Mapping the Israeli gaming ecosystem with 143 companies and $3.65 billion in published exits

A new sector report reveals the scale, maturity, and emerging global reach of Israel’s fast-growing gaming industry.

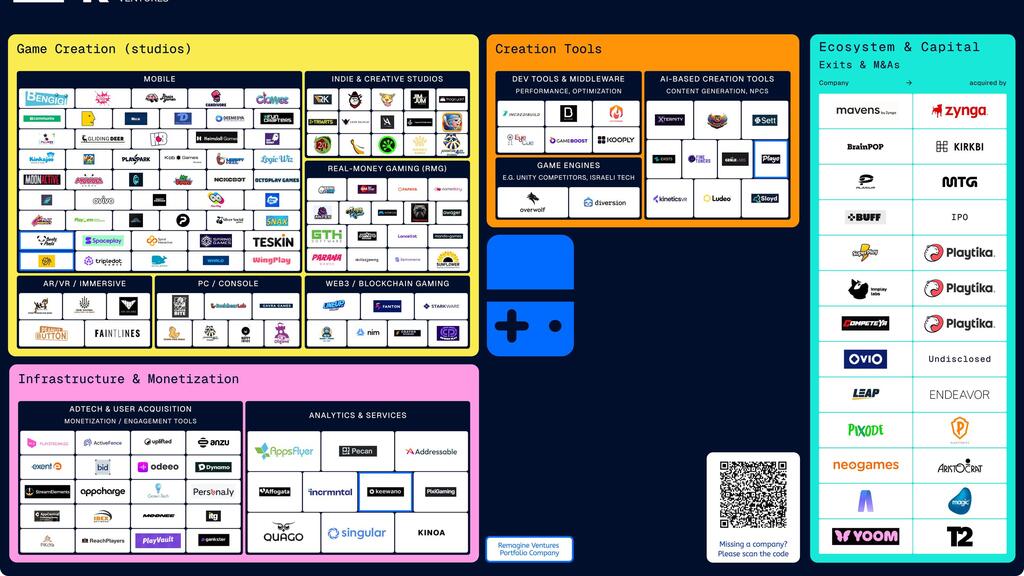

Israel’s gaming and gaming-technology sector is entering a new phase of global relevance, according to a new industry landscape report that charts the expansion of an ecosystem long overshadowed by the country’s dominance in cybersecurity and enterprise software. The “Israeli Gaming and Gaming Tech Landscape Q4 2025” report, published by Remagine Ventures, identifies 143 active companies and documents $3.65 billion in disclosed exits, evidence, its authors argue, of a sector that has matured into a strategic pillar of Israeli innovation.

The report, written by Shanny Rofe and Shir Dayan and based on proprietary industry data, draws a portrait of a market defined by a powerful combination: world-class technological infrastructure and a commanding position in mobile content, particularly in the freemium economy. Of the 63 gaming studios identified, 52 focus on mobile titles, an emphasis that aligns with Israel’s decade-long role in shaping the economics of global mobile gaming through monetization and data-driven engagement techniques.

Alongside game creators, the ecosystem includes a robust cohort of technology providers. The largest segment outside studios is Adtech and user-acquisition tooling, with 20 dedicated startups building monetization and engagement technologies that underpin performance-driven gaming. The study presents this deep technical bench, rooted in data science, machine learning and performance marketing, as one of Israel’s most durable advantages in the international gaming market.

The financial signals are similarly strong. While the report identifies 12 exits in total, only seven had publicly disclosed valuations, and those alone reached $3.65 billion. Yet the report’s authors caution that the market remains undercounted: much of the sector’s Seed- and growth-stage financing is not publicly reported, leaving its true capital footprint significantly understated.

International investment appetite appears vibrant. The report lists 55 VCs and investors active in the sector, including 19 from the United States alongside 36 from Israel. This distribution, the authors argue, reflects growing foreign confidence in the country’s ability to build consumer-facing entertainment products at scale.

Related articles:

“Israel's reputation as Startup Nation is rapidly expanding beyond its traditional strengths in cyber and enterprise software, proving its value in the consumer-facing world of gaming and entertainment,” said Eze Vidra, Co-founder and Managing Partner at Remagine Ventures. “The $3.65 billion in proven exits is a powerful signal to the world that this is an established, high-value industry, built on a strong foundation of monetization technology and world-class talent.”

The sector’s next chapter, the report suggests, will be shaped by infrastructure rather than content alone. Israeli founders are increasingly building the tools, platforms and technical layers that underpin the interactive experiences of the future, from AI-powered creation systems to middleware and performance-optimization engines.

“The most exciting part of this landscape is the deep tech fueling the future of play,” said Kevin Baxpehler, also Co-founder technologies that underpin performance-driven gaming. The study presents this deep technical bench, rooted in data science, machine learning and performance marketing, as one of Israel’s most durable advantages in the international gaming market.

The financial signals are similarly strong. While the report identifies 12 exits in total, only seven had publicly disclosed valuations, and those alone reached $3.65 billion. Yet the report’s authors caution that the market remains undercounted: much of the sector’s Seed- and growth-stage financing is not publicly reported, leaving its true capital footprint significantly understated.

International investment appetite appears vibrant. The report lists 55 VCs and investors active in the sector, including 19 from the United States alongside 36 from Israel. This distribution, the authors argue, reflects growing foreign confidence in the country’s ability to build consumer-facing entertainment products at scale.

Related articles:

“Israel's reputation as Startup Nation is rapidly expanding beyond its traditional strengths in cyber and enterprise software, proving its value in the consumer-facing world of gaming and entertainment,” said Eze Vidra, Co-founder and Managing Partner at Remagine Ventures. “The $3.65 billion in proven exits is a powerful signal to the world that this is an established, high-value industry, built on a strong foundation of monetization technology and world-class talent.”

The sector’s next chapter, the report suggests, will be shaped by infrastructure rather than content alone. Israeli founders are increasingly building the tools, platforms and technical layers that underpin the interactive experiences of the future, from AI-powered creation systems to middleware and performance-optimization engines.

“The most exciting part of this landscape is the deep tech fueling the future of play,” said Kevin Baxpehler, also Co-founder and Managing Partner at Remagine Ventures. “Israeli founders are uniquely positioned to leverage their deep technical expertise to build the foundational layers of the metaverse and next-generation interactive experiences, giving the 143 companies in this report a powerful, competitive edge.”

and Managing Partner at Remagine Ventures. “Israeli founders are uniquely positioned to leverage their deep technical expertise to build the foundational layers of the metaverse and next-generation interactive experiences, giving the 143 companies in this report a powerful, competitive edge.”