New foreign bid for ZIM tops management’s rejected offer

International shipping group enters talks at a higher valuation as Evercore leads parallel negotiations.

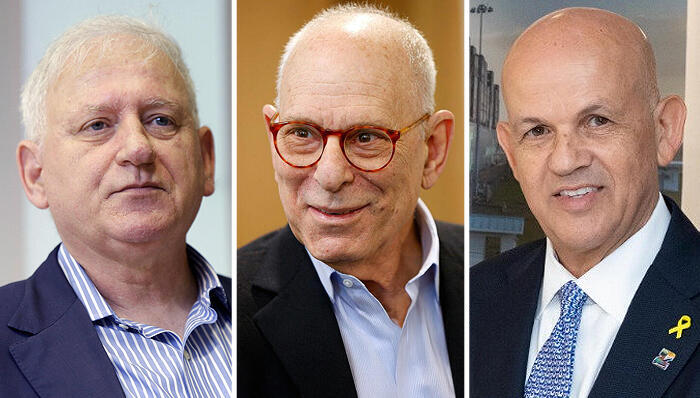

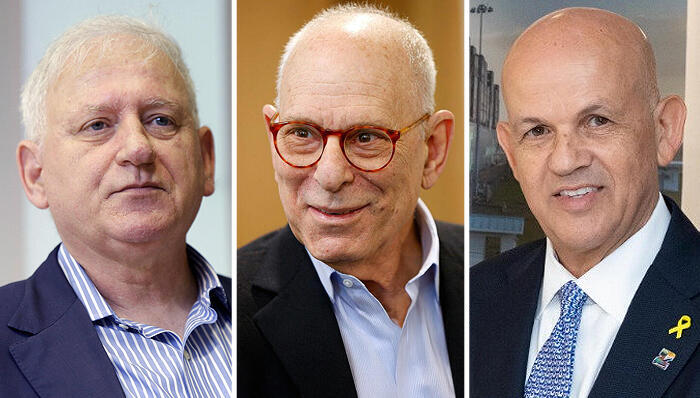

An international shipping company is in talks with the investment bank Evercore to acquire control of ZIM. The negotiations are centered on a price higher than the bid submitted by CEO Eli Glickman and Kia importer Rami Ungar, whose offer was rejected by ZIM’s board of directors.

In August, Calcalist revealed that Ungar was the businessman who joined Glickman and four other senior executives in a management buyout attempt in which the group sought to acquire the company. Their proposal, as far as is known, was $25 per share, valuing ZIM at $2.3-$2.4 billion, compared with its trading value at the time of $1.87 billion. Yesterday, after ZIM confirmed the offer, its Wall Street-listed shares rose more than 10%, reaching a market cap of $2.35 billion.

ZIM’s board, chaired by former Bank Hapoalim chairman Yair Seroussi, rejected the bid and hired Evercore to examine strategic alternatives for the company’s sale. Although ZIM is not currently controlled by a single shareholder, the process could lead to a new controlling interest.

Ungar, whose wealth is estimated at $4 billion, also owns Ray Shipping, a fleet of 65 vessels, and is seeking to merge the companies. He declined to comment, leaving open the question of whether he and ZIM’s management will submit a higher offer through Evercore to compete with the international bidder.

The state also holds a “golden share” in ZIM, obligating it to provide ships to the government in emergencies. Any foreign acquisition would therefore require state approval, making the process more complex.

The initial buyout attempt sparked criticism because ZIM currently holds $2.8 billion in cash and trades below its cash balance. The company, however, faces significant future payments for vessels it has ordered. The bid also raised concerns about conflicts of interest, as senior executives, including Glickman, would be both managing the company and attempting to acquire it. This dual role raised questions over whether executives might benefit from a lower valuation. Some scenarios discussed included asking Glickman to take a leave of absence until the acquisition process is clarified.

After months of silence regarding Calcalist’s revelations about the Glickman-Ungar partnership and the hiring of Evercore, ZIM on Tuesday confirmed both the offer and Evercore’s role. The company said the board formed a team to “examine strategic alternatives,” including Evercore, Israeli law firm Meitar, and an international law firm.

The timing of the announcement appears linked to a letter sent about ten days ago by three Israeli shareholders, More Gemel, Sparta, and Reading Capital, who together hold 8% of ZIM. They demanded the appointment of three new directors to replace two associated with former controlling shareholder Idan Ofer. The shareholders argued that a refreshed board is necessary to maximize shareholder value and narrow the gap between ZIM’s asset value, cash balance, and market value. The move was widely interpreted as pressure on the board to distribute a dividend.

Under increasing pressure and despite earlier reluctance to engage with Glickman, the board acted quickly. It appointed two directors, Yoram Turbowicz, former head of the Antitrust (now Competition) Authority, and Yair Avidan, former Supervisor of Banks, rather than the more generic profiles suggested by the shareholder group.

Related articles:

Tuesday’s announcement was also seen as an attempt by the board to signal its independence from Glickman and Ungar as Evercore, led by Len Rosen, advances discussions with the foreign bidder and other interested parties. The process could end with ZIM once again having a controlling shareholder, or being fully acquired by another shipping company.

Idan Ofer, the company’s previous controlling shareholder, sold his stake in late 2023, generating a $1.9 billion profit. Since then, ZIM has operated without a core owner. The maritime transport sector is cyclical, with profitability tied closely to global freight rates. Although ZIM benefited from last year’s Houthi-driven Red Sea disruptions, which lengthened shipping routes and raised transport prices, the company remains far below its peak valuation of $10.6 billion in March 2022. Last year it acquired 46 new ships, including 28 powered by natural gas.