Interview

Former undercover commando made Israeli billionaire Teddy Sagi $700 million in 5 years

Ido Erlichman helped Kape Technologies, Israeli entrepreneur Sagi’s former flop, to increase its value 20-fold, reaching a $1.2 billion valuation

Sophie Shulman | 20:16, 26.09.21

Even in an exhilarating year for the Israeli high tech industry, where a new unicorn was born almost every day and initial public offerings (IPO) on Wall Street are being completed at a record rate, large acquisitions remained a pretty rare event. Even more exceptional was Kape Technologies’ acquisition of American ExpressVPN for $1 billion earlier this month.

Barely five years ago, Kape was one of the largest flops in Israeli-Cypriot billionaire and entrepreneur Teddy Sagi’s nearly-perfect portfolio. The company, formerly known as Crossrider, was founded in 2011 and quickly went public in 2014 on the Alternative Investment Market of the London Stock Exchange (AIM) at a $250 million valuation. However, the tool bar market in which it operated would go on to collapse, and Crossrider lost more than 75% of its value.

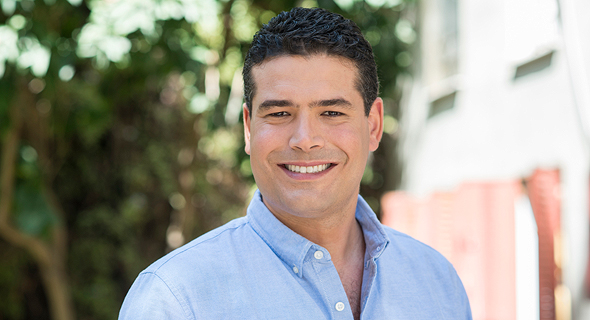

“When I joined Kape there wasn’t a lot in funds, aside from $60 million in cash leftover from the IPO. The CEO left six months prior, investors were both disappointed with the share price and by the fact that IPO funds hadn’t been used; there was no strategy. The situation was very challenging, but I joined and thought that since I hadn’t been involved in the previous round or the IPO, I could stick my hands in the mud and actually start working,” said Ido Erlichman, who has been serving as CEO of Kape Technologies for the past five years.

Erlichman is responsible for the company’s big turnaround, which caused the share price to leap twenty-fold, giving the company a $1.2 billion valuation. The company has grown from 50 employees in 2016 to over 700, and its operating profit was $13.6 million during the first half of 2021, fourfold the amount of the corresponding half. Its earnings reached $95.5 million during the first half of the year, showing 62% growth year-on-year, and continuing a steady 30% annual growth rate over the past five years. This year the company expects its earnings to reach between $197-$202 million, and after the acquisition is completed, it believes its revenue in 2022 will be between $610-$624 million.

The undercover commando’s story

This is actually the second time that Erlichman (41) has rolled up his sleeves for Sagi and led a company turnaround. His first attempt was on a much smaller scale, with Sagi’s VisualDNA, which was caught in a business crisis. Sagi acquired the company in 2015 for an estimated sum of $1 million, and after a year and a half, under Erlichman’s directorship, the company pivoted, recovered, and was sold to the global information company Neilsen for $25 million. “It was a successful exit for all those involved. I also had shares in the company, and after the sale, Kape’s board of directors turned to me, and with Teddy’s support, asked me to lead the company. The mission was to climb the food chain and transition to a Software as a Service (SaaS) model. It’s easy to say, but hard to do,” he says, and laughs during an interview with Calcalist, which takes place only a few days after the ExpressVPN acquisition, one of the largest ever conducted by an Israeli company.

Erlichman met Sagi when he moved with his then girlfriend - now wife and mother of his two sons, with a daughter on the way - to London. One day, Erlichman received a request from one of his partners at the accounting firm KPMG to found a special team to accompany transactions that were being examined by private investment funds to purchase assets in Israel, such as the Permira fund, which was then interested in Clal Insurance. “I was one of the finance guys, and then moved to KPMG in Israel. After a short time, I received an offer from London,” Erlichman says, “Permira’s team was unique, and I signed on for a year. The beginning was tough. It was all very competitive, and I needed to quickly yield results in an unfamiliar setting. But after five months I began to realize that aside from the difficulty, there were also huge opportunities here. I went to Cambridge for an MBA to complete my skill set, someone introduced me to Teddy, and the rest is history.”

