Analysis

Why FIMI is betting $80M on Benny Landa’s failing printing dream

Israel’s largest private equity fund sees opportunity where BMW and Tetra Pak heirs lost millions.

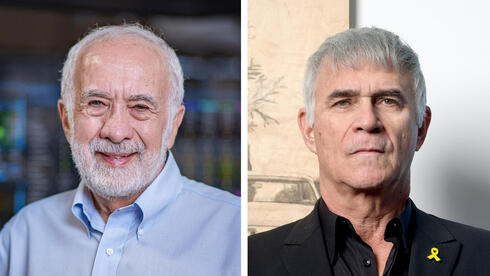

What exactly does the FIMI investment fund see in Landa Digital Printing, Benny Landa’s collapsing printing company? Why did Ishay Davidi, who heads FIMI, decide to invest in a business that the world’s top printing companies examined, and then chose not to acquire?

Two court-appointed arrangement managers were assigned to Landa’s company. They did not proactively approach potential buyers, nor did they hire an investment bank to guide the process. In practice, it was Landa Digital Printing’s management that conducted the sale process and maintained contact with FIMI. This may explain why FIMI’s settlement proposal includes repayment of NIS 55 million to dozens of suppliers, creditors who had provided products and services prior to the arrangement. The proposal notes that these suppliers were deemed “critical to the continuation of the company’s activities.” Individual debts ranged from NIS 1,500 to NIS 13 million. The Official Receiver, the state’s representative, also hinted in his court response that the list of creditors deserved closer scrutiny.

The creditors’ list suggests a close connection between the company’s management and FIMI. Additional evidence indicates this relationship was intensive. Such ties create an advantage for those seeking to exploit distressed companies: access to precise, detailed insight into the business. If Davidi decided to pursue this deal, it is not on gut instinct alone.

Risks remain high. Landa Digital Printing has been, by most accounts, poorly managed. Court filings show the company operated based on letters of intent from customers for 50 printers, but only 11 contracts were ultimately signed. This led to the company burning through $10 million per month, while paying employees wages in the tens of thousands of shekels.

“Landa had a free tap of funds,” said one source close to the company, referring to its shareholders, mainly Susanne Klatten, heiress to the BMW fortune, and the Rausing family of Tetra Pak. Klatten’s exposure alone amounts to NIS 1.4 billion of the company’s NIS 1.7 billion debt.

Related articles:

In a settlement plan submitted Thursday, FIMI offered to inject $80 million into the company in exchange for full ownership. That means Klatten and Rausing would lose their entire investment. FIMI proposed compensating the families only if it exits with at least twice its investment. While not unprecedented, FIMI has a track record of such turnarounds, it could take years to realize.

Still, Klatten and Rausing may resist. They could exercise their right to submit a counteroffer, for example injecting $100 million to regain full control. Such a move would allow them to appoint professional leadership and attempt to salvage their investment.

Benny Landa himself is expected to exit regardless of the outcome. He has personally invested $200 million in the company since founding it in 2002. Neither FIMI nor the foreign shareholders appear willing to keep him on, after losses of $312 million in 2022–2023 alone and the recent entry into court-supervised proceedings.

True to its reputation, FIMI is expected to signal that its offer is final: “take it or leave it.” The fund is known for avoiding tenders and submitting offers late in processes, leaving little room for rivals to maneuver.

Should FIMI gain control, its challenge will be realizing Landa’s long-held dream: convincing the global packaging industry that uncompromising print quality is worth the premium. Each of Landa’s printers costs about $3 million, and existing customers are deeply tied to the company through long-term maintenance contracts.

If successful, FIMI believes it can revive the company and sell it within 2–4 years to another global leader, perhaps even HP.