Why Nvidia’s new mega Israeli hub may eclipse Intel’s legacy

As the $4 trillion chipmaker expands, it relies on talent, not tax breaks, to outgrow old rivals.

When Mellanox’s sale to Nvidia was signed in 2019, the deal made headlines, it’s not every day that a $7 billion exit comes out of Israel’s startup scene. But the relatively “boring” and complex field in which the two companies operated quickly pushed the story off the broader public agenda. By the time the deal closed in late April 2020, Israel was already deep in the COVID-19 pandemic, and Eyal Waldman, Mellanox’s founder and CEO at the time, was making headlines more for his efforts to bring masks and ventilators into the country than for bringing Nvidia to Israel.

Five years later, Waldman’s legacy can be placed alongside that of Dov Frohman, the man who brought Intel to Israel. Over the decades, Intel has become the country’s largest private employer. Some of its most successful processors were designed here, and Frohman received the Israel Prize for his contribution. Waldman has received the same award, though in his case it involved an ongoing political struggle, partly because he belongs to the “wrong” political camp in the eyes of Prime Minister Benjamin Netanyahu.

Today, Nvidia, which globally has long surpassed Intel in revenue, profitability, and market value, seems poised to overtake Intel as Israel’s largest private employer too. But there’s an important difference: Unlike Intel, which expanded locally with extensive government coordination, tax breaks, and incentive grants, Nvidia’s growth here has been entirely private, without subsidies or conditions.

Nvidia’s commitment to Israel rests on one thing: local talent. Its latest move, revealed on Sunday, to search for a massive plot of land in northern Israel to build a campus of over 100,000 square meters, signals that Nvidia is betting Israel will continue to supply the engineers needed to develop what is still considered to be the crown jewel of AI chips.

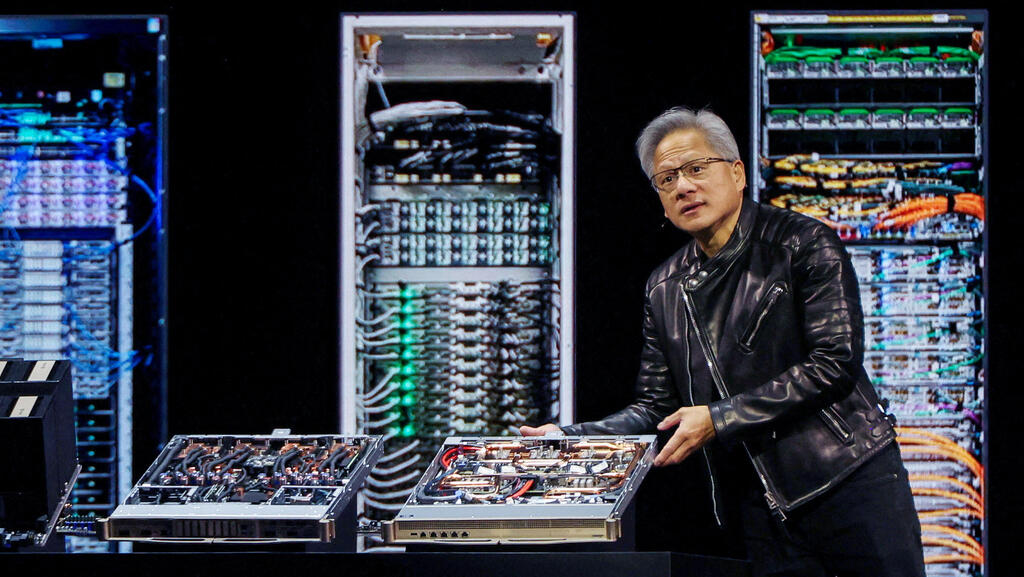

The AI boom is fueling fierce competition in the processor market, which must deliver chips that are more powerful yet cheaper, so the technology revolution can remain profitable. Judging by Nvidia founder Jensen Huang’s recent statements, and moves like this new campus, the company sees Israel as its “secret sauce” for holding onto its dominant share of the AI chip market.

