2024 antitrust watch: 4 cases that could redefine tech industry giants

An overview of pivotal legal battles against Apple, Google, Meta, and the potential fallout that could reshape the tech landscape

Sometimes it seems that nothing will change the balance of power in the world of technology. The biggest players - Apple, Google, Meta, Amazon, and Microsoft - have been in dominant positions for nearly a decade now. It seems that even the generative artificial intelligence revolution has only strengthened the power of the likes of Google, Meta, and Microsoft, which has a significant direct impact on OpenAI.

But a series of legal rulings that are expected to be announced this year and regulatory moves that are set to be implemented could shake the world order, significantly limit the power of technology giants and their control over their platforms, and also take away billions of dollars from their revenue. These are the most important moves to follow in 2024.

US vs. Google: Search

The testimonies given in the antitrust trial in September and October 2023 provided one of the most fascinating legal discussions in the history of the field, and also revealed quite a bit of exciting information (for example, that Google paid Apple $26 billion in 2021 to be the default search engine on the iPhone). At the center of the lawsuit is the claim that Google built its power as a search monopoly through illegal agreements with device manufacturers that made it the default.

The summary stage is scheduled for the beginning of May, and the ruling may be announced towards the end of the year. In the most extreme case, the court can compel Google to part with some of its activities. However, legal experts say this is an unlikely move in a case that does not center on the issue of a corporate merger. More reasonable sanctions could include prohibition and revocation of exclusivity agreements. Such a move would immediately hurt Apple and other manufacturers and take cost them annual revenues of tens of billions of dollars each.

US vs. Google: Advertising

Before even presenting the closing arguments in the trial regarding its search engine, Google will return and meet the lawyers of the Department of Justice, as well as eight attorneys general. These will discuss the claim that the company created an illegal monopoly in the field of digital advertising by purchasing potential competitors, charging websites and advertisers to use its tools and manipulating the advertising sales mechanism. The Department of Justice seeks to order the cancellation of "anti-competitive acquisitions", such as that of DoubleClick from 2008, and to oblige Google to sell the activity that deals with the connection between advertisers and websites (ad-exchange).

Nearly 80% of Google's revenue comes from advertisements, and at stake are tens of billions of dollars a year. The court is also expected to discuss the case at an accelerated pace: both sides asked to start the hearings only in the summer, but Judge Leonie Brinkema set the start of the pre-trial for January 18 and said that she intends to start the trial itself in March at the earliest.

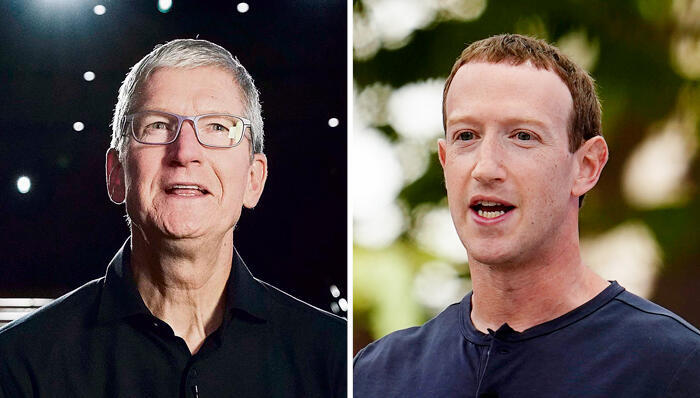

Trade Commission vs. Meta

The Federal Trade Commission's (FTC) lawsuit against Meta began in the twilight of the Trump administration, in December 2020, and has been lazily rolling along ever since. At its center, the claim that Meta's purchases of WhatsApp and Instagram constitute a violation of antitrust laws because the technology giant acquired companies that could have become a significant competitive threat to its operations. Last December, the FTC asked the court to speed up the lawsuit, a move Meta opposes on the grounds that given the time that has passed since the acquisition of Instagram in 2012 and WhatsApp in 2014, there is no urgency for the case. However, the FTC hopes that the trial will start this year and that the decision will be made before 2025.

If Meta loses, the court can compel it to say goodbye to WhatsApp and Instagram. These are two popular platforms, especially among young people. Meta is only beginning to realize the revenue potential of WhatsApp, and Instagram is also the basis for Threads, Meta's attempt to take on X (formerly Twitter). Losing it would not only result in an immediate loss of tens of billions of dollars, but also pull the rug out from under Meta's entire business strategy.

Related articles:

EU vs. Apple

In March, the European Union's Digital Markets Act (DMA) is expected to take effect, and then Apple will be forced to do something it has never done before: allow users to download apps outside of its app store. The App Store, where Apple collects a 30% commission on each purchase, is a key component of its services division's revenue, and according to estimates generates between $6-7 billion in revenue per quarter.

Apple's stranglehold on the store - it and only it decides which apps will enter it, and also requires developers to use its payment system for in-app purchases - has been a source of criticism and resentment from developers. Now they will be able to reach iPhone users without the restrictions imposed by Apple, at least in the European Union.

It is not clear how significant the damage to Apple's revenues will be - most users will still prefer the convenience of the App Store - but large and established applications will surely find a way to direct users to independent versions where they can offer wider capabilities. Meanwhile, the DOJ has also begun examining the issue, and the antitrust division is examining Apple's app store policy. The department will probably act on the issue in the coming year, as a loss for President Biden in the November elections and a change of government in January 2025, will bring to a halt most unfinished moves.