’s one of the only companies that both designs and manufactures its own chips—an identity that’s increasingly hard to sustain in an era dominated by nimble, design-focused players like AMD and Nvidia, and manufacturing powerhouses like TSMC.

Which brings us to another twist: reports that Intel is in advanced talks with TSMC to form a joint venture. That would’ve been unthinkable a few years ago. TSMC is the rival. But desperate times make for pragmatic deals, and Tan is nothing if not pragmatic.

There’s a reason the layoffs are hitting HR, marketing, and middle management the hardest. Tan has hinted that engineering talent—once the company’s crown jewel—has been quietly drained over the years. Now, he wants to replenish it. He wants builders, not bureaucracy.

And yet, the AI elephant in the room remains.

Intel has effectively no competitive offering in the AI race right now. Falcon Shores, its much-hyped GPU, was shelved for internal testing. The company just appointed a new CTO, Sachin Katti, to lead its AI push—but the fact that AI still needs “fixing” inside Intel tells you how far behind the company is.

Then there’s the geopolitical chaos. China—Intel’s largest market in 2024—is threatening 85% tariffs on U.S.-made chips. Intel is exposed in ways Nvidia and AMD simply aren’t. It’s not just business; it’s global diplomacy.

Related articles:

So where does this leave us?

Tan’s moves are bold. There’s no arguing that. But they’re also a referendum on just how far Intel has fallen. No thriving company sells a prized business for half of what it paid, or lays off 20% of its workforce, or quietly exits AI without a flagship product.

This is triage.

But sometimes triage is the first step in healing.

Tan is making decisions that should have been made five years ago. The question is whether he’s too late—and whether the cuts now will free up enough room to rebuild a company that still has extraordinary talent, deep infrastructure, and a name that still matters.

Maybe this is the moment when Intel finally gets out of its own way. Or maybe we’ll look back on this as the last act of a once-great institution trying to shrink itself into relevance.

Either way, the next 48 hours will tell us more than a thousand earnings slides ever could.