Decoding Israel's cyber success amid 2023 challenges and predictions for 2024

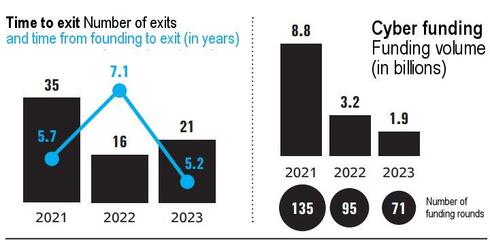

YL Ventures' analysis exposes Israeli cyber's resilience, with total fundraising among Israeli cybersecurity startups last year amounting to $1.9 billion in 71 investment rounds, marking a 41% drop compared to 2022. However, the average Seed round rose to $9.8 million in 2023 and 21 Israeli cyber companies were acquired, compared to 16 in 2022

Funding rounds for Israeli cybersecurity startups did indeed shrink in 2023, but there are several surprises in a report which analyzed the local ecosystem. Total fundraising amounted to $1.9 billion in 71 investment rounds, marking a 41% drop compared to 2022 and a decrease from the historical record of nearly $9 billion in 2021, according to the 2023 summary of the Israeli cyber industry prepared by YL Ventures, a venture capital fund specializing in cyber, led by Yoav Leitersdorf.

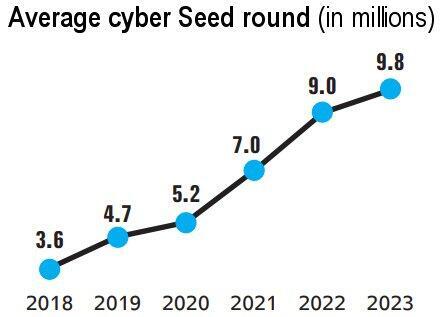

Notably, no new unicorn emerged in Israeli cyber, except for Island, established in the U.S. by Dan Amiga. Despite the overall disappointing figure, two encouraging trends were observed: the size of the Seed round in cyber increased to almost $10 million, compared to just a few million in other industries, and there was a significant rise in exits (merger and acquisition transactions) of Israeli startups. These trends signify growing investor interest in the Israeli industry despite the complex situation Israel faced throughout 2023.

The most interesting figure in the report is the impressive increase in the average Seed round, reaching $9.8 million in 2023, compared to $9 million in 2022 and half of that in 2019 and 2020. The total funding at this stage was almost unaffected, decreasing by only 8% to $354 million.

YL explains this data by the high concentration of cyber-experienced entrepreneurs who establish new companies after selling their previous ventures. In 2023, out of 36 startups that raised a first round, 10 were led by serial entrepreneurs. Serial entrepreneurs are the ones raising the average, while fundraisings of young entrepreneurs were below the average. For instance, Gutsy's extraordinary Seed round that reached $51 million is explained by the team's previous founding of Twistlock, sold to Palo Alto for $450 million in 2019. YL notes that although only 36 new cyber companies raised Seed in the past year, in practice, another 10 new companies were established in 2023 and have not officially completed their funding rounds. These fundraisings are expected to be closed in the first half of 2024, potentially bringing the number of new companies to the same level as in 2022, countering concerns of fewer startups in the industry last year.

Another intriguing figure is the increase in the number of exits for cyber companies. In 2023, 21 Israeli companies were sold, compared to 16 in 2022. There was also a significant decrease in the number of years until the exit, only 5.2 years, even lower than the average of 5.7 years recorded in 2021. This decrease in the number of years from establishment to exit is connected to the trend of an increase in exits in 2023, driven by the significant challenge of raising follow-on rounds in a difficult macroeconomic environment. Another notable trend in exits is the doubling of the number of purchasing companies that are not in the cyber sector, rising from 5 in 2022 to 10 in 2023. This dramatic increase is attributed to the desire of software and hardware companies to enhance their solutions with security capabilities. Microsoft, with its in-house cyber arm, has become a role model, leading companies in perceived outdated sectors to rebrand themselves as cyber companies. The most prominent transactions include the purchase of Israeli Axis by HPE for half a billion dollars and the acquisition of Imperva by the giant European defense corporation Thales for $3.6 billion.

Related articles:

YL estimates that the trend of increasing sales of cyber companies will continue to expand in 2024 because many companies in the field are sitting on large cash reserves, and their shares have recently recorded sharp increases. This includes companies like Palo Alto, trading around $100 billion, Check Point at an all-time high, and CyberArk, approaching a value of $10 billion, as well as large American companies, such as CrowdStrike, which acquired Israeli company Bionic for $350 million in 2023, and Okta, which purchased Israel’s Spera during the war. “Many companies are starting to run out of money raised in 2021 and will have to decide either to be sold or to do a down round,” said Nadav Lev, CTO of YL Ventures, who recently joined after a long series of senior positions in Israeli cyber companies.

Most of the damage to capital raising was recorded in the later growth stages, continuing the trend that began in 2022. During these stages, recruitment volumes plunged by 40%-50%. Consequently, many companies that tried to avoid recruitment in the last two years will not be able to continue doing so. "A company that does not have enough money for 18 months will have to do something," added Lev. "Unlike them, startup companies that raised Seed rounds in 2023 will be able to raise healthy and significant follow-on rounds in 2025."