Opinion

Money moves faster than missiles

"We’re at a critical crossroads. As fintech capabilities grow, they can either be used for good or exploited for harm. If liberal democracies don’t lead the way in using technology for financial defense, terrorist groups and hostile states will use the same tools to exploit our vulnerabilities. This is a race, not just of tech, but of will," writes Noam Inbar, Partner at Viola FinTech.

As the world watched Israel’s latest strikes on Iran triggered by Tehran’s nuclear ambition standoff, the stage for conflict had extended far beyond missiles. Just last month, an anti-regime hacker group known as Predatory Sparrow announced that it stole $48 million in cryptocurrency used by Iran to fund terror by attacking Iran’s Nobitex crypto exchange. Since October 7, there has been a very clear battlefield in the Middle East, but behind the scenes, there is a battlefield just as impactful: one of financial and digital terror.

Though always essential, Counter-Terrorism Financing (CFT) was, for years, treated as a technical, behind-the-scenes regulatory concern. But with geopolitical conflicts escalating and terrorist activity dominating headlines, it has now moved into the spotlight. When Hamas executed one of the most brutal attacks in modern Israeli history, a harsh truth surfaced: the money behind terrorism often flows unnoticed through mainstream financial platforms. It’s no longer just about intelligence gathering or border security; it’s about Venmo accounts, crypto wallets, and charity sites weaponized in plain sight.

Terror financing has evolved. So must our defenses.

We now know that groups like Hamas, Hezbollah, and IRGC-backed operatives raise funds through legitimate-looking online campaigns, manipulate informal networks like hawala, and exploit blockchain to obscure transactions. These tactics make detection extremely difficult because, unlike traditional money laundering (which tries to hide dirty money), terror finance often begins with clean money donated in good faith by unsuspecting supporters.

The scope is staggering. According to the Financial Action Task Force (FATF), billions of dollars are laundered annually, with a significant portion suspected to support terrorism. In one documented case, Russian-backed cybercriminal groups used ransomware attacks on European banks to extort funds later traced to state-affiliated networks. Meanwhile, Hamas has raised international funds using Bitcoin wallets under the guise of humanitarian relief. Iranian-linked hackers have also launched ransomware attacks against Israeli banks, using cyber disruption as both a fundraising method and a psychological weapon. This is 21st-century warfare - dispersed, digital, and dangerous.

And yet, many financial institutions still treat it like a low-priority issue.

Royi Markowitz, an Israeli tech founder, was one of the many civilians who took action against financial terror after October 7th. “I just felt the need to do something”, he told me. He started tracking Hamas fundraising campaigns via Telegram and helped shut down over 10 accounts on platforms like PayPal and Barclays by himself. “I’ve learned that financial institutions are either blind to this or just don’t care,” he said. Only when he copied regulators into emails did anyone take action. “A simple Israeli in a small town was able to find things that big financial institutions couldn’t - or wouldn’t - see.”

This story isn’t just about one man’s vigilance. It’s about a systemic blind spot. And it raises the deeper question: do financial institutions have a strong enough motivation to act?

The tools are already here. Artificial intelligence can detect transaction anomalies. Blockchain analytics can trace crypto trails. OSINT platforms can scan social media for terror-linked fundraising. However, the will to use them and to prioritize this threat is often missing.

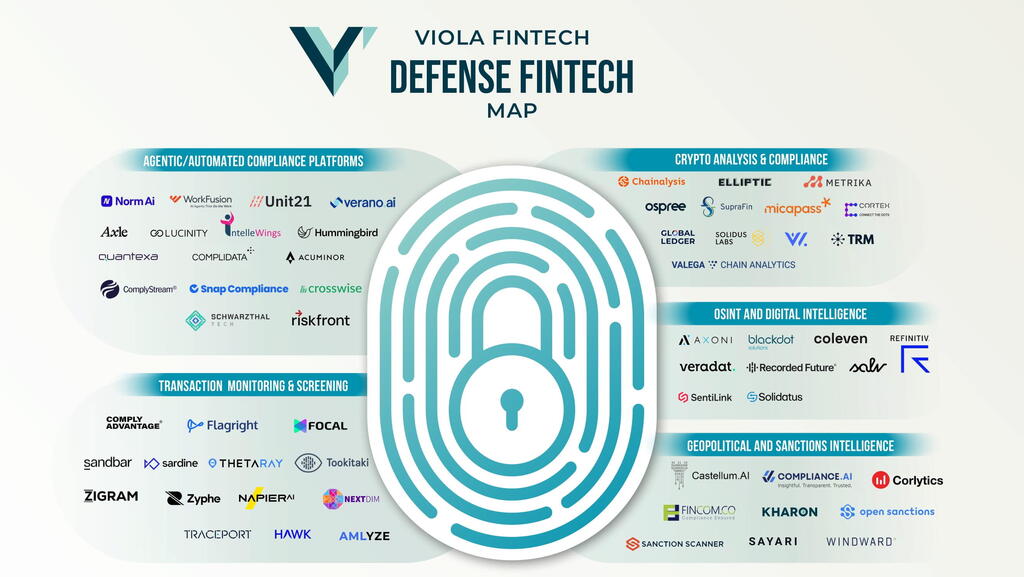

Tech companies that combat financial crime can be grouped under a broader strategic category: Defense Fintech. This isn’t a new vertical, but a way to frame existing technologies, many of which are already used in financial services.

Solutions across AML/CFT compliance, Blockchain Analytics, Open-Source Intelligence (OSINT), and Cybersecurity play a critical role in detecting and disrupting terror-linked financial activity and can serve as vital components of modern counterterrorism. Meanwhile, the burden of compliance on financial institutions, which rely heavily on manual labor, is enormous. Fintech has the potential to make that work not only more effective, but dramatically more efficient.

There are over 50 companies today working on solutions in this space (see map) – some are Israeli (such as ThetaRay, Fincom, NextDim, Winward, Coleven and Solidus Labs).

We’re at a critical crossroads. As fintech capabilities grow, they can either be used for good or exploited for harm. If liberal democracies don’t lead the way in using technology for financial defense, terrorist groups and hostile states will use the same tools to exploit our vulnerabilities. This is a race, not just of tech, but of will.

The battle over financial integrity won’t be fought only in courtrooms or war rooms. It will be fought in codebases, algorithms, digital intelligence, and infrastructure progress.

It takes a village - regulators, banks, and fintech - because in the digital age, defense is written in shared code.

Noam Inbar is a Partner at Viola FinTech.