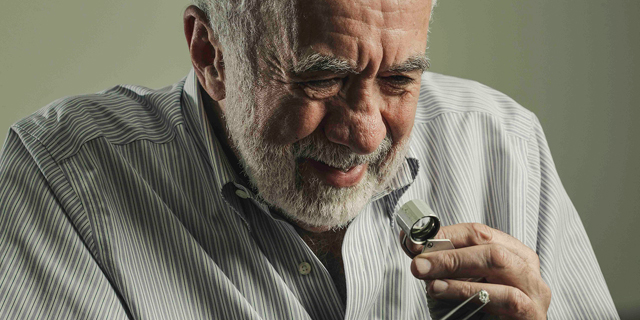

Benny Landa’s lab diamond startup Lusix sees valuation crash, raises urgent funding

The Israeli company has been significantly hit by high interest rates and increased industry competition, resulting in an emergency funding round at a valuation of just $50 million

High interest rates and increased industry competition have significantly hit Benny Landa's synthetic diamond venture. Calcalist has learned that Landa's laboratory diamond company, Lusix, recently undertook an emergency funding round due to a pressing need for cash at a valuation of just $50 million. This resulted in significant dilution for Landa, led to the replacement of the veteran CEO Silviu Reinhorn with a former executive from the fashion giant Louis Vuitton, as well as a strategic refocusing of the company's activities.

Lusix, founded in 2016 by Landa, who sold digital printing company Indigo to HP in 2002 for $830 million, produces laboratory-grown rough diamonds, also known as synthetic diamonds. They are sold to polishers who transform them into processed diamonds used by various jewelry companies. Laboratory diamonds offer an environmentally friendly alternative to natural diamonds mined from the ground, often associated with environmental pollution and human rights issues, earning the term "blood diamonds" if mined in certain parts of the world.

Landa, who serves as the chairman of Lusix, invested tens of millions of dollars of his own money in financing the company until mid-2022, single-handedly supporting its operations at its Rehovot factory.

In June 2022, Lusix secured a significant $90 million funding round from a consortium of investors, led by the investment fund of the fashion giant LVHM. LVHM, trading in Paris at a value of 335 billion euros, owns luxury brands such as Louis Vuitton, Fendi, Christian Lacroix, and Christian Dior.

The aforementioned fundraising was conducted in the format of a SAFE (Simple Agreement for Future Equity). This fundraising involves an undetermined valuation of the company and incorporates mechanisms to convert the invested funds into shares during a subsequent fundraising round. These mechanisms also define an anticipated valuation range for the next funding round. According to information obtained by Calcalist, the mechanisms implemented in this particular fundraising round established a prospective company valuation ranging between $300-500 million.

Related articles:

During 2023, Lusix ran into a cash crunch due to the need to repay part of the loans it took from banks in Israel. Landa began promoting a new fundraising round, but due to the overall upheaval in the diamond industry, he had difficulty recruiting new investors. In November, Lusix ultimately raised funds from existing shareholders, including Landa, with SAFE investors converting funds into shares.

The company was valued at about $50 million in the fundraising, representing one-tenth of the maximum predicted value from the June 2022 round. This resulted in a substantial drop in Landa's ownership stake from 97% to 25%, with LVMH Luxury Ventures and the Ragnar Crossover Fund seeing their stakes rise to 17% each.

The challenges faced by Lusix's business are attributed in large part to industry upheaval, including the entry of several Indian companies into the laboratory diamond sector, leading to increased competition and a decline in laboratory diamond prices. The price of 5-carat laboratory diamonds dropped by 72% in the last 12 months, and 1-carat laboratory diamonds fell by 40% during the same period. Global interest rate increases, particularly in the U.S., also dampened demand for natural diamonds, with prices falling approximately 20%.

In response to these difficulties, Lusix opted to diversify its activities by producing finished diamonds for jewelry and watches, aiming to establish itself as a jewelry company with an independent brand. The company replaced CEO Dr. Silviu Reinhorn with Hamdi Chatti, the former president of the watch and jewelry division of LVHM. Chatti, based in France, views the expansion as a challenge but anticipates presenting diamonds and jewelry for direct sale by the end of the year, envisioning a Lusix brand diamond chain within two years.

Reinhorn, who managed Lusix for seven years, told Calcalist that he relinquished the position of CEO because "it was evident that there was no one within the company who could oversee the process of developing finished diamonds for jewelry, as we are primarily technologists."

In a telephone interview from France, Chatti told Calcalist that "Louis Vuitton's representatives on the board of Lusix reached out to me two months ago and requested a meeting with Landa. I was impressed by his energy and decided to join the company. My responsibility is to transform the rough diamonds we currently produce into finished diamonds that the entire world will want to buy." However, Chatti, who established the jewelry department of the luxury brand Mont Blanc at LVHM, will continue residing in France and will not relocate to Israel to manage Lusix. He stated, "I'm accustomed to it. I held various positions in companies in the U.S. and Switzerland while living in France."

Chatti views the expansion of Lusix's activities as a challenge. "Entering the field of elite jewelry will be very challenging. But I hope that before this upcoming Christmas, by the end of the year, we will be able to showcase diamonds and jewelry for direct sale, and within two years, we will have a diamond chain of the Lusix brand."