Cybersecurity unicorn Snyk sees valuation plummet by over 50% in secondary deals

Former Snyk employees and early investors are in the process of selling shares at a company valuation of $3.3 billion, a $4 billion drop from last December’s Series G

Secondary deals currently taking place are shedding light on the declining value of unicorns, revealing what some consider their true worth. According to information obtained by Calcalist, a transaction is currently underway involving the sale of shares of the unicorn Snyk in which the company is valued at $3.3 billion. This reflects a significant drop from its previous fundraising round at the end of 2022, when the company was valued at $7.4 billion. Former employees and early investors are selling a package of shares worth $5 million at a price of $5.25 per share, less than half of the previous share price of $11.50.

Check out all Snyk related articles

This latest deal also represents a significant drop from another relatively big secondary transaction that took place recently in which $6 million worth of shares were sold at a little over $6.85 per share.

This decline in value aligns with estimates in the high-tech market according to which the value of most unicorns has been halved since the onset of the crisis. A leaked presentation from reputable investment fund Coatue last week estimated that the aggregate value of all unicorns has plummeted from $5 trillion in their last fundraising round to $2.5 trillion today, representing an average decrease of 50%.

Snyk's previous fundraising round in 2022 was already labeled as a "down round," as it closed at a lower valuation compared to the previous round. In December 2022, the company raised $196.5 million in a Series G at a valuation of $7.4 billion, whereas in September 2021 it raised $300 million at a valuation of $8.5 billion.

Related articles:

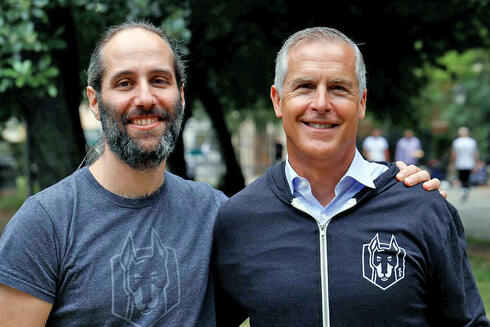

Snyk was founded in 2015 by Israelis Assaf Hefetz, Danny Grander, and Guy Podjarny. The company's security product is aimed mainly at developers, providing a solution that finds and fixes vulnerabilities and license violations in open-source dependencies and container images. The company is currently headed by CEO Peter McKay.

The devaluation of Synk is also reflected in the cutbacks undertaken by the company. Over the past year, the company underwent three rounds of layoffs, with the latest seeing 128 employees laid off, equivalent to 10% of its workforce. In October 2022, 200 employees, accounting for 14% of the company, were let go. The first and smallest round occurred a year ago, resulting in the dismissal of 30 employees. Overall, Synk's personnel has decreased by 25% in the past year, with approximately 1,000 employees remaining. Snyk operates across Israel, the U.S., and Canada with a significant presence in London. In June, Snyk acquired Israeli startup Enzo Security for $50 million.

The secondary sale of shares, as seen in this transaction, involves the purchase of shares from existing shareholders, with the funds going directly to the sellers. This type of sale does not impact the total number of allocated shares in the company.