WeWork Files Confidential IPO Prospectus

WeWork's potential IPO comes at a time where other tech juggernauts such as Lyft, Pinterest, and Uber are listing

Sophie Shulman | 08:55, 30.04.19

Coworking company the We Company, formelry WeWork, announced on

Monday the filing of a confidential amended draft registration statement with the U.S. Securities and Exchange Commission (SEC). The company first filed a prospectus for an initial public offering with the SEC in December, according to the announcement.

For daily updates, subscribe to our newsletter by clicking here.

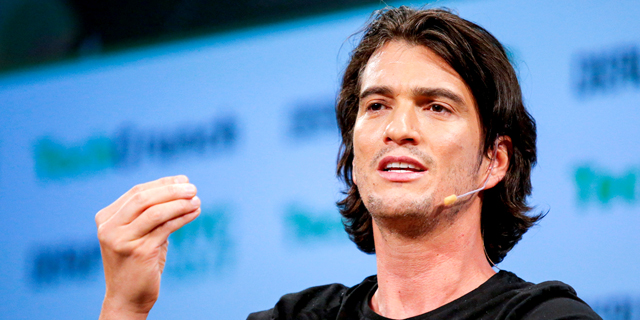

The company filed its amended prospectus last week, according to a memorandum sent to employees by co-founder and CEO Adam Neumann that was cited in the New York Times Monday . WeWork previously discussed plans to go public. Its potential IPO comes at a time where other tech juggernauts are listing: ridesharing company Lyft and social media network Pinterest both made public offerings earlier this month, and ridesharing company Uber is expected to list in the upcoming week at a valuation of $85 billion. WeWork's latest funding round, raised in January from existing investor SoftBank, valued the company at $47 billion. SoftBank invested $10.5 billion in the company overall, backtracking on its earlier intention to invest $14 billion more.

No Comments Add Comment