However, if Erlichman is asked to rate the difficulty of his missions, at the top lies one that is wildly different from anything aforementioned. “Aside from all my business achievements and my career, the hardest thing I ever did was write a book.” Erlichman is talking about his bestseller, “Battle of Strategies,” which was published by Yedioth Books in 2014 and sold over 10,000 copies in Israel. The book, which he authored alongside a former army comrade details his military service in Duvdevan, an elite Israeli undercover counterterrorist commando unit, and describes his combat service as a captain as well as the death of his commander, Lieutenant Colonel Eyal Weiss in 2002, during an operation that went awry. This is the first time that Erlichman has revealed that he has authored the book, since the local military sensor prevented him from using his actual name, and the authors were only listed as “Ido and Einav.”

Paying for a service

How does a failing ad-tech company turn into a successful cyber company, which according to your estimates will sell more than $600 million in products and generate $150 million in cash?

“Crossrider was focused on the antivirus software market. Our customers were McAfee, Norton, and others, using a non-qualitative model that was based on sales generated from a one-time commission charged for software purchase using the Israeli company’s advertising engine. In 2016, some events transpired that led us to what we do today. The first was the early interest in privacy initiatives, which are now known as the GDPR regulations in Europe. Around the same time, criticism arose against Google and Facebook, who wanted to use user information. Suddenly the paradigm changed, and web users realized that many sources were trying to control and gain access to their information. The second process was the consumer trend to transition to a premium model, where products were provided for free but users were charged a subscription fee for certain features - to consume SaaS - such as Netflix and Spotify. Those companies began educating the market, and discovered that many preferred to pay a subscription fee instead of purchasing an entire product. Aside from that, we identified cyber companies who worked in the small and medium-business sector whose services were mostly free. The combination of all of those factors, such as awareness of user privacy and consumer willingness to pay a subscription fee for services, created several opportunities for companies like Kape to compete with security companies for control, who targeted the small and medium-sized business market.”

Today, Kape can be compared to Palo Alto Networks, Israeli founder and CTO Nir Zuk’s giant cybersecurity company. Kape has done for small and medium-sized businesses what Palo Alto has done in the big leagues: by embarking on a journey of acquiring seven companies in six years, it has built an all-encompassing product, which covers most consumer user security, from password management, enabling secure connections, leak detection, and cloud encryption.

“Obviously now it seems like a given, but back when we started we had a lot of uncertainty concerning user willingness to pay for our service. I don’t think that anyone aside from myself believed that we’d be a major player with $600 million in earnings,” recalls Erlichman, “we started with 145,000 paid users in 2017, and since then every year that number has doubled and more. In 2020, we had 2.2 million paid subscribers, prior to our acquisition of Express we’ve now reached 2.7 million users, and after the transaction is completed, we’ll have 6 million paid subscribers. Kape doesn’t offer any free products, and the average cost a user pays is around $99 per year for a security package.”

Was Sagi also skeptical? “One of Teddy’s redeeming points is the freedom he gives managers and his support for their strategies. Since 2016, he hasn’t sold a single share in Kape. He also benefits, since the value of his shares (he holds a 60.5% stake) has risen from $20 million to $750 million.” How involved is he in the company’s operations? “He’s busy, and isn’t involved in the day-to-day operations, but he has a representative on the board.” You’re growing at a 30% rate every year and are also profitable, but your main growth isn’t organic and is based on the ambitious acquisition campaign, which reached its peak when you acquired ExpressVPN, which is larger than Kape. Do you have enough knowledge and experience to digest this acquisition? “We’ve made several acquisitions, but we also decided to start small and grow gradually. You could say that Cyberghost VPN, which was acquired in 2017 for $10 million, was our first attempt to test our assumptions about strategic changes in the privacy and security market. From an integration standpoint, all of the founders of the companies we’ve acquired over the years still work at Kape, and play key roles in management. We let them express themselves freely.” So why would ExpressVPN sell to Kape? “It wasn’t simple, or a given. Express has been at the top of our list since 2018. We’ve tried talking to their founders a few times, but it never worked. What really made that change was when we acquired Webselense in March. ExpressVPN is their largest customer. Since then, things have rolled along.”