Dispute emerges over Landa Printing acquisition

FIMI claims administrators inserted unauthorized costs; fund extends offer ahead of Sept. 4 hearing.

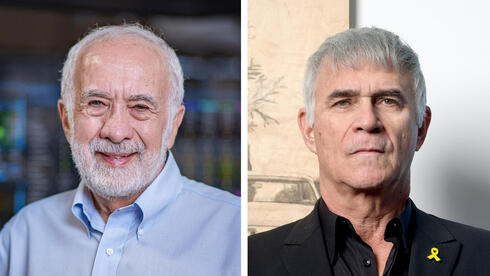

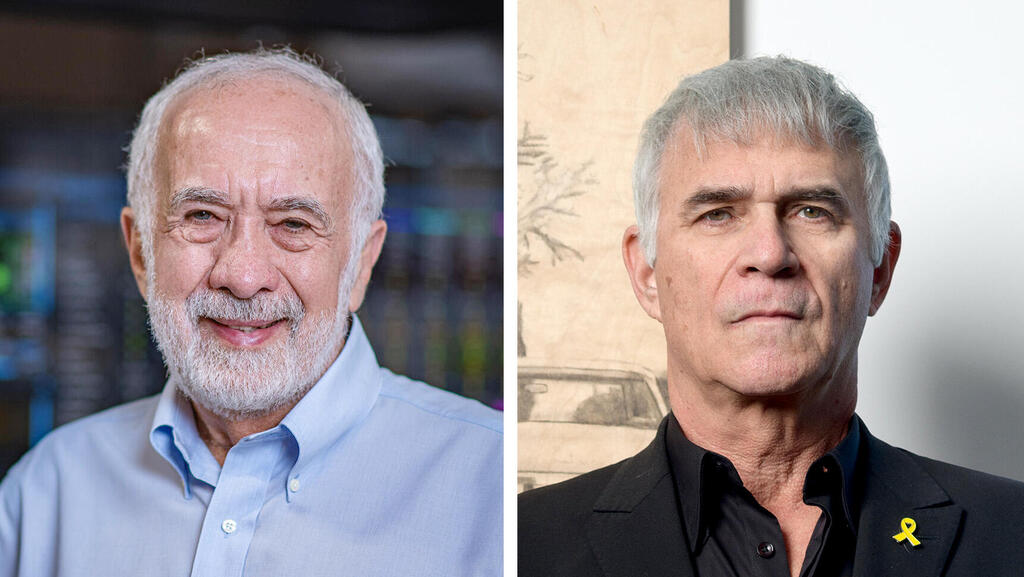

FIMI is opposing the administrators of the debt arrangement for Benny Landa’s printing company. The fund, which has offered to purchase the company for $80 million, claims in its response to the administrators’ court filing that the submitted arrangement proposal is not based on FIMI’s original offer but on a revised version introduced by the administrators. The administrators are Sigal Rosen-Rechav and Shlomi Filiba.

“The proposal was amended in a way that FIMI did not approve, and it does not agree to the amendments. This is an unacceptable and unauthorized deviation,” FIMI stated before the court.

The fund pointed, for example, to its intention to terminate the lease with the public company Vitania for the company’s building in Rehovot, “an agreement involving huge expenses for a facility that the company has not yet moved into and does not need.” FIMI also seeks to revise other lease agreements covering areas that, given the company’s current scale, are unnecessary. The fund’s position is that it should be allowed to cancel unprofitable agreements already signed.

In addition, the fund expressed willingness to pay the legal fees of the arrangement administrators but claims the administrators are attempting to impose additional expenses on the company that were not part of FIMI’s initial offer. “This is an illegitimate attempt to add costs that were never included in the original proposal, and FIMI strongly objects,” the fund argued.

Related articles:

FIMI agreed to extend the validity of its offer until September 4, the date set for the court hearing, and proposed to accelerate the closing, reducing the period from seven business days after the decision to just two.

“The acquisition offer is intended to save the company from collapse, out of a sense of responsibility, mobilization, and deep commitment to the future of Israel’s technology industry. We are prepared to invest significant sums and, if the effort succeeds, to share with the current owners payments of up to tens of millions of additional dollars,” the fund concluded.