Nvidia’s meteoric rise on the global stage almost coincided with its entrance into Israel. The back-of-the-envelope equation says it all: 7 + 93 = 1,000 - that’s the $7 billion Mellanox deal plus Nvidia’s $93 billion market cap at the time, soaring to a trillion-dollar valuation just a few years after the merger.

The Mellanox acquisition marked Nvidia’s first major move to expand beyond its roots in gaming GPUs. The timing was perfect. The companies had two years to integrate so that when ChatGPT arrived in late 2022, Nvidia was ready with a solution that could process vast amounts of data, distributed efficiently via Mellanox’s routing technology.

When Nvidia bought Mellanox, it gained 2,000 employees and a real foothold in Israel. For comparison, Nvidia has long maintained significant operations in India (since 2004) and China (with a Shanghai hub employing 4,000 people). But this year, its Israeli workforce surpassed its Indian operation, recently reaching 5,000 employees, making Israel its second-largest hub outside the U.S.

Despite being the largest U.S. company by market capitalization, nearing $4 trillion, Nvidia’s workforce is relatively small. Google, Microsoft, and Apple each employ over 100,000 people; Nvidia reported just 36,000 employees worldwide at the end of 2024. Even Intel, whose workforce Nvidia continues to poach in Israel, is still massive by comparison. Even after its current 20% workforce cut, Intel will remain above 100,000 employees. This highlights how lean Nvidia is, and how central Israel is to its growth. Unlike Intel, Nvidia designs chips but outsources manufacturing, so its design centers carry more weight than production plants. None of the other global giants with big R&D centers in Israel - Microsoft, Google - match Nvidia’s strategic reliance on Israel.

Nvidia’s choice to buy land for its new campus, rather than rent space, as most tech firms do, signals that it’s here to stay. Nvidia Israel currently has about 250 open positions, one-fifth of all its global job openings. In each of the past two years, Nvidia has hired about 1,000 employees in Israel, most at its main hub in Yokneam.

The only region rivaling Israel’s growth pace for Nvidia is Taiwan, Jensen Huang’s birthplace. Visiting in May, Huang announced plans for a new Asian headquarters in Taiwan, aiming to hire 2,500 people, despite Taiwan’s own geopolitical challenges. The planned Israeli campus will be comparable in size to Nvidia’s main campus in Silicon Valley, which includes two main buildings totaling over 100,000 square meters.

Part of Nvidia’s local expansion has come through acquisitions beyond Mellanox. In 2022, it bought the small startup Excelero for $35 million. In 2024, in the midst of Israel’s Swords of Iron war, it acquired Run.ai for $700 million and Deci for $300 million. While these deals didn’t dramatically increase headcount or revenue in the short term, they reflect Nvidia’s strategy: buying companies it knows well and has partnered with, often after Huang highlights their tech on stage at its annual conferences.

Related articles:

Mellanox remains Nvidia’s largest acquisition to date, especially after its failed bid to buy chip giant ARM. But the grand plan for a new Israeli campus suggests more big deals may follow. Since building its Israel-1 supercomputer, which began operating in late 2023 and is among the world’s largest, Nvidia has only strengthened its ties with local startups that use it. Huang’s frequent praise for Israeli company Vast, which is now raising funds at a $28 billion valuation, has also stoked speculation about another huge exit.

Israel’s outsized role is also visible in Nvidia’s numbers: more than 10% of the company’s global revenue now comes from Israel-linked products and R&D - from CPUs to Mellanox’s legacy networking tech to autonomous vehicle chips. Nvidia’s last quarterly revenue hit $44 billion, up 12% year-over-year, despite a profit warning linked to Trump’s trade war. Almost half that revenue turned into operating profit, and net income was $19 billion. Occasionally, Huang directly credits Israel in earnings announcements, a rare honor. At Nvidia’s most recent developer conference, Huang unveiled its roadmap for countering growing competition: three of its four biggest upcoming developments will be led by the Yokneam center.

Nvidia’s massive expansion is already reshaping Israel’s northern region. “Nvidia’s rich” have become a talking point from Kiryat Tivon to Yokneam, Zichron Yaakov, and the surrounding towns. Real estate prices are rising, and rents in Yokneam now rival those in the center of Israel. Nvidia’s decision to double down nearby will only amplify that trend.