Opinion

Rumors about the death of fintech are overblown

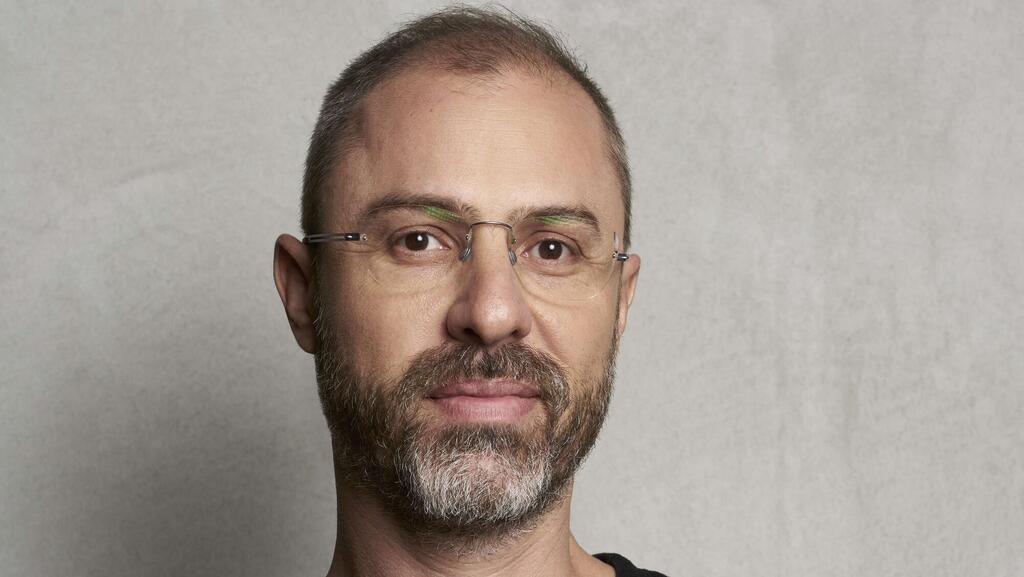

Fintech, more than any other industry, is influenced by macroeconomic trends. But the current downturn in investments is largely a market correction, presenting a great opportunity for fintech growth, writes Ronen Assia, Managing Partner at Team8 and co-founder of eToro

Anyone who doubted the extent to which fintech would be impacted by the current macroeconomic situation received a resounding wake-up call over the past year. The effects of rising inflation, followed by a series of sharp interest rate hikes, were widely felt throughout the fintech industry, but this is precisely why such a great opportunity exists for fintech to reinvent itself - and achieve new heights. The current situation can largely be seen as a perfect storm that is sowing the seeds for a new cohort of robust companies with bright futures.

Against the current backdrop, CTech published an article last Thursday titled, "The State of Fintech in Israel is Depressing,” in which Yonatan Mandelbaum, a principal at TLV Partners, presented a bleak picture that does not accurately reflect the future of the Israeli fintech ecosystem or the underlying factors that are contributing to its current state.

In an attempt to explain why the situation in Israel is perhaps more extreme compared to the rest of the world, Mandelbaum claims that Israeli fintech entrepreneurs tend to be older and more experienced than other high-tech entrepreneurs. However, Israeli entrepreneurs have always been older than their global counterparts, and studies have shown that the median age of successful entrepreneurs is actually above 40. Moreover, many successful Israeli Fintechs were founded by entrepreneurs with no prior experience in the field - including eToro (which I co-founded).

In my opinion, Mandelbaum has missed the main point: Israeli fintech entrepreneurs don’t take a different approach because they have a mortgage; they do so because they’re searching for new business models with risk and financing profiles that are different from those of the past. Because there’s such a strong and direct connection between product and market in the fintech space, when market conditions change, it gets reflected more strongly in fintech than in any other industry.

Regardless, the current financial crisis has not changed a very basic and important fact: Fintech is one of the largest and most prominent verticals in the high-tech sector, both on a global and local level. Israel has birthed large and successful fintech companies, despite the fact that the vast majority of them develop products and services that are not offered to the Israeli market.

Even when we consider that global fintech investments were cut in half between the first and second quarters of 2023 (down to $7.8 billion from $15.1 billion), anyone looking at the general trends of fintech investments since the beginning of 2019 will find the trend line to be fairly stable overall. In other words, it’s entirely possible that the massive surge in investments over the course of 2021 was the real anomaly, rather than the correction that we’ve been witnessing since 2022.

Related articles:

The current storm can also be seen as a perfect opportunity to build strong, high-value companies. Over the last decade, fintech was littered with companies that were founded with the goal of acquiring customers via an unprofitable business model premised on being able to charge for additional services in the future (e.g. neobanks). But these models are no longer relevant today as the cost of financing has become significantly more expensive. Another shift in the fintech sector is related to the fact that all major financial institutions are undergoing a digital transformation and are in search of new sources of income - which creates a significant market opportunity for fintech companies.

As a general rule, entrepreneurs who decide to launch a startup today need to rely on a more conservative, stable business model. This is particularly true for fintech entrepreneurs. In parallel, due to changes in the global market, venture capital funds are becoming more cautious about their investment decisions. Given the current market environment, the most creative and innovative fintechs will rise above the crowd, and reach new audiences by truly meeting the needs of their customers.

Among the more prominent fintech trends are startups aimed at traditional sales to medium and large organizations, rather than direct sales to consumers or small businesses. There’s also a notable trend toward solutions that are highly tailored to specific industries and verticals. For example, a growing number of new fintechs are focused on providing financial services in the healthcare industry in the United States, the renewable energy sector, the global job market and more.

The tailwind of the financial market was and will forever remain strong because of the sheer number of consumers of financial services throughout the world. This is not going to change, even if the way we consume financial services changes. Companies that can adapt to the current reality - in terms of pricing, product, business model, and knowing their target audience - will usher in the promising future that most certainly awaits this space.

Ronen Assia is a Managing Partner at Team8, where he leads the Group’s fintech company-building initiatives.