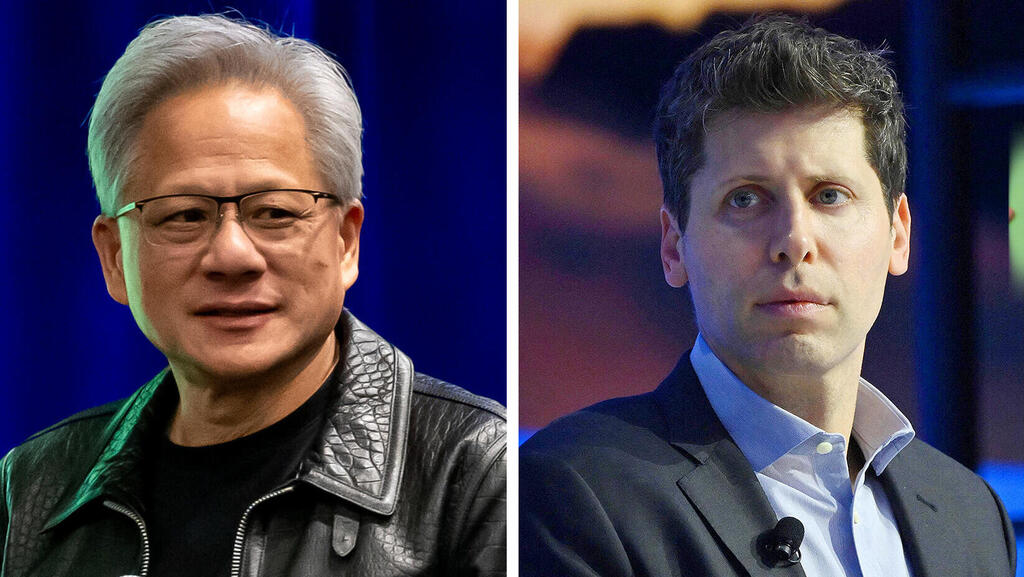

OpenAI burns billions, Nvidia prints cash, and now they’re partners

The $100 billion deal links the world’s most valuable private company with the world’s most valuable public one.

OpenAI has a problem: the AI giant is burning through money at an unsustainable pace. According to reports, the company is expected to spend $115 billion over the next three and a half years, about 44% more than its previous forecast. Nvidia, meanwhile, has the opposite problem: it is generating record profits. In the quarter ending July, the company reported $46.74 billion in revenue and $26.42 billion in net income.

This week, the two companies announced a joint solution to their problems: Nvidia will invest $100 billion in OpenAI, in a deal designed to strengthen each company’s dominance in its respective field and potentially create the most powerful partnership in artificial intelligence.

The deal connects Nvidia, the world’s most valuable public company with a market capitalization of $4.34 trillion, to OpenAI, the most valuable private company in history, valued at $500 billion. While the exact terms were not disclosed, an investment at that valuation would give Nvidia a 20% stake.

According to Reuters, the investment involves two linked transactions: Nvidia will purchase non-voting shares in OpenAI, and OpenAI will use the funds to buy Nvidia chips. The companies have signed a letter of intent under which OpenAI will deploy at least 10 gigawatts of Nvidia systems. The investment is expected to close in the coming weeks, with chip deliveries beginning in 2026.

"Everything starts with compute," OpenAI CEO Sam Altman said in a statement. "Compute infrastructure will be the basis for the economy of the future, and we will utilize what we're building with Nvidia to both create new AI breakthroughs and empower people and businesses with them at scale."

For OpenAI, the deal addresses two urgent needs: capital and computing power. The day after the announcement, OpenAI said it had reached agreements with Oracle and SoftBank to build five new U.S. data centers, in Ohio, Texas, New Mexico, and another Midwestern location, at a cost of $400 million. This is part of the Stargate Project, unveiled earlier this year alongside Donald Trump, which includes commitments to invest $500 billion in AI infrastructure.

The Nvidia deal removes the main obstacles to this data center plan: access to liquid capital and guaranteed supply of Nvidia’s scarce AI chips. For Nvidia, the investment cements its role not just as the dominant chip supplier but as a critical partner in the production of leading AI models. With demand for Nvidia hardware still far outstripping supply, the deal gives OpenAI preferential access, an advantage that could shape the balance of power in the AI race.

Nvidia’s strategy increasingly extends beyond chips into the broader AI ecosystem. It already dominates not only in GPUs but also in server racks, networking chips developed in Israel (via its Mellanox acquisition), and AI software platforms. The company has also expanded through acquisitions of Israeli startups Run:ai and Deci, reinforcing its hold over AI optimization tools. Just days before the OpenAI announcement, Nvidia invested $5 billion in Intel for a 4% stake, in a deal that includes collaboration on integrating Nvidia AI chips into Intel’s processors and data centers.

By investing in OpenAI, Nvidia gains influence over the “product side” of AI, connecting the chips it produces with the AI models and applications that reach end users. Taken together, the Intel and OpenAI deals suggest a vision in which Nvidia is not only the backbone of AI computing but also a stakeholder in manufacturing and product development.

Still, the deal underscores a structural risk in the AI economy. The explosive growth of Nvidia rests on relentless demand for its chips, funded by technology giants and startups investing hundreds of billions of dollars annually in AI infrastructure. OpenAI, Oracle, and SoftBank’s $400 billion data center plan joins estimates that Microsoft, Apple, Amazon, Google, and Meta will spend another $350 billion this year alone.

Related articles:

The business case for these vast sums remains uncertain. Many users rely on free services, creating significant costs for every query. Even paid subscriptions often fail to cover the computing expenses they generate. As models become more advanced and widely used, operating costs rise further.

Nvidia’s $100 billion investment in OpenAI highlights this precarious cycle. OpenAI must spend heavily to expand its infrastructure, but lacks sufficient revenue to fund it without outside capital. Nvidia provides that funding, only for it to flow back to Nvidia through chip purchases. The arrangement exposes how fragile the system is, and how quickly it could unravel if the underlying business model fails to support the scale of investment.