Mapping the 70 Israeli startups shaping the future of semiconductors, AI, and computing

From chip design to AI acceleration, Israel’s startup ecosystem is punching far above its weight in the global semiconductor race. With $5.5 billion raised collectively, these startups are positioning Israel as a key player in next-generation chips and AI models.

Since IBM and Intel opened R&D centers in Israel in the 1970s, the country has become a significant node in the global semiconductor ecosystem. A new study by Earth & Beyond Ventures and Deloitte Catalyst highlights just how far the sector has come: more than 70 semiconductor startups have been acquired for a combined $44 billion, while about 200 companies currently employ 45,000 people in the field.

Notable exits underscore the depth of international interest. Mellanox was bought by Nvidia, Mobileye and Habana Labs by Intel, and Annapurna Labs by Amazon. These deals helped cement Israel’s reputation as a critical hub of talent and innovation in an industry that underpins both the digital economy and national security.

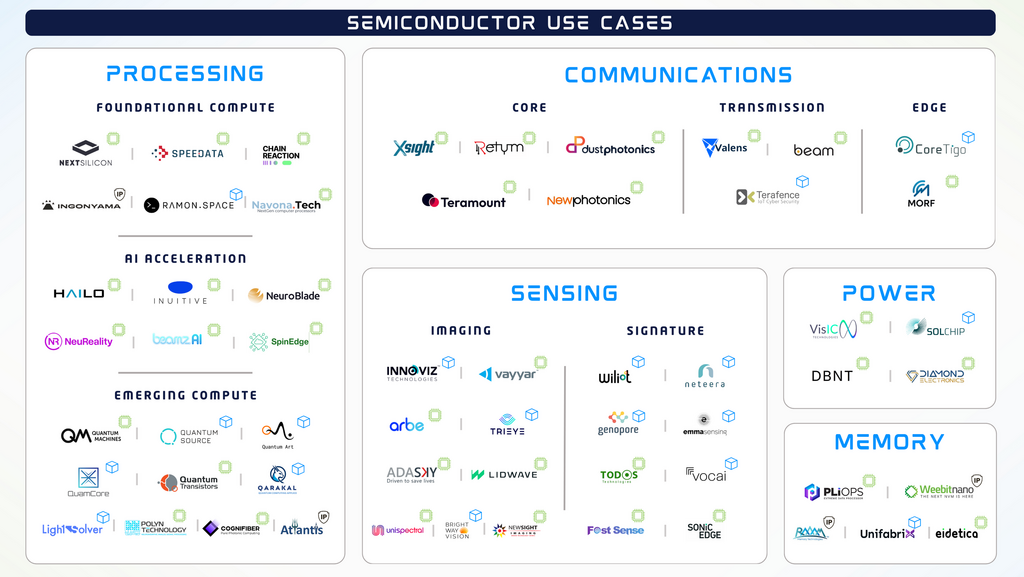

The report maps 70 active semiconductor startups in Israel, including 26 growth-stage companies and 44 earlier-stage ventures. Together, they have raised $5.5 billion since their founding. Their focus spans the full spectrum of chip technology:

- Processing and Compute (22 companies; $1.8 billion raised) - including chips tailored for AI models and novel computing paradigms such as optical and neuromorphic computing.

- Sensing (17 companies; $2 billion) - translating real-world signals into digital data.

- Communications (10 companies; nearly $1 billion) - enabling the transfer of data between systems.

- Memory (5 companies; $350 million) - storing or retrieving digital data during computation for near or long-term use.

- Power (4 companies; $90 million) - regulating, converting, or managing electrical energy for stable and efficient system operation.

- Semiconductor Infrastructure (12 companies; $220 million) - driving innovation across the semiconductor manufacturing supply chain.

The timing of the report is notable. The semiconductor industry is undergoing one of its most turbulent periods in decades. Demand for large AI models has driven Nvidia’s market capitalization above $4 trillion. At the same time, COVID-era shortages and geopolitical tensions with China have led the United States and its allies to view chips as a matter of national security as much as commerce.

Israel’s place in this landscape is complicated. It hosts two semiconductor fabrication plants - Intel’s and Tower Semiconductor’s - while also nurturing a dense network of design-focused startups.

Related articles:

Yet Israel’s position is not without vulnerabilities. Competition for skilled engineers, export restrictions, and continued reliance on East Asian manufacturing threaten to limit growth. Still, the report’s authors see reasons for optimism, particularly as venture capitalists who once shied away from the capital-intensive chip sector are increasingly backing early-stage startups amid surging AI demand.

Amit Harel, Partner and Leader at Deloitte Catalyst, framed semiconductors as a matter of national strength: “The capacity to develop innovative IP, alongside the continuous upgrading of manufacturing and development capabilities for advanced chips, forms the foundation for creating future competitive advantage among nations. Israel has positioned itself as a significant player in this race, yet we must not take our foot off the gas.”

Zack Fagan, Partner at Earth & Beyond Ventures, emphasized the convergence of Israeli expertise and global need: “Israel’s strengths in core DeepTech verticals such as chip design, advanced materials, and photonics form a critical technological foundation for the next era of the semiconductor industry… there is reason for optimism about the future of semiconductor startups in Israel.”