SBI Group Backs Social Banking App PayKey

Targeting the millennial market, PayKey enables banks to provide customers with mobile financial services using social applications

Tel Aviv-based social banking startup PayKey raised $10 million in Series B funding, the company announced Thursday. The current round brings the company’s total equity funding to $16 million.

More by CTech

The round was led by Tel Aviv-based investment firm MizMaa Ventures. Other participants included the Tokyo-based financial services company SBI Group, Digital Ventures - the fintech subsidiary of Siam Commercial Bank, St. Louis, Missouri-based fintech accelerator SixThirty, Columbus, Ohio-based fintech accelerator Fintech71, Singapore-based fintech accelerator the FinLab Pte Ltd., and existing investors.

The third quarter of 2017 saw a dip in global fintech funding, but if the existing trend holds for the fourth quarter then 2017 could achieve a new annual high in fintech investments, according to a report published earlier this month by venture capital database CB Insights. Fintech venture capital deals amounted to $12.2 Billion so far in 2017, according to CB Insights.

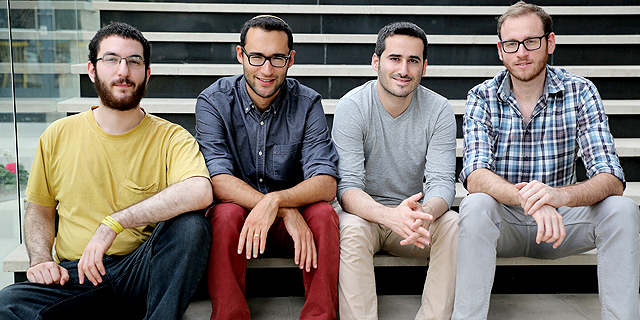

Established in 2014, PayKey develops and offers a mobile keyboard that integrates with installed mobile banking applications, enabling users to perform financial actions such as P2P payments, balance checks and cardless cash withdrawals from social and chat applications, without needing to open their bank's dedicated app. The integration occurs only at the API (application program interface) level, meaning security measures and authentication are still processed through the bank’s app. PayKey lists as customers Sydney-based Westpac Banking Corporation, Bogotá, Colombia-based bank Davivienda, Singapore-based United Overseas Bank (UOB), Istanbul-based Türkiye Garanti Bankası A.Ş (Garanti Bank), Oslo-based SpareBank 1, and Israel-based Bank Leumi. Paykey expects to double the number of its customers in the next six months. “It’s been a really successful year for us, as we’ve doubled the number of employees and signed seven commercial deals with banks around the world,” said Daniel Peled, CEO and Co-Founder of PayKey, adding that the company looking to expand in Asia. “Fintech is booming in Asia right now,” said Paul Ark, managing director at Siam Commercial Bank's Digital Ventures. “As a rapidly evolving space with huge market potential, we’ve been searching for companies with the right ingredients to invest in." Paykey “has established itself as the leading solution provider for P2P payments and contextual banking solutions," said Yoshitaka Kitao, representative director, president and CEO of SBI Group. PayKey intends to use the funding to expand its market reach and continue the development of its product.

No Comments Add Comment