Mapping Israel’s emerging spacetech ecosystem

There are currently 105 startups operating in Israel in the field of space applications. These companies raised a total of $314 million in the past year

Israel is not a space giant and certainly hasn’t got a competitor to Elon Musk's SpaceX or any other global space conglomerate. However, it is clear that the local industry is slowly growing, finding its own little niches within an ecosystem that is mainly centered on American, European, and Asian giants.

The Earth & Beyond Ventures VC fund, which specializes in investments in the field, and Deloitte Israel mapped the Israeli spacetech startup industry for Calcalist, showing that today 105 startups are operating in Israel in the field of space applications. These startups have raised a total of $314 million in the past year, with many focusing on dual application technologies that solve challenges in the space market, but can also be utilized on Earth.

Despite the increase in the number of startups, Israeli spacetech is still in its infancy. Unlike other sectors, space giants such as SpaceX, Blue Origin, Axiom Space, and Sierra Space do not operate R&D centers in Israel. The current stage of the Israeli spacetech industry is reminiscent of that of the autotech industry before the acquisition of Mobileye by Intel in 2017, which led to the opening of development centers in Israel for the world's largest car brands, in addition to professional delegations coming to Israel to locate innovation and technologies.

Today, most companies in the space field from Israel are located close to the customer in the industry's value chain. They piggyback on the infrastructures of the big companies that manufacture missiles, launchers, and satellites, to offer the customer a service-based and dependent on these infrastructures. Therefore, in the foreseeable future, it is expected that the type of companies that will grow in Israel's space industry will be those that develop technologies and components based on traditional space infrastructures and not those that develop the infrastructures themselves.

Noga Yaari, Vice President of Ecosystem Development at Earth & Beyond Ventures, says that "the presence of startups targeting the space market is currently low compared to our share in global high-tech. The key to change is the understanding that space is not just 'spaceships', but a potential market for a variety of technologies developed for traditional industries on Earth. There is huge business potential here and an opportunity for Israel to lead in innovation in the field, with hundreds of deep tech startups relevant to the industry but not yet operating in it."

