Israeli Regulator to Wall Bitcoin Company Out of Stock Indices

Natural Resource Holding is down 36% on the Tel Aviv Stock Exchange

Update 13:27: Natural Resource Holding is down 36% on the Tel Aviv Stock Exchange following Israel Securities Authority announcement that it will block bitcoin-related companies from listing on the exchange's indices.

Update 12:20: The Israel Securities Authority has announced it will block bitcoin-related companies from listing on the indices of the Tel Aviv Stock Exchange. “We will not allow companies whose value is dependent on the bitcoin, such as Natural Resource Holdings, to be included in the indices of the Tel Aviv Stock exchange,” said Shmuel Hauser, chairman of the Authority, in a press release today.

For daily updates, subscribe to our newsletter by clicking here.

The authority is also considering to blacklist crypto-currency companies from listing on the exchange altogether until a suitable regulatory framework will be put in place. “We will consider preventing bitcoin in disguise-companies from trading on the exchange through the use of backdoors,” Mr. Hauser said.

The Tel Aviv Stock Exchange is wrestling with a thorny problem: Should cryptocurrency companies be on its indices, despite their stock volatility?

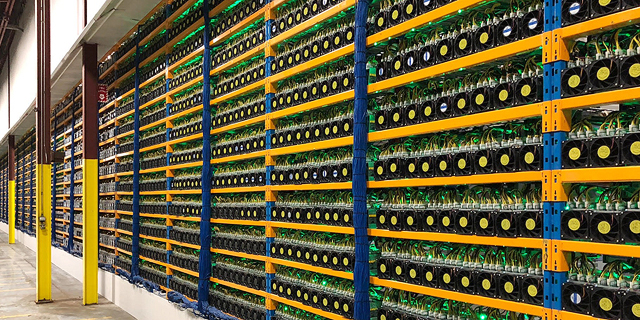

Last week, Calcalist reported that Quebec-based cryptocurrency mining company Backbone Hosting Solutions Ltd. will be listed on the exchange following a merger deal with a Tel Aviv shelf company called Natural Resource Holdings Ltd. The deal was closed Wednesday but still needs to be approved by the latter’s board before being finalized.

Natural Resource's stock shot up over 9,000% in the last two months, after the company said it is considering a pivot into cryptocurrency in October. Most of the increase occurred in the last week, following the merger announcement. Last Sunday, the company had a market capitalization valuation of NIS 133 million. On Monday Market close, Natural Resource reached a market capitalization of NIS 964 million, making it the 111th company on the exchange in terms of size, bigger than Israel’s national carrier El Al Israel Airlines Ltd.

On Thursday it will be decided whether Natural Resource will be included in the exchange’s indices, based on the value of its listed shares times the median price per share in the preceding 10 days. If its meteoric rise continues Natural Resource might even be eligible for the TA-125 index, which lists the 125 highest capitalized companies on TASE.

TASE management is reluctant to include Natural Resource in the indices. The main concern is that the stock will be included based on an extremely high valuation that will sabotage the holders of ETFs, and also the indices themselves if the stock crashes later.

A safeguard that could possibly bar Natural Resource from being included in the indices is TASE's demand that companies included have "an affinity to Israel." Following the merger, Natural Resource is controlled by an Israeli owner, Roy Sebag. TASE management might claim that due to the company's Canadian-based activity, the company has no affinity to Israel, but many other companies whose operations are mainly located overseas, like Teva Pharmaceutical Industries Ltd., are listed on the indices.

Related stories

Another possible barrier is the demand that all companies listed on the indices have at least 35% of their shares freely traded on the exchange. Following the merger, the number of traded Natural Resource shares is expected to drop from 41% to 25%, potentially blocking the company from inclusion on the indices, but Natural Resource might choose to issue additional shares, removing that obstacle.

If the company keeps a value of at least NIS 800 million until the middle of January it will be eligible for inclusion in both TA-90 and TA-125, provided all other requirements are met, forcing exchange-traded funds holders to purchase the volatile stock.

No Comments Add Comment