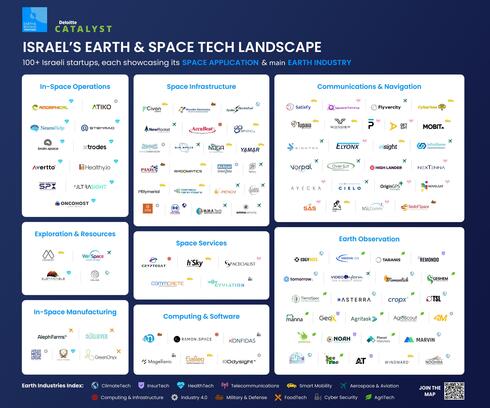

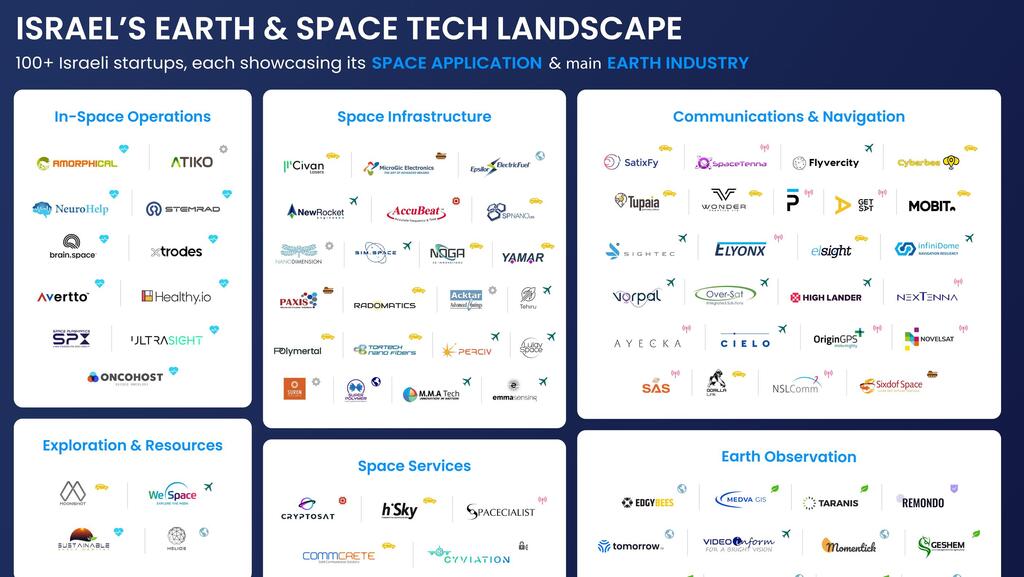

The mapping in the report includes a division of the startups according to the space applications to which they belong. The eight different categories include:

- "Earth Observation" which makes up 26% of all startups. Ventures operating in this category use satellite images and sensors to collect and analyze the Earth's data for scientific, environmental, and commercial purposes.

- "Communications and navigation" (25%) - Technologies and systems used by satellites and spacecraft to transmit data, information, and signals, in addition to determining location and guiding traffic.

- "Space infrastructure" (20%) - The physical systems and technologies, facilities, and components necessary for space exploration and commercial activity in space.

- "In-space operations" (10%) - Activities conducted in a space environment, including services, assembly, and maintenance of satellites, in addition to experiments and scientific research.

- "Computing and software" (6%) - The systems, hardware, and software used to process, manage, and store mission and space research data.

- "Space services" (5%) - Commercial and government services provided in space and to support exploration and trade activities.

- "In-space manufacturing (4%) - Production and development of various goods, materials, and equipment made in space.

- "Exploration and resources" (4%) - Space technologies for finding resources and exploiting resources on planets, moons, and asteroids, in addition to technologies for space exploration and learning.

Related articles:

Since many of the spacetech companies develop dual-use technologies, the report also divided the companies according to the type of traditional industry in which they operate on Earth. "Smart transportation" includes 17% of all startups, followed by “aerospace” (16%), “energy and climate” (12%), “agriculture” (11%), “communication” (10%), “health” (10%), “Industry 4.0” (7%) ), “computing and infrastructure” (5%), “insurance” (4%), “military and security” (4%), “food” (2%), and “cyber” (2%).

The combination between space applications and industries on Earth could, for example, be the analysis of satellite photographs to serve industries such as agriculture, climate, and insurance. In addition, conducting medical experiments in space accelerates research in the field of health, satellite communication helps to develop smart transportation infrastructures, while the production of food substitutes for space missions can be used by the food industry on Earth.

According to the report, the average amount that Israeli startups in the space field raise at the Seed stage is $3.8 million, followed by $10.7 million in Series A, $21 million in Series B, and $76 million in Series C and later.

A general acceleration in fundraising is expected in the rapidly growing field, which will also affect Israel as a result. It is estimated that the traditional space industry is expected to reach a trillion-dollar value by the end of the decade due to several factors. Among them is a significant decrease in the cost of launches that makes the industry accessible to more companies, in addition to smaller types of satellites that fly in a lower orbit and improve cost-efficiency. The industry is also affected by the entry of global players such as SpaceX, Blue Origin, and traditional companies copying their activities into the space field. For example, Amazon, which offers AWS cloud services to companies in the space sector. In the same way, other giant companies such as Honda Motor or T-Mobile are taking their steps into the field, creating for startups new business opportunities for collaborations and commercial agreements.

Idan Adler, Israel Innovation Hub (IIH) Leader at Deloitte and one of the editors of the report, says: "The entry of private companies into the space industry, combined with ongoing investments by the public sector, opens the door to unprecedented possibilities for ventures that until now were not relevant. In our view, space has the potential to become a new business dimension for existing ventures from various sectors, and it may give Israeli companies a significant competitive advantage."